Ever wondered how brands uncover insights without breaking the bank? Enter the omnibus survey. Think of it as carpooling for data: efficient, cost-effective, and packed with answers to essential questions.

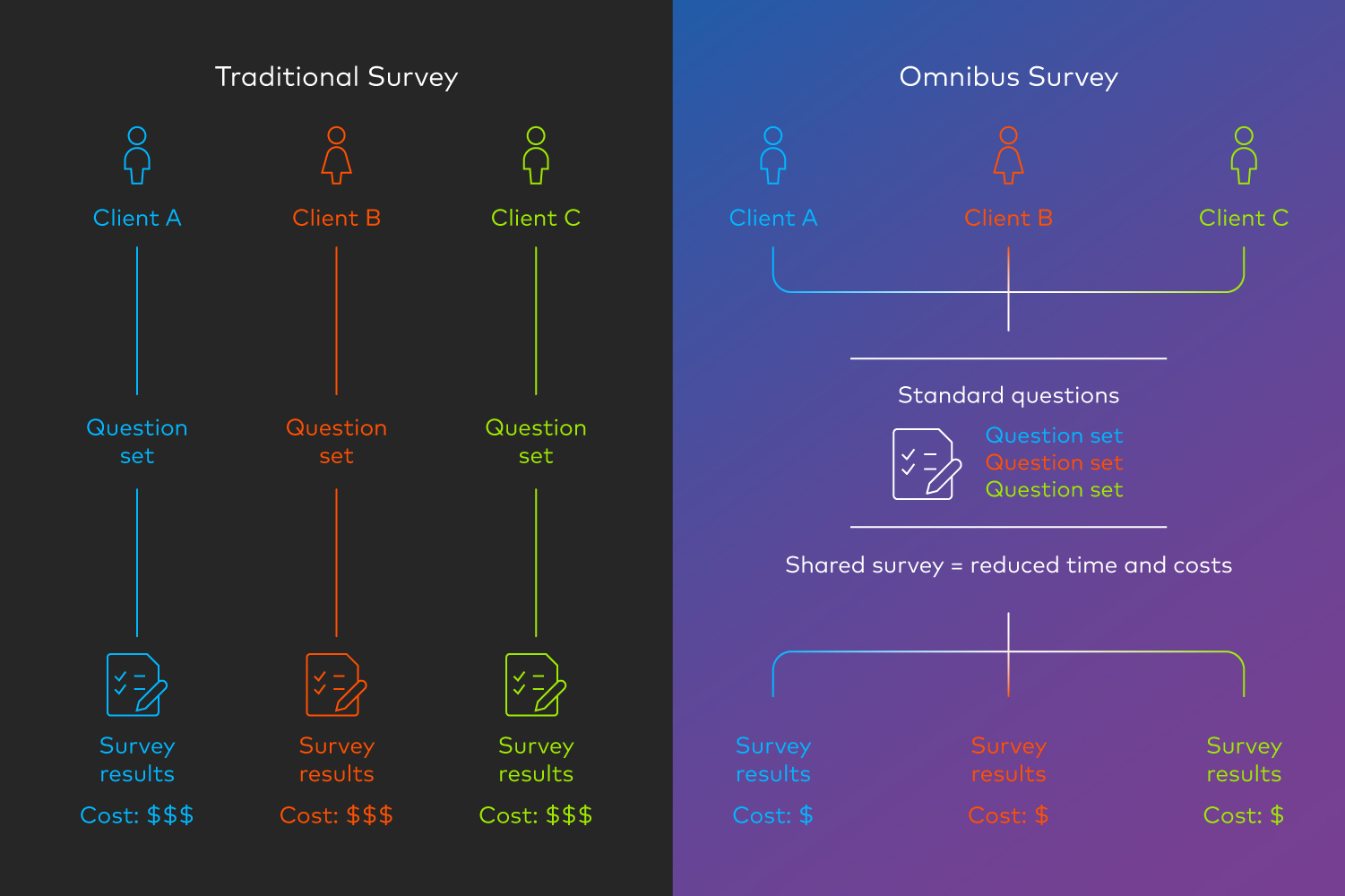

An omnibus survey is a collaborative research method in which multiple clients place their questions into a single, shared survey. By pooling fieldwork and sample, organizations can gather quick, directional insights on a wide range of topics without the higher cost of running a bespoke study. For brands, agencies, and researchers that need timely answers on constrained budgets, omnibus research is a pragmatic way to keep a pulse on consumers while preserving resources.

In this article, we’ll break down everything you need to know about omnibus surveys, from what they are and how they work to their biggest advantages and potential drawbacks. We’ll also explore common use cases that make omnibus surveys a go-to tool for businesses and researchers alike, helping you decide when this cost-effective approach is the right fit for your insights strategy.

How Omnibus Surveys Work

An omnibus survey is a cost‑effective method where multiple clients share a survey to gather diverse data from a target group.

In practice, several clients contribute a concise set of questions to the same survey wave. Each pays only for their question slots, while sharing sample and fieldwork costs. After fielding, each client receives data for their questions (plus agreed‑upon profiling variables) from a representative sample that’s designed to reflect the target population. Importantly, all client data remains confidential, meaning responses are not shared across clients, which helps address common concerns about privacy and competitive sensitivity.

Typical steps include:

- Question intake. Clients submit their questions using clear, unbiased wording that aligns to their objectives. As part of the service, the Profiles team at Kantar can review draft questions and suggest improvements to ensure clarity and neutrality.

- Sample & fielding. The survey undergoes programming, drawing from a representative sample, and fields in scheduled omnibus waves. For international surveys, Kantar provides translation into local languages—unlike some providers who may require clients to supply their own.

- Processing & delivery. Data and basic tabulations are delivered quickly, enabling fast decision‑making. With Kantar, clients can specify which demographic variables they’d like included as banners and even request custom banners as long as they are agreed upon upfront.

Benefits of Omnibus Surveys

Omnibus surveys offer a combination of speed, flexibility, and affordability, making them an attractive choice for businesses and researchers. From reducing costs through shared resources to enabling quick turnaround and global reach, these surveys deliver without the heavy lift.

Cost‑effectiveness

Because costs are shared across participants, an omnibus approach delivers robust, directional insights at a fraction of the price of standalone projects—ideal when you need a “quick read” to guide next steps.

Scheduling

Omnibus waves run on a predictable, fixed schedule — so clients know exactly when their data will be delivered. This reliability means faster answers, ideal for reacting to market shifts, testing hypotheses between campaign milestones, or sanity‑checking product ideas ahead of a launch.

Flexibility

Another key benefit of omnibus surveys is that you can use them when you need them, without being locked into lengthy contracts. Slot in a few questions to validate creative, track a headline KPI, or gauge sentiment, then scale up or down as priorities evolve.

Global reach

Providers like Kantar offer coverage in 53 markets and support making it easy to capture insights from diverse audiences worldwide. This global footprint ensures your data reflects regional nuances, helping you make decisions with confidence across multiple geographies.

Tip: For stronger results, follow Kantar’s survey best practices when drafting questions.

Use Cases and Applications

Zooming in on a few high‑value applications:

Consumer and market insights

Omnibus surveys are a fast, low‑lift way to understand how people feel about issues, brands, categories, or current events without commissioning a full custom study. By dropping in a small set of questions on a recurring wave, you can capture quick reads after a news cycle, campaign launch, pricing change, or product update and see how sentiment moves over time.

Brand tracking

Omnibus surveys are well suited for lightweight, ongoing brand health checks. By rotating in a concise set of KPIs you can gauge the impact of marketing campaigns or product launches and compare performance against competitors. Consistent, repeated measures provide directional guidance on what’s working, where equity is building, and where messaging needs refinement.

Ad testing or creative validation

Before you launch, validate concepts, copy, and visuals with a broad audience at a fraction of the cost of a bespoke test. Short, focused question blocks can assess clarity, relevance, recall, and intent to act, and can be used to A/B test alternative headlines, CTAs, or imagery. The result: faster creative decisions with evidence to back them up.

Product testing

When exploring a new product or feature, omnibus surveys offer a quick read on appeal, perceived value, price expectations, and adoption barriers. Early feedback from a wide audience helps teams prioritize features, refine positioning, and identify “must‑haves” versus “nice‑to‑haves” before investing in development or market entry.

Limitations to Consider

While omnibus surveys offer speed and cost advantages, they’re not without limitations:

- Question depth. Omnibus research is optimized for shorter surveys that deliver fast insights. While longer question sets are possible, to get the most value, focus on the metrics that matter most.

- Sample considerations. Omnibus surveys typically use a nationally representative sample in each market, which supports broad targeting needs. Clients can apply targeting within that framework—for example, by filtering for specific demographics or behaviors—but feasibility depends on how many respondents qualify. While omnibus can accommodate a range of targeting goals, it may not be suitable for very small or niche audiences. Always confirm with your sample partner that the available audience aligns with your research needs.

- Data granularity. Again, because the design serves multiple clients, deep sub‑segmentation may be limited. If you need fine‑grained analysis of niche cohorts, plan a follow‑on custom study.

How to Leverage Omnibus Surveys Effectively

- Align questions to clear research objectives. Start by being crystal‑clear about what decision your questions need to inform before you add them to an omnibus wave. Keep items straightforward, focused on broad themes, and tightly tied to your primary KPIs so you get maximum value from a limited question allotment. Check out our article on How to write achievable research objectives for surveys for guidance on where to start.

- Know your audience. Clients should clearly define the audience they want to reach (whether that’s all adults, women aged 20–55, or car owners) and confirm whether the sample size will be sufficient for meaningful analysis. For very specific or niche groups, omnibus may not be the best fit due to limited incidence rates.

- Combine methods when needed. Use omnibus research to get fast reads, then consider deepening learnings through additional research (e.g., custom surveys, segmentations, etc.).

- Get a professional review. Not sure if you are asking the right questions? Asking them the right way? Have your survey design professional reviewed by the Profiles team at Kantar to catch potential bias, improve flow, and align measures to your KPIs.

Conclusion

Omnibus research blends cost‑effectiveness, speed, and flexibility—a smart way to stay informed about shifting consumer attitudes, validate creative, and keep brand health on track without overextending your budget. As part of a balanced insights strategy, it provides the fast answers you need today while informing the deeper work you may choose to do tomorrow.

Want to learn more?

Check out our full suite of Research Services and Survey Solutions to get representative and reliable consumer data in as little as one week.