In October 2022, the British government introduced a significant piece of legislation aimed at reducing the consumption of foods high in fat, sugar, or salt (HFSS). With just over six months since these regulatory changes took effect, Kantar has analysed the data to assess their impact on the food and drink industry.

As of March 2023, the market for food and drink in the United Kingdom was valued at an estimated £114 billion. Products affected by the HFSS legislation accounted for a substantial £18 billion of this total, representing about 16% of all sales. While HFSS products still hold a significant share of the market, there has been a gradual shift towards healthier options.

Shifting shoppers

Notable changes in consumer behaviour are evident in the categories impacted by the legislation. In the 12 weeks to 19 March, we observed a steady movement of £82 million away from HFSS products within the legislation categories, with £34.4 million of this moving to healthier non-HFSS alternatives.

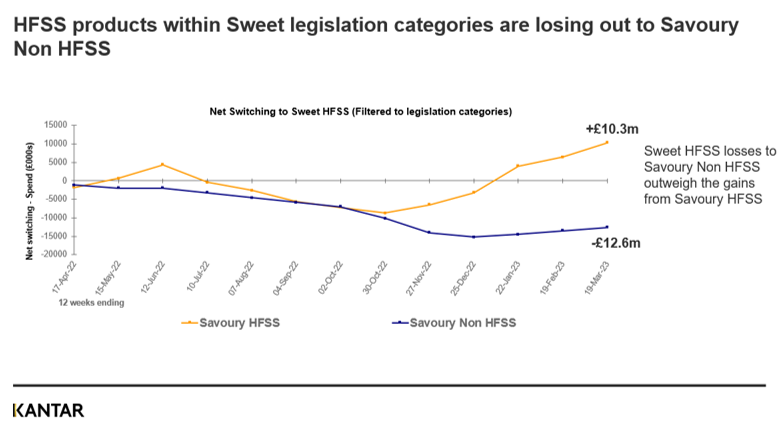

One category that swiftly adapted to the changes is savoury snacking. Healthier (non-HFSS) savoury snacks are attracting spend that was once spent on sweet HFSS products, particularly appealing to an older demographic.

Source: Kantar Take Home Purchase Panel – 12 weekly rolling data to March 2023. Filtered to HFSS legislation snacking categories: savoury – potato crisps and savoury snacks / sweet – chocolate confectionary, sugar confectionary, sweet biscuits, ambient and chilled cakes.

Part of the shift to healthier products can be attributed to the legislative ban on placing less healthy products in prominent store locations. For example, the HFSS laws prevent products targeted by the legislation being placed on aisle ends or at checkouts. But, in parallel to this, we’ve noted that the increased availability of non-HFSS products in stores appears to be catching the attention of shoppers, who claim to be health-conscious, across all age groups. Some of these shifts may also be happening subconsciously as healthier alternatives become more widely available.

Source: Kantar Take Home Purchase Panel – 12 weeks to 19th March 2023 vs 20th March 2022. Filtered to HFSS legislation snacking categories: savoury – potato crisps and savoury snacks / sweet – chocolate confectionary, sugar confectionary, sweet biscuits, ambient and chilled cakes.

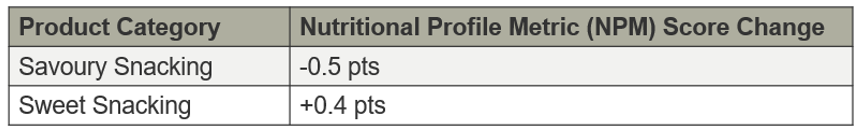

The Nutritional Profile Metric (NPM) score, which measures the healthiness of food and drink products based on their nutrient content, provides further insights. In the first quarter of 2023, the NPM score for savoury snacking declined by 0.5 points, indicating an overall healthier product profile. Conversely, the sweet snacking category saw a slight increase of 0.4 points in its NPM score which does not necessarily mean higher sugar levels in all products but suggests slightly less focus across this category on improving NPM levels on average.

Spending patterns also reflect notable shifts, albeit partly influenced by inflation. According to the Kantar Take Home Purchase Panel data for the 12-week period ending on March 19, 2023, spending on non-HFSS (healthier) products within legislation categories experienced a double-digit increase of 16.2% compared to the previous year. This suggests a growing preference for healthier options, even in challenging economic times. In contrast, spending on products high in fat, sugar, and salt in these categories saw a more modest increase of 5.7%.

Insights for action

As we surpass the six-month mark since the HFSS legislation, we can observe a gradual yet discernible change in consumer behaviour towards healthier options. While HFSS products still hold a significant market share, the tide is slowly shifting towards healthier non-HFSS items.

Looking ahead, as the legislation continues to impact the industry and food and drink manufacturers adapt their strategies, we can expect further evolution in the market landscape and consumer purchasing habits. Continuous monitoring and analysis will be crucial to fully understand the impact and progression of this significant policy change on our food and drink industry.