RBC (Royal Bank of Canada) and TD Bank have retained the top spots in the second annual BrandZTM Top 40 Most Valuable Canadian Brands ranking – announced today by WPP and Kantar – despite the challenges posed by the COVID-19 pandemic. The total value of the brands in the ranking slipped by 6% to USD$135 billion in the face of tough economic conditions caused by the lockdown, though this was ahead of similarly sized European economies, such as Spain and Italy.

Lululemon was the biggest success story in the Canada Top 40 ranking, with a rise in value of 60% at no.4 ($12.1 billion). The yoga clothing brand benefited from the lockdown by being ecommerce ready at a time when being at home gave people more time to focus on their wellbeing, but it also grew through a successful strategic expansion into the male segment. Its unique approach has made it the third-largest apparel brand in the world by sales.

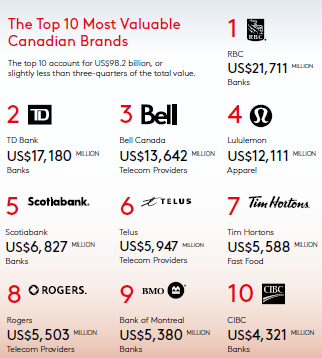

The distribution of value across Canada’s ranking remains highly skewed, with RBC (no.1, $21.7 billion) and TD Bank (no.2, $17.2 billion) accounting for 29% of the total value, and the Top Five making up 53% of the total value. The Banking category makes the largest contribution to the ranking’s overall brand value, with a 42% share, with Telecom Providers second at 23%.

Mary DePaoli, Executive Vice President & Chief Marketing Officer, RBC commented: “As a purpose-driven brand, this distinction is especially meaningful given all the challenges the world has faced in 2020. Helping clients and communities is what gives the RBC brand its meaning and strength. We are grateful to our clients for putting their trust in us, and to our employees for their commitment to delivering exceptional advice and service. They are RBC’s greatest brand ambassadors.”

The dividing line between the strongest-performing brands and those that struggled was the perception of ‘difference’. A high score for difference highlights that consumers think a brand stands out from its rivals, while enabling it to charge a premium and generate greater overseas value. The 10 Canadian brands that scored most highly on difference grew by 6%. Brands that demonstrate outstanding performance on difference include Aritzia, Tim Hortons and Lululemon.

Ecommerce boost makes brand experience more vital than ever

Canadian consumers’ use of online shopping nearly doubled in the first half of 2020, with 48% buying more online, which boosted ecommerce. At the same time, BrandZ data shows that consumer perceptions of Canadian brands’ ability to deliver a great brand experience have declined. Improving the online and offline experience will play a vital part in brands’ future performance; this is also a key contributing factor to creating differentiation.

Strong brands are far more insulated from crises and economic shocks, and also gather pace much faster when the recovery comes. We are still in the midst of a global pandemic, but Canadian brands can do much to protect their businesses from what may lie ahead. There are huge untapped opportunities to build a strong sense of difference. Brands can take advantage of premium positioning and consumer loyalty earned by having a distinct offering in a marketplace that’s dominated by value brands.

The BrandZ Top 10 Most Valuable Canadian Brands 2020

The top Canadian brands have demonstrated their staying power, in a year of high economic and social disruption. They’ve proved what we’ve often seen in challenging times – that great brands cushion the blow of a crisis – and have largely held their value. Perhaps this isn’t surprising, as Canada has built many iconic brands, so beloved that they seem like part of the national fabric. Difference is the key factor driving both value and resilience.

Converting convenience and value into brand equity

Many of the brands in this year’s ranking grew by focusing on convenience and offering value. This presents a huge opportunity for those that now choose to invest in building a better customer experience and improved ecommerce capabilities, helping them to retain the gains they accrued during the pandemic.

Retail was one of the fastest-growing categories, up 13% in total value, driven by value and grocery retailers, which benefited from people spending more time in their homes. The single new entry in this year’s ranking was value retailer No Frills (no.39, $370 million). Four retail brands feature in the six fastest climbers; Food Basics (no.36, $419 million) up 24%, Dollarama (no.15, $1.9 billion) up 21%, Sobeys (no.34, $466 million) up 19% and Shoppers Drug Mart (no.20, $1.7 billion) up 17%.

Other key trends highlighted in the BrandZ Canada Top 40 ranking include:

- Canadian brands continue to struggle overseas. Only 28% of the BrandZ Canadian Top 40’s value comes from overseas contribution, compared to 62% for the UK ranking. Lululemon was the exception, generating 86% of its value from overseas exposure. Many brands struggle beyond Canadian borders because of the lack of a strong perception of difference among consumers.

- Apparel (+55%), Retail (+13%) and Food (+12) were the sectors that led in value growth during the year. Luxury, Energy and Travel Services were the hardest hit categories, down -29%, -29% and -18% respectively.

- Private label food brand President’s Choice (no.33, $505 million) rose 12.4% by managing to navigate the tricky balance between offering value-loving Canadians the prices they like, while also securing strong scores for Brand Love – one of the key pillars of long-term value creation.