It’s a well-known fact that the pandemic has fast-tracked ecommerce growth, and all signs indicate it will continue all over the world. Most of us are surprised, not only by the increase in ecommerce, but the many forms in which it has taken hold. Similar to the way new variants have kept the pandemic going, digital shopping has morphed to adapt to the needs of shoppers in different places.

But what makes shoppers choose one ecommerce platform over another?

Findings from our eCommerce ON 2022 global shopper study reveal how people are using ecommerce around the world, the categories they buy, the platforms they use and their motivations for doing so.

There is no stereotype shopper

You can’t describe online shoppers by stereotypes or align platforms with specific demographics. ‘Old’ ecommerce shoppers have matured, and ‘new’ ecommerce shoppers come from older and younger demographics. ‘Developing’ markets are leading the way and ‘mature’ markets are lagging.

In advanced ecommerce markets like Korea and Japan, online shoppers are older than in other Asian countries, where a far greater share of online shoppers are in their 20s and 30s.

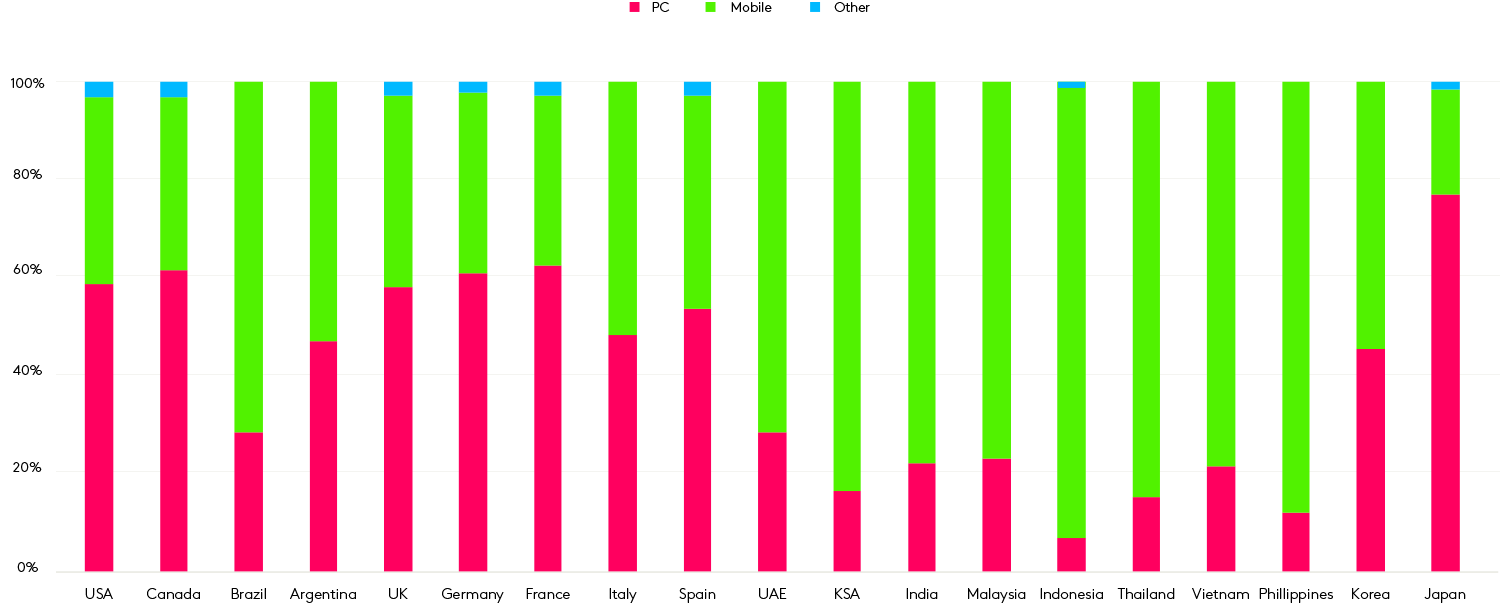

Not surprisingly, smartphones are gradually taking over as the preferred device for online shopping. eCommerce ON was first conducted pre-pandemic in 2019. Since then the growth of smartphone usage for shopping has increased by 13% - from half of shopping trips to nearly two-thirds (based on 8 countries included in 2019 and 2022 studies). This year, 58% of online shopping ‘trips’ were from a mobile device vs 40% on PC.

But again, this varies widely by country; 77% of Japanese online trips are PC-based vs only 7% in Indonesia. While we see mobile dominance across the Middle East, Southeast Asia and India, Europe is dominated by PC, with only Italy at 51% for mobile. Generally speaking, the younger the shopper, the more likely they are shopping on mobile.

Device used to shop online

For any brand or category, understanding who your online shopper is and what their motivations are will provide the foundation for a successful ecommerce marketing strategy. This study shows us we can’t assume even apparently similar neighboring countries will have the same online shopping needs and behaviors.

What shoppers want

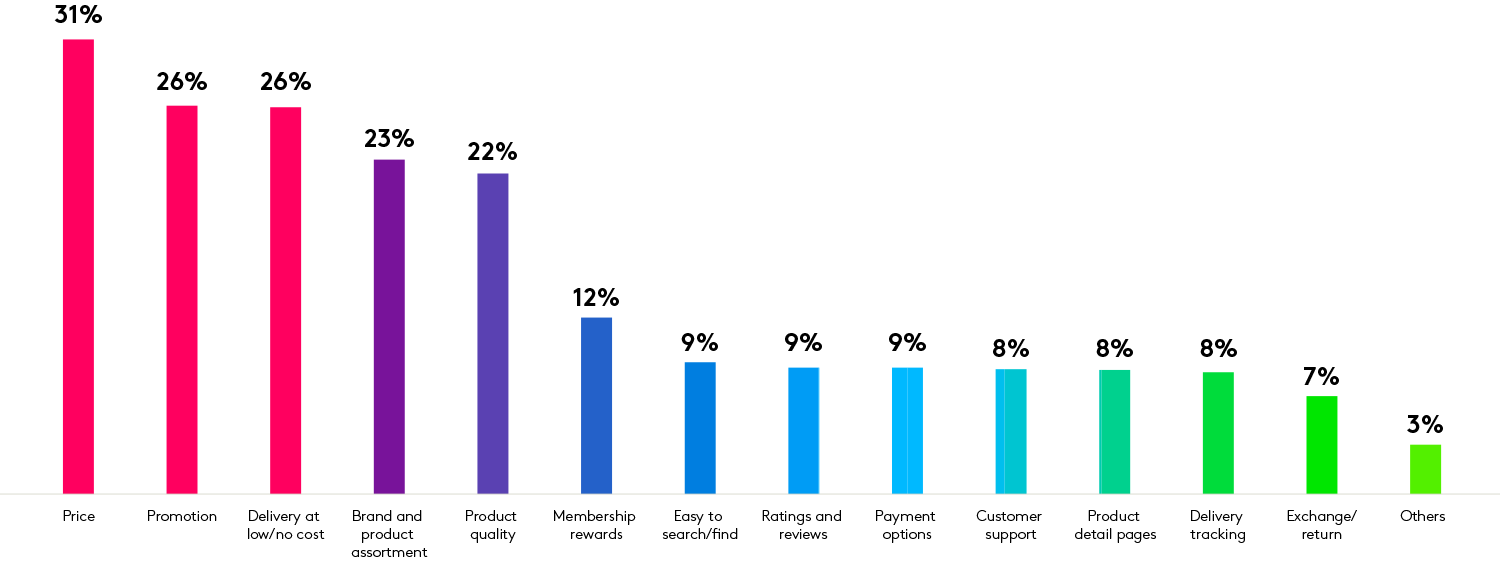

Across the world, price factors, including promotions and low/no cost delivery, remain top online retailer choice drivers. No doubt reinforced by inflation and economic uncertainty. However, when did consumers ever tell us price was not important?

Reasons for choosing online FMCG retailers

Beyond price, the reasons for retailer choice vary by country. In the USA and Japan, online shoppers prioritize brand and product assortment, whereas their counterparts in the UK and Brazil consider product quality to be more important. Compared to other countries, membership rewards are important for online shoppers in Korea and the UK, where top retailers have successfully established points programs. In Indonesia and Malaysia, ratings and reviews play an important role in e-retailer choice.

To stay competitive and successful in ecommerce - and to avoid price wars - brands and retailers need to address shopper priorities by category and pay attention to other values shoppers seek in different countries.

Where do the opportunities lie?

eCommerce ON captured insights from over 69,000 shopping trips covering consumer electronics and consumer goods to explore how shoppers buy different categories and products online.

Globally, 48% of shoppers go online to buy consumer electronics for a replacement or upgrade, rather than a first-time purchase. Yet again we see vast differences by market, peaking at around 60% or more in the USA, Canada, UK, France, Korea and Japan – with lower than average levels in UAE, Saudi Arabia and India. And the age breakdown varies too.

We also saw that many consumer electronics shoppers return to the brand or retail website of the product they previously bought from.

Not surprisingly 60% of online FMCG shopping trips involved buying multiple categories (with Germany and Japan being exceptions). In countries with high ecommerce penetration, such as the UK and Korea, 68% of online FMCG shopping trips covered multiple categories.

So for consumer electronics loyalty is key for repeat purchasing, and for consumer goods, understanding how categories interact can help increase the size of the basket.

Ecommerce ‘variants’

The pandemic has accelerated a number of ecommerce trends, including rapid grocery delivery (RGD), meal kit services and second-hand purchasing.

60% of ecommerce shoppers now use RGD services - ranging from 91% in Vietnam to just 15% in Germany. Baby milk and diapers top the list, closely followed by snacks, alcoholic and soft drinks. Not surprisingly, the higher the costs of labor in a market, the lower the RGD penetration. And the younger the shopper, the more likely they are to use RGD.

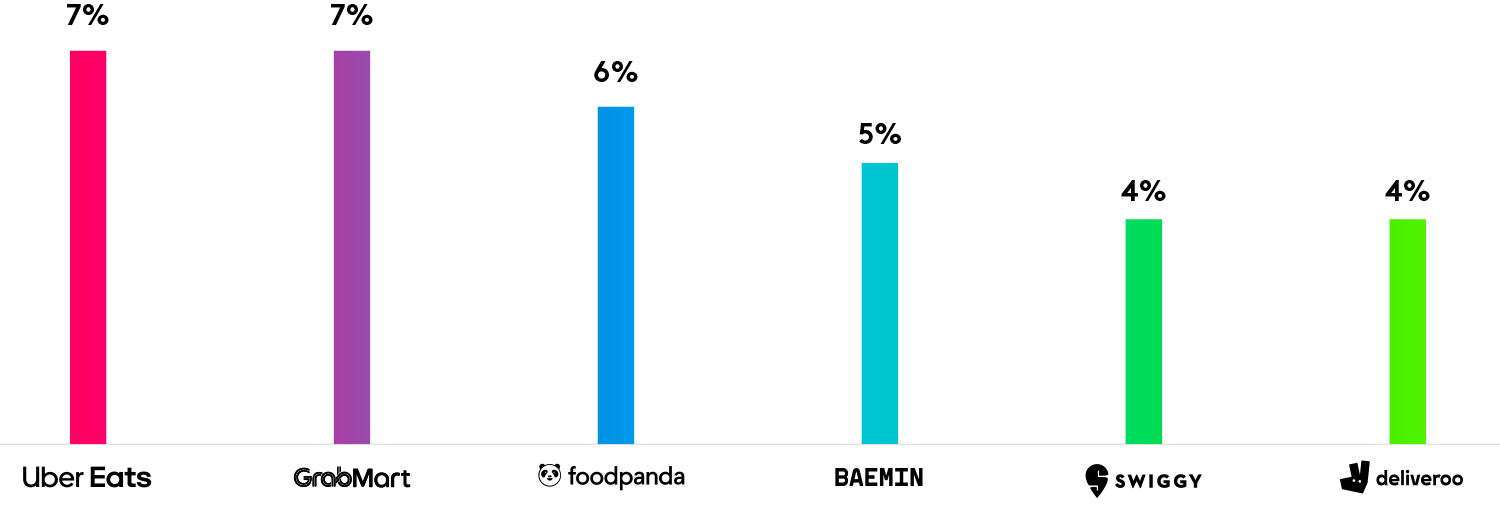

The RGD market is fragmented worldwide, with the top two suppliers, UberEats and GrabMart each accounting for only a 7% share of trips.

Top 5 Rapid Grocery Delivery Providers share of trips

The popularity of meal kits also grew during the pandemic in Europe and North America, where 17% of online shoppers have adopted them. Hello Fresh dominates in five out of seven markets surveyed, with only Italy and Spain preferring local meal kit providers (Rana and Food in the Box, respectively).

34% of online shoppers worldwide buy from second-hand online platforms. The most purchased categories for the ‘circular economy’ are digital devices, women’s fashion and home appliances – with Asia leading the way in terms of usage. While men and women are equally likely to shop second-hand, younger ecommerce shoppers dominate this space (48% are under 35).

Understanding the motivations behind these trends will open up opportunities for ecommerce growth.

Understand your online shoppers

Knowing how people shop online, what they buy where, the triggers and barriers to usage and what motivates them to buy on different platforms is key to a successful ecommerce strategy.

To find out more about the ecommerce landscape in your categories and your markets download our eCommerce ON booklet, and get in touch to find out about the in-depth reports available for sale.

About eCommerce On

eCommerce ON is a global study covering 19 countries, 15 consumer goods and electronics categories and over 69,000 shopping trips. It provides contextual ecommerce data and ecommerce insights to help you identify priorities and understand triggers and barriers across countries and categories to match the needs of online shoppers across the ecommerce landscape. eCommerce ON allows you to find new opportunities in your omnichannel strategy.