Original and exclusive sports content continues to drive growth for Subscription Video on Demand (SVoD) services. While the number of British households subscribing to at least one service remained stable, new programming has helped SVoD providers cement their place in consumers’ homes.

Our latest ComTech data reveals the following behaviours within SVoD from July to September 2021:

Can Squid Game boost Netflix’s share of new subs in Q4?

The release of original content and more exclusives also delivered successes for SVoD services. Netflix’s Money Heist was the top recommended show by friends and family to SVoD subscribers in GB and unsurprisingly also featured amongst the top three enjoyed content for Q3 across all the main SVoD service subscribers. Loki also made a notable impact, as Disney+ tapped into the nation’s love for action and adventure.

Over the last few weeks, Netflix has also experienced record-breaking viewership figures for Squid Game, which has driven signups. Since the hit series launched on 17 September there has been a day-by-day growth in new subscriber numbers as word-of-mouth advocacy, memes and media buzz spread. Netflix continues to drive excitement through reactive marketing by retweeting memes and accolades about the show from famous faces.

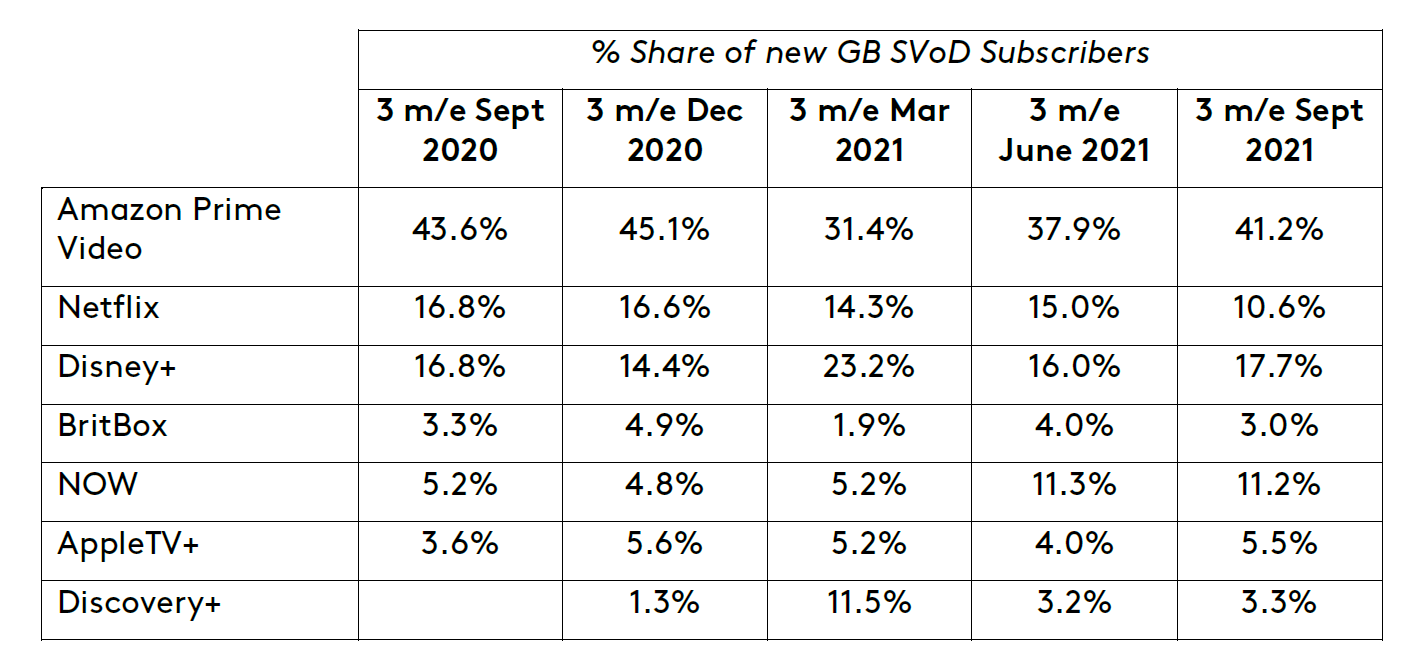

Amazon Prime Video had the single largest share of the new subscriber market in Q3 and has been steadily gaining market penetration, which can partly be attributed to its acquisition of sporting rights. Its content investments across sports and localised content continues to pay off as it diversifies its content range into top-tier football and tennis. This quarter, subscribers tuned in to see the latest adventures on Clarkson’s Farm and to enjoy Amazon originals such as the gripping Nine Perfect Strangers. All of this has led Amazon Prime Video to experience an increase in satisfaction for the number of new release films, new content and value for money.

We know that Netflix performs well when it comes to word of mouth, as it has the highest proportion of new subscribers who say they spoke to friends/family or tested the service with them prior to sign up. However, data collected to the end of September shows Amazon Prime Video remained #1 for growth.

Many streaming services have had a busy quarter, particularly those with sports rights agreements who harnessed opportunities with major tournaments, such as the delayed 2020 UEFA European Football Championship and the Tokyo 2020 Olympic Games. As we look towards the end of 2021, it will be interesting to see which of these titans can make the biggest impact on new subscriber shares in Q4.

Innovation beyond content streaming

Aside from providing premium content, Netflix is expanding its offering into the gaming market with the recent acquisition of video game developer and publisher Night School Studio and the roll out of mobile gaming titles across Europe. Our findings show that 24% of Netflix subscribers also subscribe to a gaming service, suggesting a sizeable proportion of its subscribers will be receptive to the latest offering.

While Netflix ventures into gaming, other services are turning their attention to Smart TV production. Sky recently announced its new Sky Glass Smart TV that operates via a broadband connection, removing the need for a satellite dish or set-top box, while its parent company Comcast launched the XClass Smart TV in the US which comes with a year’s free premium subscription to streaming service Peacock. Alongside these two new entrants, the Amazon Fire TV Omni Series has entered the market to provide consumers with a cinematic home theatre experience with Alexa built in. These developments are the latest entrants, such as Roku’s white label partnership with TCL.

We know that of the EU5 markets, Great Britain is most likely to be streaming content via a Smart TV, at 55% vs 42% EU5 average. This indicates that GB streamers are more likely to be responsive to new technologies that make it easier to watch SVoD services, and creates an opportunities for providers to merge their solutions into a more compelling offering.

Discovery+’s partnerships with Sky and Vodafone are driving up free trials

A relative newcomer to the GB streaming landscape is Discovery+, which secured a 3.3% share of new subscriber households last quarter. Discovery+ has partnered with Sky Q to provide customers with a 12-month free version of the service. Vodafone pay monthly UK customers can also currently add a 6-month free trial of the streaming service to their bill. With such big partnerships and great offers, it is no surprise that 48% of Discovery+ subscribers are currently using a free/trial version, compared to the market average of 4.7%.

As Discovery+ migrates trial users into paying customers, it needs to keep them hooked by continuing to release more exclusive content that can also attract more households. This is certainly possible for Discovery+, as 31% of new subscribers say they signed up to watch specific content. Discovery+ scores high amongst subscribers for the variety of TV series and amount of original content and has proved it can compete against the more established players in a crowded market. With subscribers increasingly stating they are satisfied with factors such as ease of use and value for money, we are likely to see Discovery+ continue to make an impact on the streaming landscape in 2022.