Our latest take home grocery figures for Ireland show that sales fell by 7.2% over the 12 weeks to 17 April 2022. Against a complex backdrop of global supply chain issues, grocery price inflation has hit 4.7% this period, its highest level since September 2013.

The impact of grocery inflation is being felt widely across store shelves and consumers will be noticing the effects on their budgets. Foods like cooked poultry, bread, pasta, and butter have seen some of the biggest jumps. The average household is facing a €330 price increase on their annual grocery bill, and 23% of households say they are now struggling to make ends meet when it comes to their weekly food shop according to our most recent Link Q Service. Retailers are responding to the rising price of goods, focusing their efforts on offering everyday low prices for shoppers.

Basket sizes fall due to more meals out of home

For the first time since the pandemic began sales are in decline by 5.2% compared with two years ago, as the period now includes the start of the first lockdown when only essential shops were allowed to open. The pandemic might no longer be the first thing on shoppers’ minds, but we’re still seeing its effects on the grocery market as life gets back to normal. The number of supermarket trips made each month has continued to fall, with shoppers making 3.5 fewer visits on average than this time last year when COVID-19 restrictions were much tighter. The average spend per buyer has also fallen significantly by €144 as consumers eat more meals out of the home. On top of that, the types of items we’re buying have changed too. Sales of instant hot snacks and frozen pizzas are growing by 9% and 4.3% respectively over the last four weeks as shoppers turn to quick and easy meals now that many of us are back in the office and juggling school runs again.

Regardless of rising prices, consumers were keen to make the most of the Easter weekend – the first without social restrictions for two years. The retailers had some fantastic ranges on offer ahead of the long weekend and Irish consumers were eager to celebrate, spending €10.8 million more on Easter eggs and seasonal chocolate over the latest four-week period compared to the same time last year. The traditional hot cross bun is still a firm favourite, with shoppers spending an extra €620,000 this year.

Online market provides convenience for busier shoppers

The online market has continued to grow over the latest four-week period, with sales boosted by 3.9% as shoppers spent an additional €2 million. The channel’s market share is now 3.3 percentage points higher than the same 52-week period in 2019. Many people became more reliant on online shopping over the course of the pandemic, and this has fitted in quite naturally with our busier schedules post-COVID-19. In the context of rising prices, it also allows consumers to be more considerate as they add items to their basket. While people are buying less in stores, the average number of items being purchased online is actually on the rise, growing by 3.2% year on year.

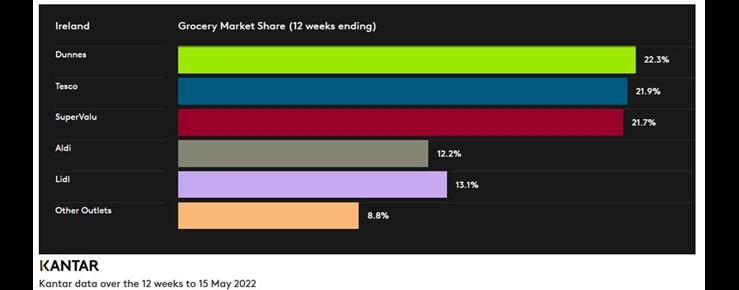

All the major retailers saw take-home grocery sales fall in the twelve weeks to 17 April 2022. Dunnes has retained its position as Ireland’s largest grocer, holding a 22.4% market share in the latest 12 weeks. The retailer was bolstered by the largest influx of new shoppers this period, who contributed an additional €56.8 million to its overall performance. SuperValu holds a 21.8% share of the market. Tesco follows closely behind at 21.7%, meaning that there is now just 0.1 percentage point between the retailers. Lidl and Aldi account for 13.0% and 12.1% of the market respectively.