The latest Kantar Worldpanel research into product usage shows clear shifts in how often and when consumers eat everything from desserts to sandwiches. The changes mean food and drink manufacturers may need to make rapid changes to the positioning of their products.

Kantar’s head of food and drink consumption team, Nathan Ward, said understanding the evolving needs, states and motivations of shoppers was essential for brands to be able to serve up products for the consumption occasions they demanded.

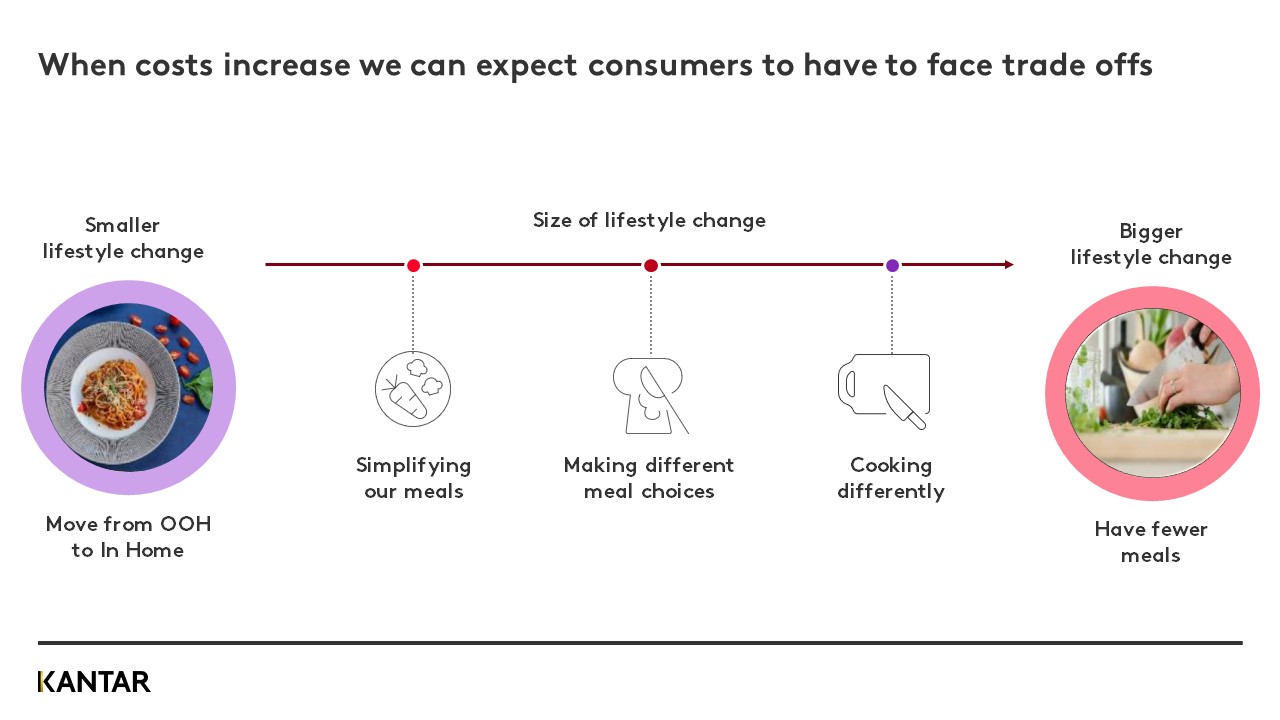

Ward said that there had been a shift towards simplifying meals in the past four months. This often meant cutting back on the number of ingredients or making tradeoffs such as removing a side dish or condiments from the meal.

“Increasingly for brands, it will be about making a case for why your product needs to be on the plate…why it is essential to the meal. It’s about giving your brand that point of difference,” Ward said.

Dessert differences

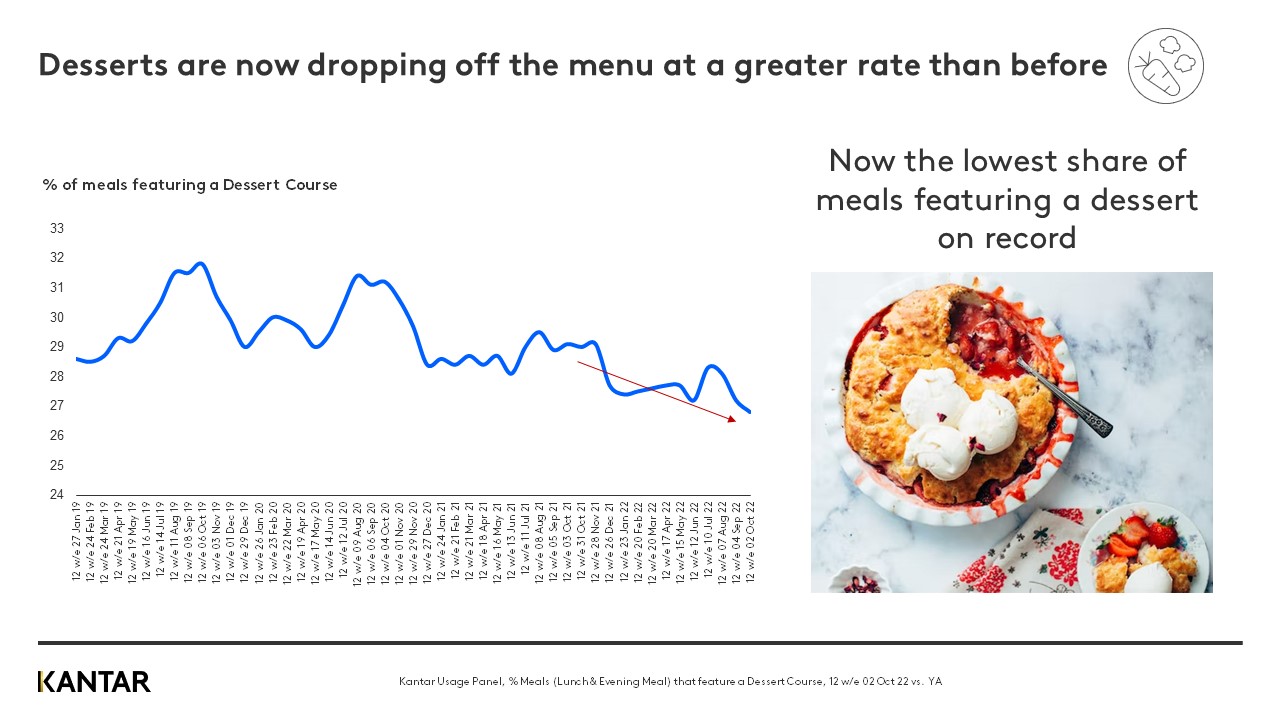

Desserts are a good example of an area impacted. Kantar data shows they now occupy the lowest share of meals featuring a dessert on record.

“We saw a peak during the pandemic of dessert consumption but we have returned to a longer-term trend of desserts dropping off. In recent months, we have seen it dropping more quickly, a response that appears to tie to economic challenges.”

But that doesn’t mean desserts are completely dead; they are still being consumed outside of meal occasions and being consumed as a single indulgent snack at other times in the day, such as later in the evening. Adjusting products, positioning and pricing will be even more important.

Frozen vegetables on the rise

On the healthier side of eating, vegetable consumption is changing. Data over recent months has reflected a rise in frozen and canned vegetables and a decline in fresh vegetables.

“Customers are thinking about how they can make tradeoffs. They want to save money but still eat vegetables. We are particularly seeing this shift in those who tell us they are struggling,” Ward said.

He said frozen vegetables were also increasingly popular as households strived to make the most of their spending and reduce food waste that commonly happened with fresh vegetables.

The humble sandwich is also doing its part to help struggling households.

Kantar’s usage data shows an 8% increase in the proportion of lunches featuring a sandwich between March and October of this year.

“Sandwiches are still the biggest meal in the UK. They are also a good bellwether for how people are reacting to the rising costs.” Leftovers and meat-free meals are also on the rise as shoppers fight for value.

But in a trend that may be counterintuitive, an expected rise in cooking from scratch to save money is yet to play out at scale. Demands for time and convenience likely play a part, but it may also be that intensive home cooking puts pressure on energy bills.

Ward said the data showed a shift towards cooking requiring a single method of cooking, such as a hob, instead of using multiple energy sources.

Whatever the meal or the method, Ward said brands needed to rethink their part in the way people used their products. “It’s about finding and protecting your role in a meal. Know the value you bring and communicate that well. You need to understand how meals are chosen, or not chosen, and then position your product within that dynamic.”

Kantar Worldpanel conducted a seven-part webinar series examining the impact of the cost of living.

Kantar Worldpanel conducted a seven-part webinar series examining the impact of the cost of living.

Watch our webinar on demand by signing up here.

To get details from the sessions, CLICK HERE.