Economic pressures and digital innovation are reshaping how Americans manage their money. As inflation and uncertainty persist, U.S. consumers are rethinking spending, saving, and the tools they use to stay financially resilient.

Using research conducted with Kantar’s Accelerated Answers, we explored how consumers are adapting their financial habits, their openness to digital tools, and what these changes mean for the banks and financial institutions that regularly engage with them.

Let’s dive into some of the findings.

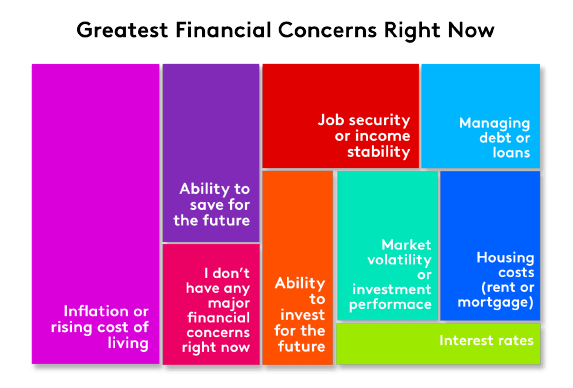

Top financial concerns: Inflation and the future

Today’s consumers are most worried about the rising cost of living and their future financial preparedness. In fact, 32% cite inflation as their greatest financial concern, followed by the ability to save for the future (13%). While 9% say they have no major financial worries, the majority are focused on stretching their dollars and preparing for what’s ahead. Concerns about job security, market volatility, and managing debt also weigh heavily, but interest rates are less top-of-mind for most.

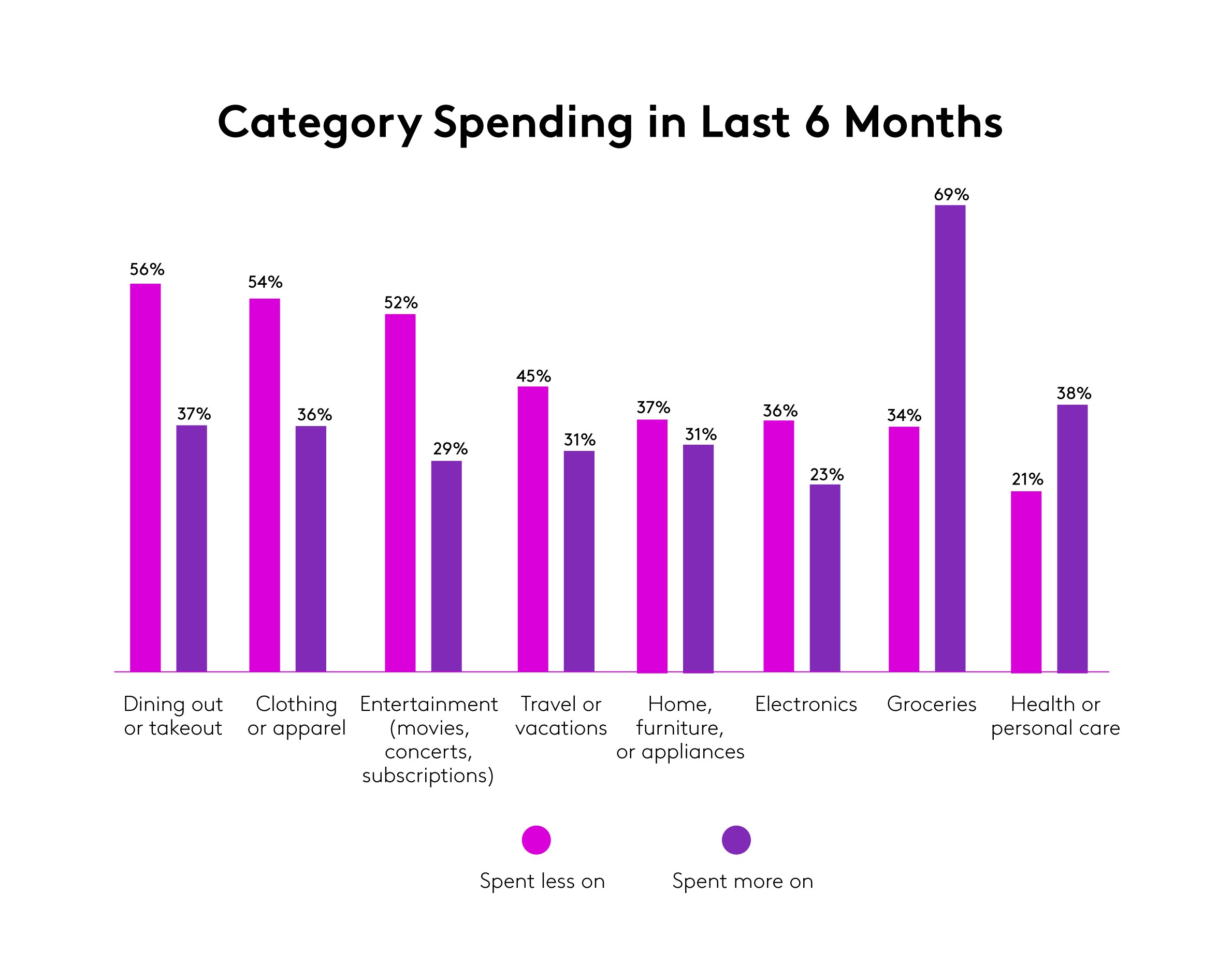

Spending habits are stable for most, cutbacks for Gen Z

Despite economic headwinds, 60% of U.S. adults report their spending has stayed about the same over the past six months. However, Gen Z stands out: 36% have decreased their spending, and only 49% say their habits have stayed about the same. When consumers do cut back, it’s most often on discretionary categories like dining out, clothing, entertainment, and travel. Essentials like groceries and health remain resilient, with fewer reporting reductions in these areas.

Many have focused on saving, investing, and paying off debt

Two-thirds (68%) of U.S. consumers have made changes in how they manage money compared to last year. Among these, 34% have increased their savings and 31% have paid off credit cards, highlighting a focus on liquidity and debt reduction. Others are exploring new investment avenues: 20% have invested in stocks, 17% in cryptocurrency, and 11% in real estate, reflecting a growing appetite for financial diversification.

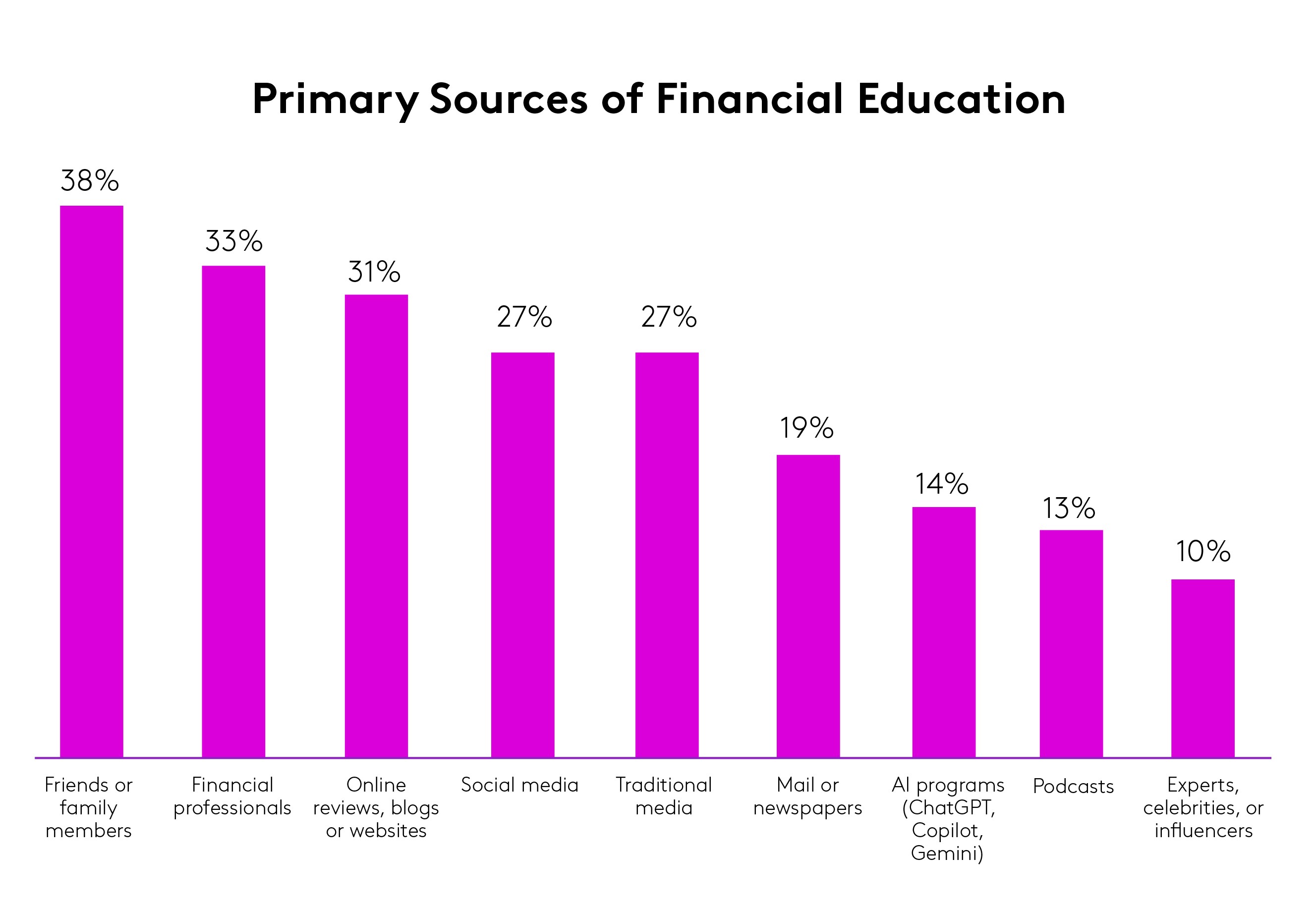

Consumers turn to the people they trust for financial education

When it comes to financial guidance, U.S. consumers say they most often turn to friends and family (38%), followed by financial professionals (33%) and online sources like blogs and reviews (31%).

However, Gen Z and Millennials are more likely to seek advice via social media and AI programs, while older generations prefer traditional media and professional advisors. Gender also plays a role, with men lean toward online reviews and professionals, while women rely more on personal networks and social media.

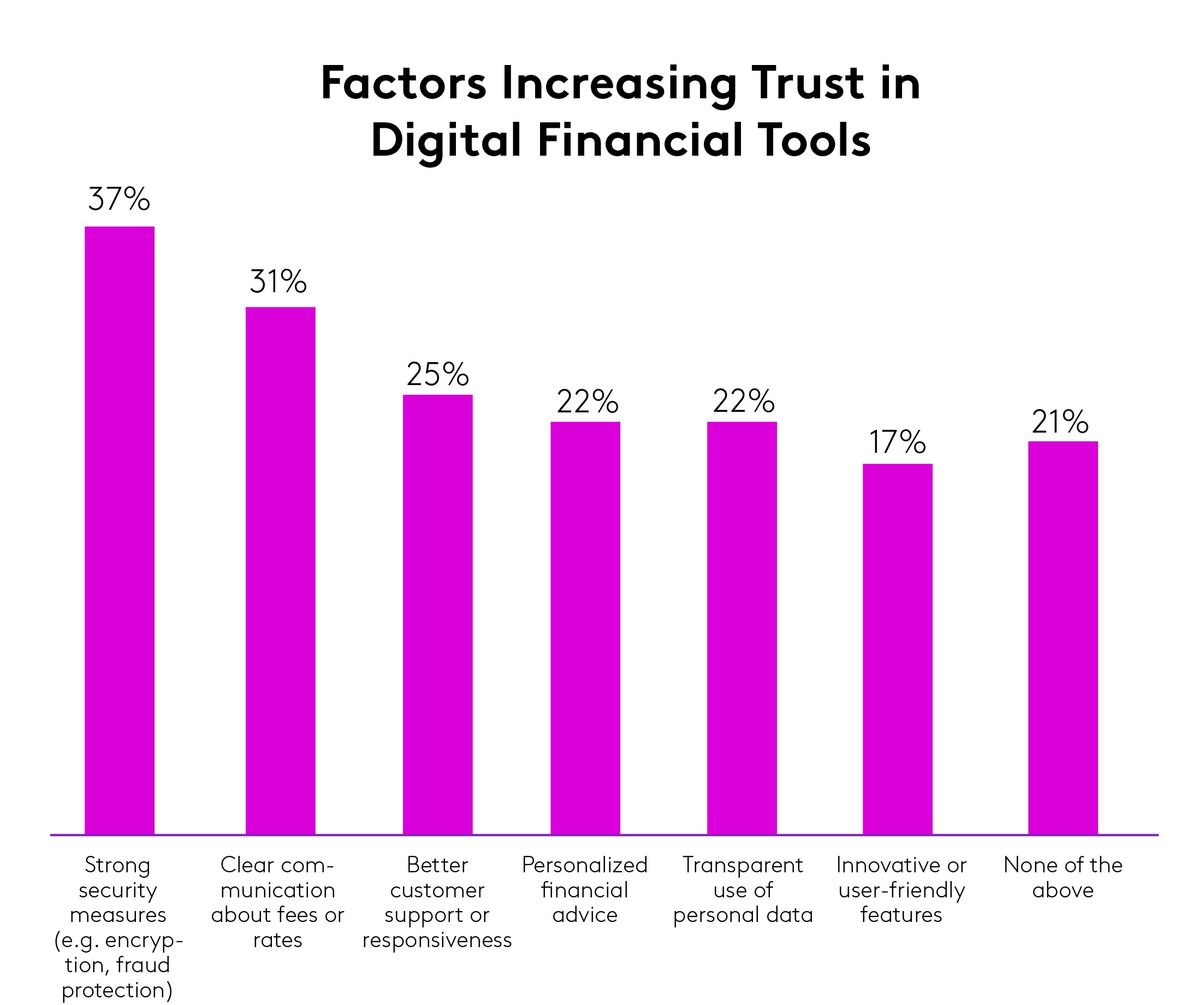

Digital banking is now the norm for many

Sixty-eight percent of U.S. consumers say they feel confident managing their finances using digital tools. The appeal is clear among current mobile or online bankers: anytime access to accounts (59%), time savings (56%), and convenience over going to a branch (55%) are the top reasons for going digital. Yet, among those who aren’t confident using digital tools to manage their finances, security remains paramount. Strong security measures (37%) and clear communication about fees or rates (31%) are the most important factors in building trust in digital banking.

As economic uncertainty lingers, U.S. consumers are doubling down on saving, paying off debt, and leveraging digital tools to manage their finances. Financial brands that prioritize security, transparency, and personalized support will be best positioned to earn trust and loyalty in this evolving landscape.

Get more answers

For more findings from this study, access the full report How U.S. Consumers are Managing Finances and get actionable insights to help financial services brands adapt to the needs of today.

About the Research

This research was conducted online via Accelerated Answers, Kantar’s agile survey platform for custom research, among 1,000 U.S. respondents sourced from Kantar’s Premium Panels. All interviews were conducted as online self-completion between 14 - 20 October 2025 and includes consumers ages 18–84 who hold an account with a bank or financial institution, balanced to be nationally representative by age, gender, and region.