Inflationary pressures have forced brands and retailers to rethink everything from product portfolios to store layouts. Still, amidst the headlines of price increases, there is a risk that lower-priced products are given too much emphasis.

Our latest research shows sustainable growth will not come from focusing on price alone for most brands. Instead, a more nuanced approach will be essential to maintaining brand positioning and market share.

Creating demand will continue to be an important part of brand and retailer strategies and it will need to extend beyond focusing only on value opportunities for shoppers, despite feeling the pressure to do otherwise.

But a value proposition doesn’t in itself create demand, elements such as changing shopper priorities and needs and even how people feel as they navigate rising prices are equally important.

We have established three population groups across the British shopping landscape who self-identify as either “struggling”, “managing” or “comfortable”. These cohorts enable a better understanding of how people feel about their personal financial circumstances and provide an early indicator of intentions and actions.

But jumping to conclusions on who falls into which cohort could be a mistake. For example, in the absence of evidence, a likely assumption could be that the elderly might be most exposed to price hikes, particularly on energy costs. In reality, they are telling us that they are in better financial shape than might be expected. A total of 38% in the over 65s described themselves as financially comfortable compared to just 28% among the under 35s.

In other words, the obvious answer is not always the answer. A review of categories from the Great Recession of 2007 and 2008 showed growth in categories including pet treats, coffee beans, and healthier biscuits. None of those would have been intuitively expected, but as costs rose, consumers shifted to small luxuries as they were forced to forgo spending on higher-cost items such as holidays and home appliances.

Fast forward to today, and of the top 100 grocery categories, 81 are growing behind inflation, but 19 are growing ahead of it, including mineral water, dog food, and ice cream. The higher sales of mineral water and ice cream have been attributed to summer seasonality but those sales were evidence that demand-driven sales can still carry importance despite inflationary pressures.

Understanding pack sizes will play an important role as consumers, particularly those who were struggling, managed their cash flow. Even though, on a price-by-volume basis, it is typically cheaper to buy larger pack sizes, struggling consumers typically choose to buy smaller packs to manage their available spending power.

To mitigate this dynamic a balanced approach for brands is essential as larger packs continue to drive consumption levels and encourage spending, but smaller packers still needed to be offered to those managing tighter budgets and buying on shorter cycles.

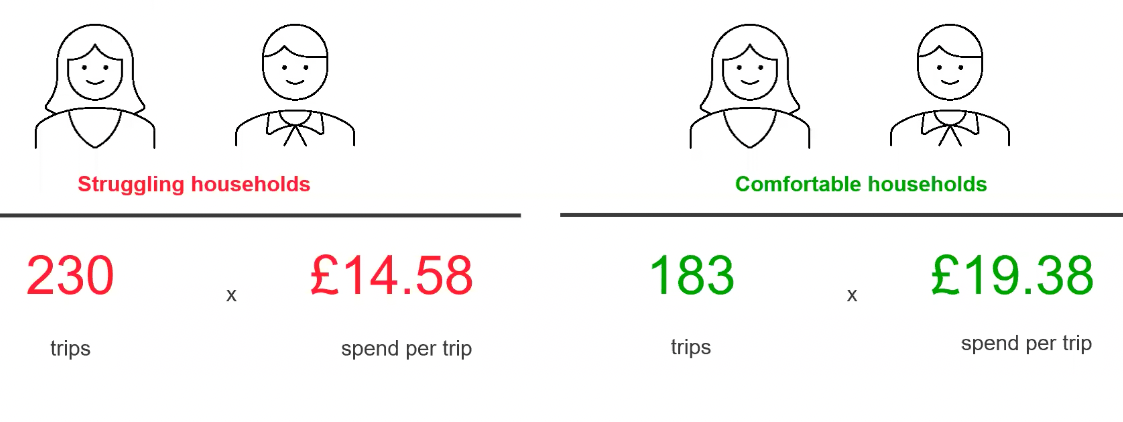

And there is clear evidence that those in the “struggling” category have shifted to more frequent shopping trips with smaller spends per trip as they manage their cash flow.

Filtered to pre-family households

Kantar FMCG panel 52 weeks ending Aug. 7, 2022