Our latest Entertainment on Demand data on the UK’s streaming market reveals that between July to September 2022, the number of Video on Demand (VoD)-enabled households that subscribed to at least one video streaming service in Great Britain fell to 16.18 million, down -234k, quarter on quarter, representing 56% of households in the UK market.

Worldpanel’s data reveals that House of the Dragon on NOW was the most enjoyed Streaming Video on Demand (SVoD) title over the quarter, followed by Lord of the Rings: The Rings of Power on Prime Video. Furthermore, the findings indicate some degree of market stabilisation after consecutive declines in subscriptions this year.

Kantar’s Entertainment on Demand study in Great Britain uncovers the following behaviours within the VoD market over the three months to September 2022:

Kantar’s Entertainment on Demand study in Great Britain uncovers the following behaviours within the VoD market over the three months to September 2022:

- Between July to September 2022, the number of VoD-enabled households that subscribed to at least one video streaming service in Great Britain fell to 16.18million, down -234k, quarter on quarter, representing 56% of households

- Almost half of churned Netflix subscribers dropped out of the SVoD category altogether

- Despite overall VoD penetration falling slightly, the total number of SVoD subscriptions in GB rose to 28.2million, a rise of 108k vs the previous quarter

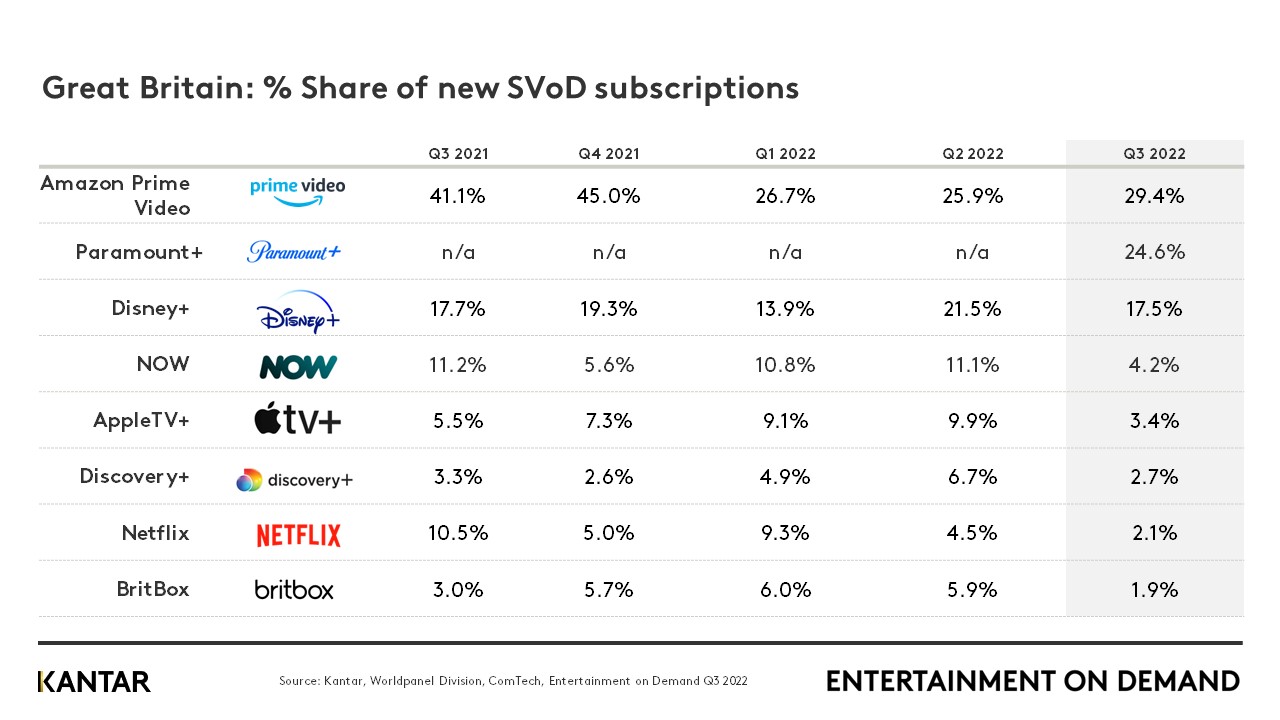

- Paramount+ enjoyed a successful launch across GB and is already the #5 largest SVoD service in the country, leapfrogging both Discovery+ & AppleTV+

- House of the Dragon on NOW was the most enjoyed SVoD title over the quarter, followed by Lord of the Rings: The Rings of Power on Prime Video

- The proportion of consumers planning to cancel one or more SVoD services in the next quarter (Q4’22) fell slightly, indicating some degree of market stabilisation

Paramount+ buoys overall numbers whilst households continue to cut back

After a sharp fall in SVoD household penetration in Q2’22, some degree of stabilisation in the market in Q3 should be seen as a positive sign, with penetration losses lower than in the previous 2 quarters. Continuing the improving picture is the fact that overall SVoD subscriptions increased, in absolute terms in Q3’22, up by 108k compared to Q2’22.

Commenting on the research, Dominic Sunnebo, Global Insight Director, Kantar, Worldpanel Division remarks: “There are a number of dynamics at play in the market, such as the cost of living crisis and subsequent ‘cord-cutting’, as well as a degree of ‘content fatigue’, experienced by some VoD viewers, which has resulted in an overall drop in household SVoD penetration. However, the launch of a new streaming service into the UK market has been relatively successful, suggesting that fresh content is still a key attraction for British viewers.

“Netflix accounted for just under 1 in 4 SVoD churners in the latest quarter, but what’s key here is that 45% of these Netflix churners dropped out of the SVoD market altogether. Data indicates that viewers did not switch to a competitor, or use a secondary streaming subscription; rather, they left the SVoD market altogether, reverting back to either pay TV or linear TV. In fact, 38% of Netflix customers only have a Netflix streaming subscription, and these ‘solo streamers’ are making up a disproportionate number of Netflix churners.”

With a major new streaming service, Paramount+, launching in the quarter, it might be expected that SVoD would see a bounce in penetration, but 95% of Paramount+ subscribers were already subscribing to one or more subscription streaming services. So, whilst they contributed to the overall size of the SVoD market, the service brought in a negligible number of entirely new streaming households. Subsequently, subscription stacking slightly rose in the latest quarter, with the average VoD-enabled household subscribing to 2.5 different services, up from 2.4 the previous quarter.

For Paramount+ to leapfrog Discovery+ and Apple TV+, both who have been present in the GB market for well over 12 months, is an impressive feat. However, this rapid growth must be caveated with the fact that many of Paramount+ subscribers are accessing the service via a deal with Sky TV, as Sky Cinema customers are able to access the service at no extra cost. Halo proved a strong draw for new Paramount+ subscribers, with 25% of their new content-driven subscribers citing the title as their key motivation for joining, whilst Star Trek: Strange New Worlds also performed impressively.

Sunnebo adds, “Off the back of its rapid growth, Paramount+ now has to work fast to ensure the strength of bond with its newly acquired subscribers. Current subscriber advocacy is relatively low, with just 7% of Paramount+ subscribers having multiple SVoD services ranking it as their most important service. At this early stage of launch, this is not unusual, but the critical task for Paramount+ is enabling fast discovery of their wider content catalogue beyond heavily marketed titles like Halo and Star Trek.”

Disney+ stays #1 for subscriber advocacy, but Netflix reverses negative trend

Last quarter, Disney+ unseated Netflix in a key measure of subscriber advocacy – net promoter score – and has held onto its pole position in Q3’22, though the gap with Netflix has reduced somewhat as it bounced back from an all-time low Q2’22. The steady increase in subscriber advocacy for Disney+ is resulting in positive movement across an array of other key metrics, with monthly churn in the quarter falling to an average of just 1.7%, whilst the same time continuing to secure strong share of new subscriber acquisition. That made Disney+ the fastest growing major service in the Q3’22 quarter (excluding newly-launched services).

The rings vs the dragons

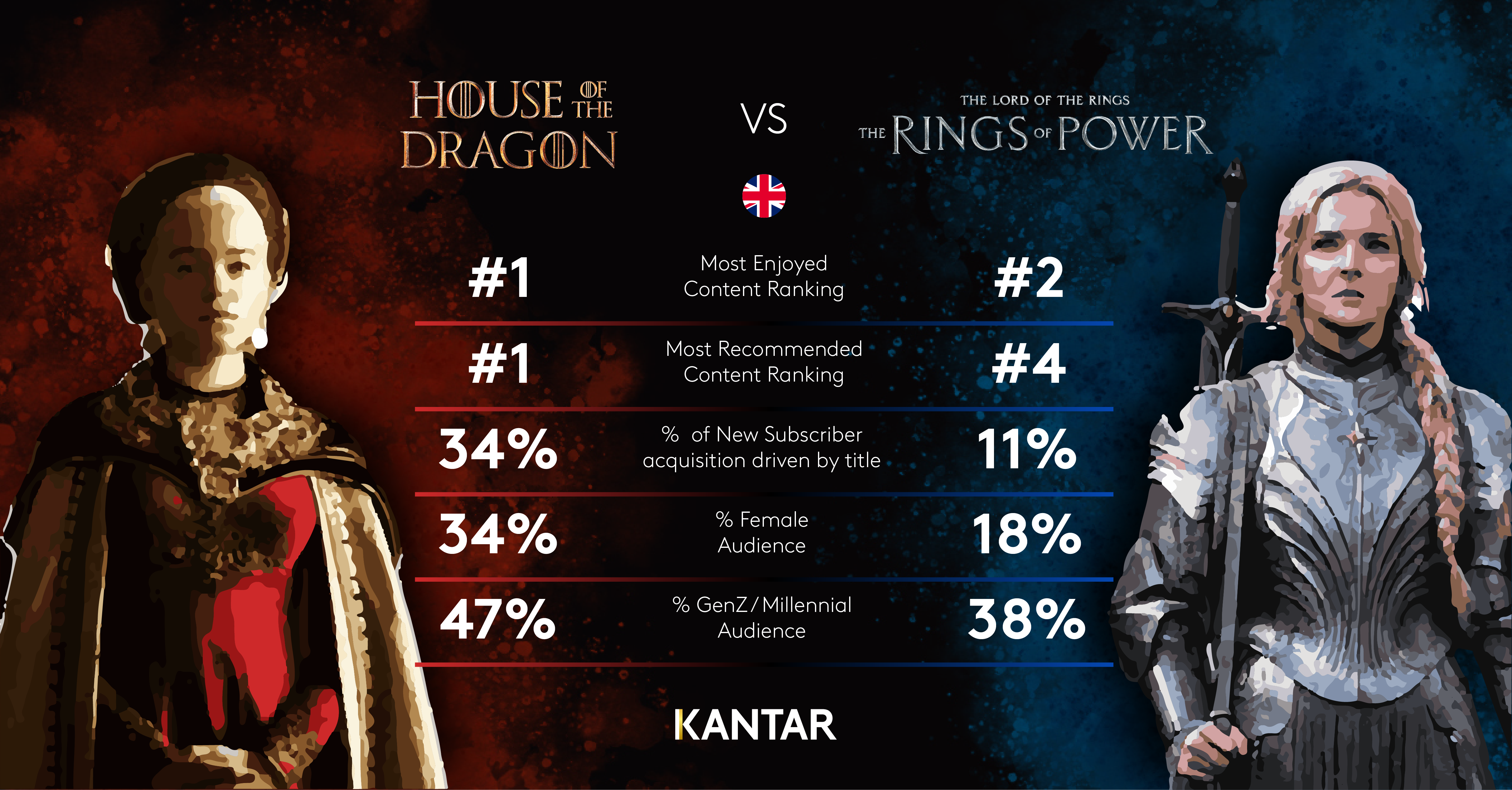

Q3’22 saw the release of two hugely-anticipated and expensive series, Lord of the Rings: The Rings of Power (tRoP) on Prime Video, and the Game of Thrones prequel, House of the Dragon, available on NOW. The two titles accounted for #1 and #2 in the list of most-enjoyed SVoD content over the quarter – House of Dragon at #1 with 7% and Lord of the Rings: The Rings of Power at #2 with 4%.

Stranger Things on Netflix rounded out the top 3 list. House of the Dragon was a key source of acquisition for NOW in the quarter, accounting for 34% of new content-driven subscribers, whilst the equivalent figure for Prime Video with tRoP was 11%. 82% of those citing tRoP as their top title over the quarter were male, compared to 66% of House of the Dragon viewers, highlighting a key difference in terms of mainstream appeal.

After the success Disney+ enjoyed with Obi-Wan Kenobi in Q2’22, one of its top-performing titles in the latest quarter was Only Murders in the Building (#8), highlighting the broader appeal Disney+ is now generating with its ‘Star’ branded content.

Access the interactive data visualisation tool for more information.