Take home sales at the grocers grew by 5.4% in the four weeks to 13 July compared with last year, according to the latest figures from Worldpanel by Numerator. Grocery price inflation also accelerated again, hitting the highest level since January 2024 at 5.2% this month. With the average household spending £5,283 each year at the grocers, this latest rise could add £275 to bills if people’s shopping habits stay the same.

Just under two thirds of households say they are very concerned about the cost of their grocery shopping*, and people are adapting their habits to avoid the full impact of price rises. Own label products, which are often cheaper, continue to be some of the big winners and, in fact, sales of these ranges are again outpacing brands, growing by 5.6% versus 4.9%. These inflationary worries aren’t just changing what we buy, but how we prepare it too. We often see people choosing to make simpler meals when they are trying to save money, and today, almost seven in ten dinner plates include fewer than six components**.

New trends and old summer favourites

With budgets under pressure, supermarkets have been finding new ways to pique the interest of consumers. Innovation is absolutely vital to help grocers keep up with new trends and make sure they’re meeting shoppers’ needs as behaviours and priorities shift. The drinks aisle in particular seems to be offering up plenty of inspiration. Iced coffee has soared in popularity in recent years and with summer temperatures rising, sales were up this month by 81%. Kombucha drinks have also burst onto the scene, with sales more than doubling over the latest four weeks compared with 2024. No and low alcohol drinks continue their gradual march into the mainstream too with nearly seven in every 100 households buying a product this month, pushing sales up by 21%.

Amid the summer sunshine, there was plenty of room for more traditional seasonal staples alongside new favourites. With consumers looking to cool off, sales of ice cream and sorbet soared by 33%. Shoppers also enjoyed a glass or two of champagne or sparkling wine as sales grew by 9%. And while not everyone is putting strawberries and cream in sandwiches just yet, Wimbledon did help get them back on shoppers' minds, with sales shooting up by 28% and 16% respectively.

Double digit growth for Ocado and Lidl

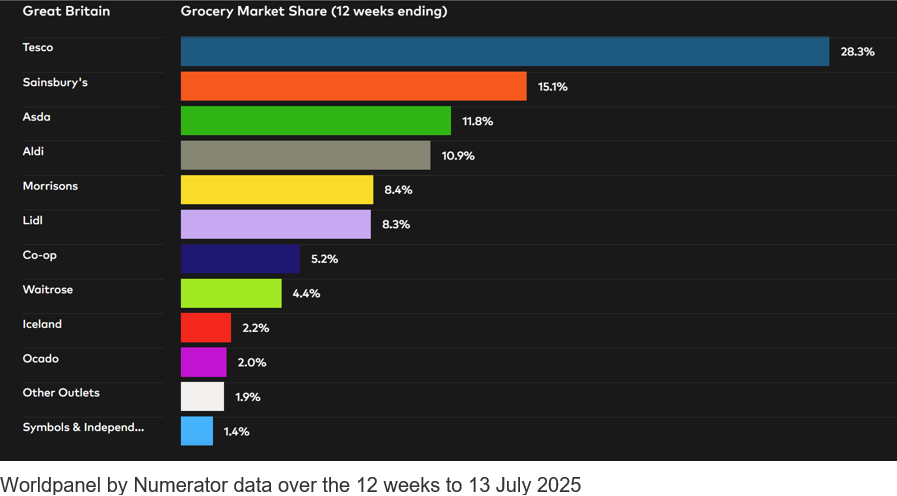

Lidl reached a record high market share this period at 8.3%, gaining 0.5 percentage points as it attracted more than half a million new customers to its stores. Tesco also boosted its share to 28.3% as sales grew by 7.1%, the fastest rate since December 2023. Sales at Sainsbury’s increased by 5.3%, putting its market share at 15.1%.

Matching its previous share high of 2.0%, Ocado was again the fastest growing British grocer. Its sales rose by 11.7%, exceeding the overall online market growth rate of 5.7%. Over the past 12 weeks, online has accounted for 12.0% of all sales at the grocers with 23% of households making at least one virtual shopping trip. Meanwhile, on the high street, grocery sales at M&S*** were 6.5% higher than a year ago.

Spending through the tills at Morrisons nudged up by 1.0% and it now holds 8.4% of the market, while Britain’s fourth largest grocer Aldi increased by 6.3%, bringing its share to 10.9%. Asda’s portion of the market now stands at 11.8%.

Sales at Waitrose were 5.5% higher over the 12 week period, giving the retailer a share of 4.4%. Convenience specialist Co-op takes 5.2% of the market, and frozen expert Iceland holds 2.2% of British grocery spending.

*Worldpanel by Numerator PanelVoice, Pressure Groups Survey, Apr 2025, 9,808 panellists interviewed. Percentage of respondents either ‘very’ or ‘extremely’ concerned.

**Worldpanel by Numerator Usage Foods, percentage of evening meals prepared using six or fewer grocery categories.