The fashion industry has undergone the most tumultuous two years seen in recent times. We have changed how much we bought, how we bought it, and also what we bought. Consumers went from buying 3.3bn fashion items in 2019 down to 2.5bn items in 2020 – while this may still sound like a lot, it’s over 800m items lost from a market that had been relatively stable.

Sales of products such as loungewear skyrocketed by nearly 60% last year as we spent more time at home. On the other hand, categories where demand was more heavily impacted by social restrictions (such as holiday and occasionwear) plunged by 90%, and are still yet to recover to pre-pandemic levels.

Retailers looking for success in the new landscape will need to capture the spend of shoppers returning to the market, and this begins with understanding what matters most to these shoppers.

Financially uncertain times ensue

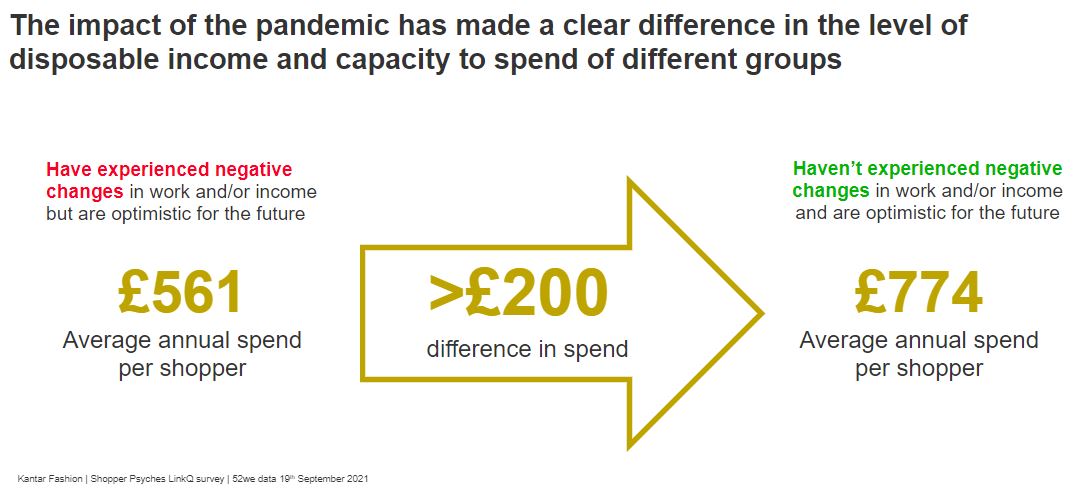

The financial implications of the pandemic have resulted in polarising fashion shopper groups emerging, with the negatively impacted shopping less frequently and spending an average of £200 less annually than the highest spending groups. With fashion being a more discretionary category, the disparity in financial stability amongst shoppers means retailers will need to cater to all spending abilities.

Retailers attracting a larger share of struggling shoppers may see a slower recovery. They will need to communicate that they understand the constraints of their shoppers and consider how they can support them through pricing and promotional activities.

Inclusivity is key

Our Inclusion and Diversity study shows that over 80% of shoppers are unable to name a fashion brand that they feel is inclusive. There is a clear opportunity for retailers and brands to do more; prominent issues that emerged within this were sizing and fitting.

Over 75% of respondents said that not being able to find their size was a deterrent to shopping with a retailer, while 74% of shoppers stated they would hold back if the retailer carried ill-fitting products – even with good sizing availability. This indicates that it’s not enough to simply carry a wide range of sizes, shoppers want to feel their body types are accurately catered for with regards to a garment’s fit as well.

Furthermore, 76% of shoppers found clothing sizes to be inconsistent amongst the brands they shop from, with 39% having to order multiple sizes to find the right fit. Online retailers face more of a barrier with this due to customers not being able to try products on before purchase – we know 61% of shoppers prefer to try on clothing in-store before they buy, according to our GB Undressed Study.

However, although stores have now reopened and shoppers can return to trying on products in-person, online is still accounting for 40% of all fashion spend – higher than pre-pandemic levels. It is essential for retailers to address these friction points in all channels by being more inclusive of different sizes and body types. Shoppers that feel represented by their brands are more likely to return for purchases and spend more when they engage.

Sustainability is on the rise

Our Who Cares, Who Does? study shows that, alongside financial security and inclusion of different body types, sustainability is one of the greatest shopper concerns facing the fashion industry. Free deliveries and returns policies may facilitate convenience, but they can also result in a large carbon footprint in terms of transport, and further environmental issues when those products cannot be resold or recycled.

From a consumer point of view, the onus is on brands and retailers to take action. Seventy three percent stated that it was important for retailers to tackle this issue long term, but only 13% were able to name a brand they feel is actively working to reduce their environmental impact. This leaves a big gap in a very competitive landscape for a brand to step up and position themselves on sustainable credentials to stand out. For brands looking to enhance their sustainability credentials with shoppers, it will be key to understand exactly what sustainability means for their particular shoppers.

Despite this growing expectation for brands and retailers to take action, we also see shoppers taking matters into their own hands. Pre-COVID-19, 56% of fashion shoppers stated they only buy when they need to. Cutbacks from social restrictions and amplified financial uncertainty accelerated this figure to 71% by the end of 2020. This leads to less purchasing moments for brands to cash in on, thus increasing the importance of making every interaction with the shopper count and fulfilling expectations when they do.

Key takeaways

- Given the varying financial challenges of shoppers today, understanding their differing needs, circumstances and behaviours is essential to building a holistic strategy to ensure your not excluding any group.

- Consumers wants to feel included. Be more inclusive by accommodating a greater range of sizes and body types.

- With growing awareness, sustainability is rising up the consumers’ agenda. Understand what sustainability means to your specific consumers, as this may vary, to enhance and promote your credentials accordingly.

Want to know more about our panel studies and how we can help your brand? Please contact a member of the fashion team for more information. You can also watch the on-demand video of our webinar on ‘How to be an inclusive and sustainable fashion brand’ for more insight.