The latest take-home grocery figures from Kantar show that supermarket sales fell by 6.3% over the 12 weeks to 20 March 2022. Sales are still up versus two years ago, though only by 0.7% as the comparison now includes the record buying seen before the first lockdown in March 2020.

It’s no surprise that sales are down over the latest period as consumers are now more confident eating out of the home again. As well as enjoying meals out with friends and families, people will have also been grabbing food and drink on the go from supermarkets while travelling or at work. Those sales aren’t included in these take-home figures, but they will be adding to the grocers’ overall performance. What we’re really starting to see is the switch from the pandemic being the dominant factor driving our shopping behaviour towards the growing impact of inflation, as the cost of living becomes the bigger issue on consumers’ minds.

Shopping frequency decline and price rises accelerate

The latest data marks the first annual decline in grocery shopping trips for 12 months. Households made 15.4 visits to the supermarket on average last month, compared with 15.6 trips in March 2021. We’re socialising and commuting more than at any other point since the pandemic began, so consumers don’t have as much time to go to the shops. They also simply don’t need to buy as much food and drink to have at home. Higher fuel prices could be playing a role here too as people try to save petrol by visiting the supermarkets less often – something for us to keep a close eye on over the coming weeks.

Grocery price inflation has hit its highest level since April 2012 this period at 5.2% over the latest four weeks. More and more we’re going to see consumers and retailers take action to manage the growing cost of grocery baskets. Consumers are increasingly turning to own label products, which are usually cheaper than branded alternatives. Own label sales are down in line with the wider market but the proportion of spending on them versus brands has grown to 50.6%, up from 49.9% this time last year.

Meanwhile the grocers are also adapting their pricing strategies in response to the rising cost of goods. One trend we’re already tracking is the move away from selling products at ‘round pound’ prices. The percentage of packs sold at either £1, £2 or £3 has dropped significantly from 18.2% last year to 15.9% this March.

While COVID-19 is loosening its grip on day-to-day grocery habits, some pandemic trends are proving stickier than others. Two years on since the first lockdown, we can assess what permanent changes the pandemic has made to the grocery landscape. The real story of COVID-19 has been the acceleration of online shopping, and retailers have built their digital capacity to match a seismic change in demand. 12.6% of sales were made online in March 2022 compared with just 8.0% three years ago. Shoppers over the age of 65 are leading the charge – the proportion of this demographic buying online has doubled from 9% to 18% over the past three years.

What we’re buying has shifted too and some of the recipes we learnt during the lockdowns have become firm favourites. For some, baking seems to have gone from fad to hobby as flour volume sales are 28% higher than in March 2019. The dry pasta market is also 17% larger compared with two years ago. There are hints too that people have become permanently more germ-conscious with liquid soap volumes up by 11%.

Aldi and Lidl in year-on-year growth

Looking at individual grocers’ performance this month, the discounters Aldi and Lidl led the pack, both boosting sales over the 12 weeks by 3.6% versus last year. This rise in sales pushed Aldi to a new record high market share of 8.6%. It was especially successful in attracting back older customers this month, with a 16% increase in people aged over 55 buying from the grocer. These shoppers had been the most likely to shrink their repertoire of stores during the pandemic but are now shopping around again.

Lidl equalled the 6.4% market share high it achieved in November, also attracting back customers over the age of 55. It did particularly strongly in the bakery and chilled convenience aisles, with sales up 17% and 11% respectively.

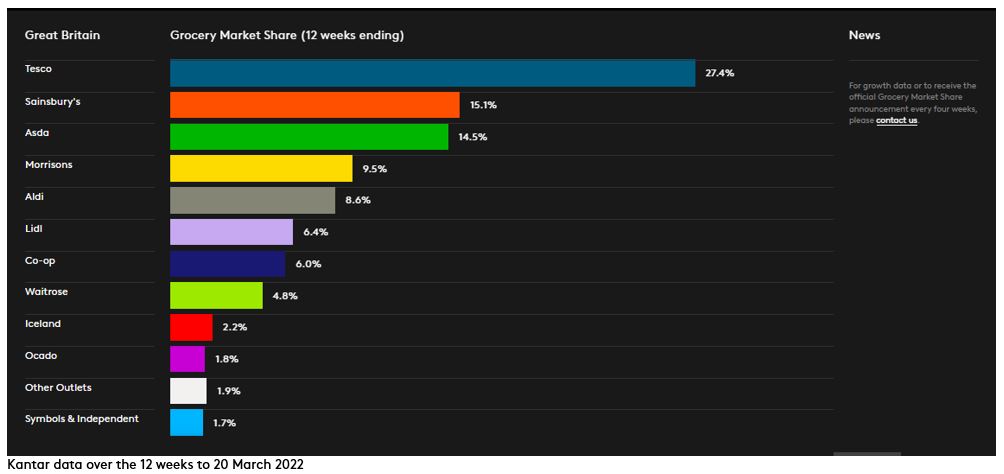

The only other retailer performing ahead of the market is Tesco, taking 27.4% of the market up from 27.1% during the same 12 weeks last year.

Sainsbury’s market share now stands at 15.1%, while Asda holds 14.5% and Morrisons 9.5%. Co-op, Waitrose and Iceland’s shares are 6.0%, 4.8% and 2.2% respectively. Online specialist Ocado has 1.8% of the market.