Supermarket sales fell by 1.9% during the twelve weeks to 12 June 2022, according to our latest take-home grocery figures, the best market performance since October last year. Over the latest four-weeks sales grew by 0.4% versus the same period in 2021. Despite the more positive figures, inflation remains a key challenge for the sector and like-for-like grocery prices rose by 8.3% over the past month, up 1.3 percentage points on May to reach their highest level since April 2009.

The sector hasn’t been in growth since April 2021 as it measures up against the record sales seen during the pandemic. However, these latest numbers show the market is to an extent returning to pre-COVID-19 norms as we begin comparisons with post-lockdown times.

The inflation number makes for difficult reading and shoppers will be watching budgets closely as the cost-of-living crisis takes its toll. Based on our latest data, the average annual grocery bill is on course to rise by £380. This is over £100 more than the number we reported in April this year, showing just how sharp price increases have been recent and the impact inflation is having on the sector.

Rising prices, rising footfall

Analysis shows that consumers are taking steps to manage the impact of rising prices at the tills. Shoppers have swapped branded items, which have declined by 1%, for own-label products. Sales of these lines, which are often cheaper, have risen by 2.9%, boosted by Aldi and Lidl’s strong performances, both of whom have extensive own-label repertoires. We can also see consumers turning to value ranges, such as ASDA Smart Price, Co-op Honest Value and Sainsbury’s Imperfectly Tasty, to save money and together all value own-label lines grew by 12%.Store footfall jumped by 3.4% over the latest four weeks, while online fell to its lowest proportion of the market since May 2020 at 12%. We’re still way ahead of our continental neighbours when it comes to buying groceries online and one in five British households makes an order each month, the highest proportion in Europe. But online sales have been suffering since the end of the pandemic. This is the twelfth month in a row they’ve been in decline and digital orders fell by almost 9% in June.

As well as the return to pre-COVID-19 habits, this drop could also be the result of shoppers looking to cut costs by avoiding delivery charges. The sunnier weather may also be pushing up store footfall, as people decide it’s warm enough to walk or cycle to their local supermarket.

Even with grocery inflation at a decade-long high, sales during the week of the Platinum Jubilee (to 5 June) were £87mn higher than on average in 2022. Despite the rising cost of living, the British public got into the jubilee spirit in characteristic fashion. Alcohol sales were up by a third and purchases of ice cream increased by 35% over the week compared to the average in 2022. Many people tried their hand at the official Jubilee pudding, the lemon Swiss roll and amaretti trifle, and sales grew by 16% for lemon curd, 58% for fresh cream, 18% for Swiss rolls and 9% for custard.

Lidl and Aldi gain more share

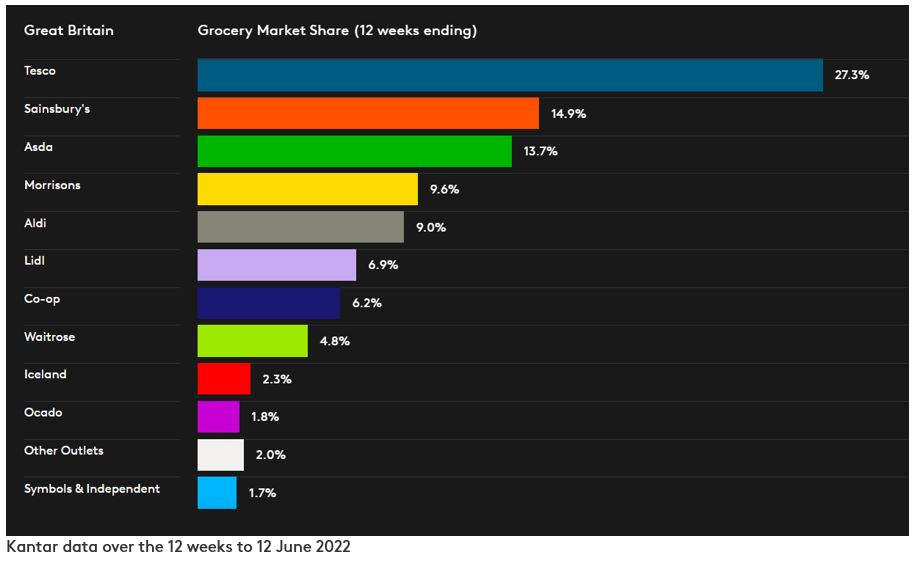

Lidl was once again the fastest growing grocer this period, pushing its sales up by 9.5% over the 12 weeks to reach a 6.9% market share. Sales at Aldi rose by 7.9%, moving its share up versus last year by 0.8 percentage points to 9.0%.

Iceland held its market share flat at 2.3%. The retailer has seen especially strong sales thanks to its 10% discount offer for over 60s, with the deal helping nearly double its market share among that demographic on Tuesdays over the past month.

While it didn’t achieve year-on-year growth, Tesco out-performed the total market to nudge its share up to 27.3%. Online retailer Ocado also did better than the wider market trend. The grocer’s sales fell by 2.3%, but it was able to retain its 1.8% slice of the market.

Sainsbury’s now holds 14.9% of the market, while Asda has 13.7% and Morrisons 9.6%. Convenience retailer Co-op accounts for 6.2% of sales and Waitrose holds 4.8%.