The early months of policing new legislation that targets how products high in fat, salt and sugar (HFSS) are sold and promoted appear to have resulted in only a handful of stores being accused of breaching government guidelines.

It remains unclear whether the low numbers reflect high levels of compliance or low levels of enforcement.

A report by the trade publication Convenience Store said a Freedom of Information request released in December revealed only two English local councils identified stores that allegedly violated the HFSS guidance. The Royal Borough of Kingston upon Thames conducted the highest number of compliance visits, with 10-15 visits to five large food retailers. During these visits, HFSS products were reportedly discovered in restricted locations in four stores. However, the council at that time had yet to issue any improvement notices based on the visits.

Similarly, Hertfordshire County Council reported conducting one store visit during which HFSS products were found in restricted areas. A separate Freedom of Information application by the publication revealed that local authorities had been allocated a budget of just £179,000 for the first year of the new legislation, reduced to £102,000 for the second and third years. There are over 300 local food authorities in England sharing this budget.

Official government guidance on enforcement says those investigating will “have discretion in choosing how to conduct initial or further investigations”.

Most councils are expected to include HFSS compliance in their regular inspection processes unless they receive specific complaints.

HFSS legislation restricts where retailers can place products in store if the products levels of fat, salt, and sugar outside the guidelines. High-profile areas such as store checkouts and aisle ends are now out of bounds for placement of non-compliant products.

Though it is early days in the legislation’s rollout, there are signs the changes may be leading to healthier purchases. Even in the lead-up to Christmas, when more indulgence might be expected, our data showed that food and drink categories falling under the HFSS legislation saw sales growth of 8.6%, outpacing non-legislation categories, which had sales growth of 6.8%.

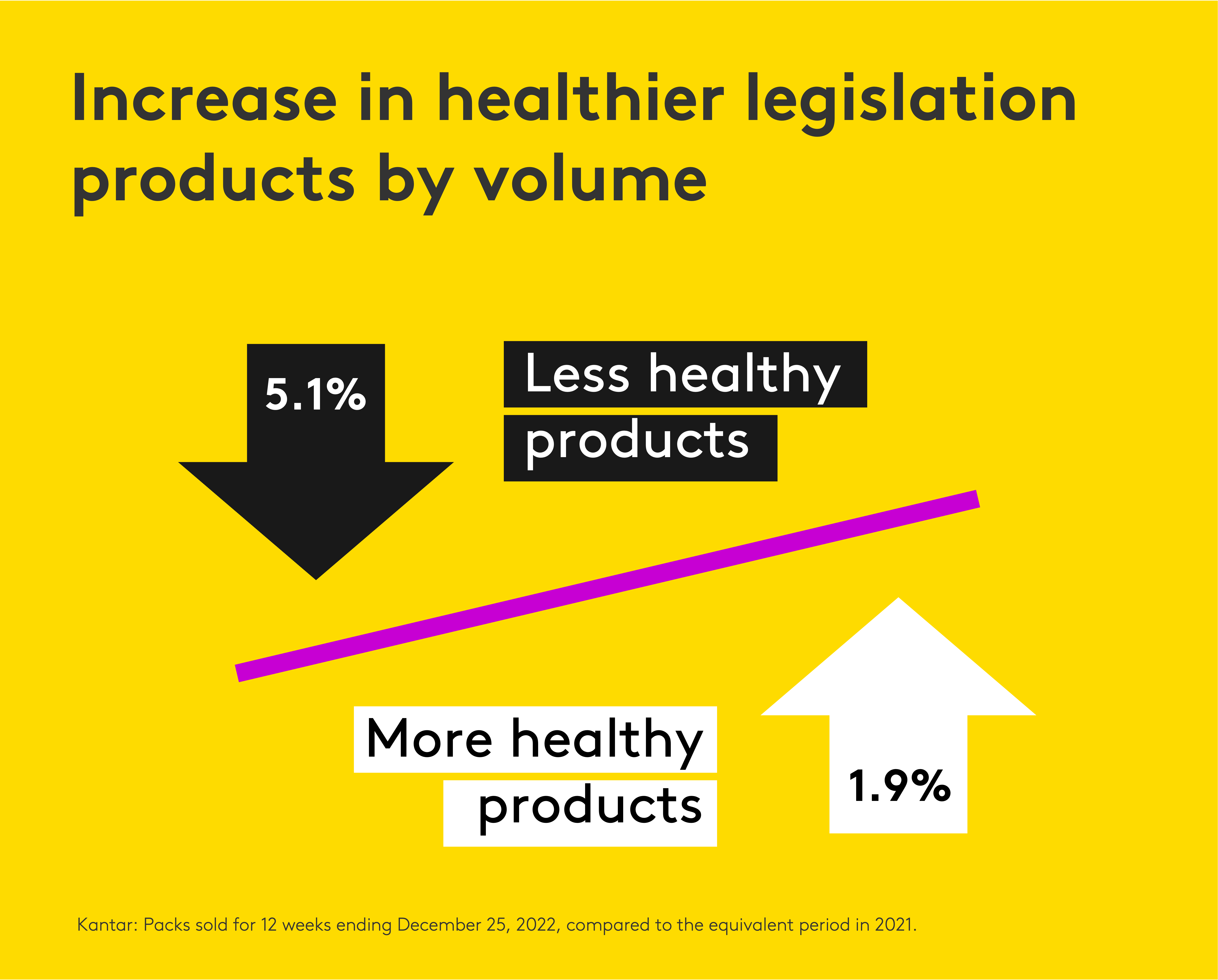

Healthier products also performed better in terms of volume, with a 1.9% increase in packs sold, whereas the volume of less healthy products within the legislation categories declined by 5.1%.

Treading lightly

In December, The Grocer reported seeing evidence of three supermarkets breaching the HFSS ban with Christmas promotions.

They also reported that a Chartered Trading Standards Institute spokesman said a supportive approach to enforcement of the new rules should be expected, “collaborative” at first but “then tough if compliance is not actively sought by the business”.

Officers can serve an improvement notice if a business is found to be in breach of the rules and makes no effort to comply. The notice is required to include details of the failure to comply. This puts the onus on inspection teams to have a clear understanding of the square footage and staffing levels of stores before issuing such notices.

Further restrictions on HFSS products are expected in October this year. They will limit volume promotions, such as “buy one, get one free”.

Meanwhile, in Wales, the government is considering a stricter approach to HFSS compliance than in England. In addition to restricting product placement Wales is considering banning temporary price reductions and so-called “meal deals”.