The UK toy market gathered strong momentum at the end of 2021, with £1.7bn in sales ringing through the tills in the 12 weeks to 26 December. The lockdown-free few months in the lead up to Christmas prompted shoppers to return to the high street, where in-store sales topped £906 million, £124 million more than in 2020.

For a quick overview, check out our handy infographic here.

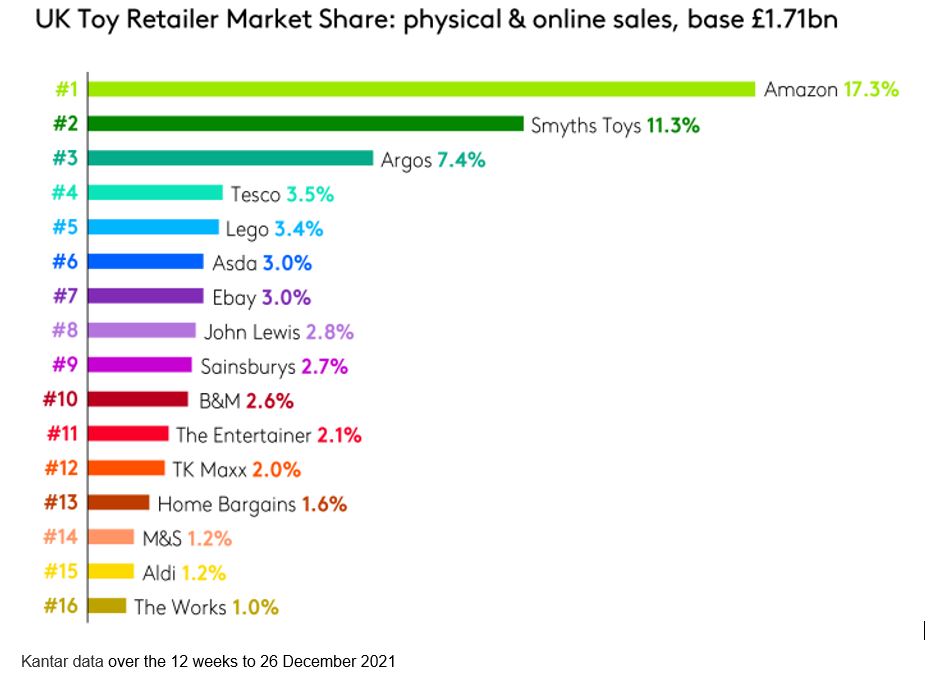

Smyths Toys enjoyed the strongest growth of any retailer over Christmas, earning nearly two percentage points of market share and solidifying its position as the second largest toy retailer in the UK.

Smyths, Amazon, and Argos led the way, with over a third of the total market share among them. Tesco was also one of the season’s standout performers, gaining an impressive 10m new toy shoppers in October.

A long tail of retailers, including The Entertainer, TK Maxx and B&M, all claimed similar slices of spend over the final few months of 2021, with narrow margins between them.

Despite 47% of Christmas sales being made online, this represented an 11% decline compared to the exceptional growth of the previous year. But digital isn’t going anywhere, as proven by the Black Friday boom: online toy sales tripled that week compared to an average week*.

The fastest growing sectors over the festive period included creative and learning toys, vehicle toys and arts and crafts. Knowing which sectors are most important to your key shoppers and adapting your offer to those shoppers groups will be increasingly important in 2022 as discretionary spend tightens. We can help you understand who your toy consumer is, what their motivations are, which toy retailers they are switching to and from, and much more. Get in touch with our experts.

* Data for the week to 28 November 2021 vs. an average week in 2021.