Our latest take home grocery figures for Ireland show that sales fell by 6.5% in the 12 weeks to 15 May 2022. Irish shoppers are adjusting to increased prices as grocery inflation hits 5.5%, marking the first time it has risen above 5% since August 2013.

Food and drink prices are continuing to climb, and the impact of this on grocery budgets is now unavoidable for many people. Our research shows the rising cost of living is a key concern for 81% of Irish consumers*. A staggering 62% expect that they will have to cut back on the amount of food they buy in response to current prices. We’ll be seeing the effects of inflation for months to come.

Shoppers are shifting their behaviour to manage the cost of buying food, including by turning to cheaper alternatives. People are now making four less trips to the supermarket on average per month than they were this time last year. Similarly, branded items – a firm favourite when we were treating ourselves more during the COVID-19 lockdowns – previously made up more than 50% of grocery sales in 2020 and 2021. We’re now seeing clear signs that people are turning to retailer’s own-label items instead, which are usually less expensive. As a result, brands’ share of grocery spend has dropped to 49% in the latest 12-week period, which is equivalent to €29 million.

Sales to rise as shoppers gear up for sunny holidays

Despite the tough circumstances, people have been enjoying the recent warmer weather and are looking ahead to the summer months. Shoppers have been enjoying barbecue essentials as the June bank holiday edges closer. Sales of BBQ meats, like burgers and sausages, and prepared salads have increased by 2% and 8% respectively in the latest twelve weeks. Soft drinks have also seen a 5% boost this period, equating to an extra €5 million through the tills. It’s likely that sales of these items will keep rising as we make the shift to more summery foods and leave the soups and stews behind, but prices are going up too. A trip to the supermarket to buy BBQ meat, salad, and soft drinks will now cost you €1 more on average in total than it would have last year.

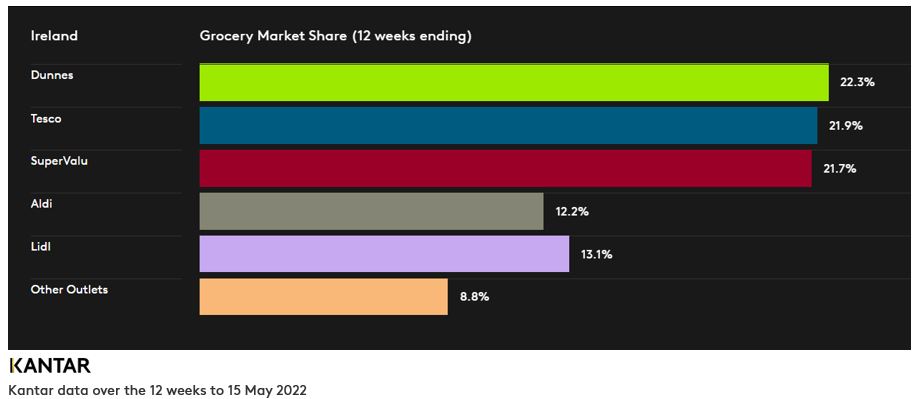

Dunnes maintains its lead as 0.6ppt separates the top 3

Tesco is now slightly ahead of SuperValu in the race for second place, each accounting for 21.9% and 21.7% share of the market respectively. The retailer benefited from an increase in the frequency of shoppers returning to store, bucking the general market trend and allowing them to move just ahead of SuperValu. Lidl holds a 13.1% market share this period. Aldi follows 0.9 percentage points behind, holding a 12.2% market share.

*Data from research with 1,002 Irish consumers on behalf of Permanent TSB