Indonesia’s most valuable brands are growing at more than double the rate of GDP, up 13% compared to 5.2% for the overall economy, according to the BrandZ™ Top 50 Most Valuable Indonesian Brands 2018, announced today by WPP and Kantar.

The success of the BrandZ Top 50 highlights the power of brand to drive stronger business performance. Over the last three years, the strongest brands in the Top 50 – the brands that consumers are most predisposed to buy - have grown nearly three times faster than weaker brands.

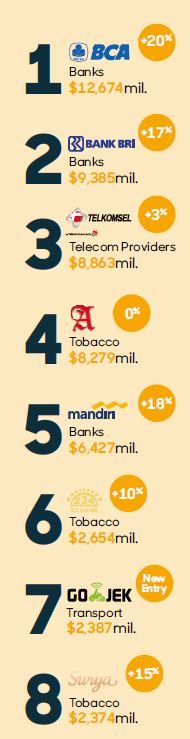

Indonesia’s most valuable brand is once again Bank Central Asia (BCA), which has grown its value by 20% to $12.7 billion. Its success saw it debut in the BrandZ Top 100 Most Valuable Global Brands in 2018 (No. 99, just behind Honda and in front of Adidas), becoming the first-ever Indonesian brand to feature in the global ranking.

In the past year, BCA has used new technology such as its virtual assistant, Vira, which enhances customer service through a range of popular chat applications, to deliver on its long-standing promise to be “Always by your side.” The brand’s work in the community includes an internship program for undergraduates and sponsorship of the annual badminton Indonesia Open.

The bank’s ongoing success also demonstrates the importance of innovation. Across the ranking, those brands that are perceived as highly innovative and offer a great experience grew 20% collectively over the past three years, compared to 12% growth among those who ranked less. The ability to develop new products and services alone is not enough to grow brand value; consumers need to see and feel the brand’s innovations and communicating them is essential.

One brand that is successfully communicating new and disruptive propositions to consumers is digital innovator Go-Jek (No. 7, $2.4 billion), the ride-hailing and on-demand apps service which was launched in 2010 and is now expanding into Vietnam. Other new Indonesian disruptor brands include digital travel booking service Traveloka (No. 20, $805 million), which is currently building operations in markets such as Malaysia, the Philippines Thailand and Vietnam; and online retailers Tokopedia (No. 33, $380 million) and Bukalapak (No. 37, $298 million).

These brands are new entrants to the BrandZ Top 50 Most Valuable Indonesian Brands for 2018, due to changes to criteria for all BrandZ listings that allows unicorns and private brands to be featured where there is credibly sourced financial information or details of funding in the public domain.

All four collectively feed a national desire to access more choices and more places as well as having more experiences. Together they have an average score of 123 for perceived innovation and 130 for experience – where 100 is the average brand. Brands that combine innovation with the provision of a highly positive experience for consumers have grown two-thirds more than those that fail to deliver on both.

However, not all Indonesia’s most valuable brands are successful in communicating their innovation, with the BrandZ Top 50 brands averaging just 108, compared to the Global Top 50’s average of 113.

David Roth, WPP, says: “BCA’s achievement in joining the BrandZ Top 100 Most Valuable Global Brands is impressive and demonstrates how powerful innovation is in growing brand value. For other Indonesian brands to match BCA’s performance, they will have to master the art of continuous innovation and then communicate it effectively to consumers.”

Indonesian consumers now look for brands that make a positive impact on their lives and can also justify how they are different to the rest of their category. The ability to create this ‘Meaningful Difference’ has become a key driver for growing brand value. Since 2015, brands in the BrandZ Top 50 that are perceived by consumers as being highly Meaningful and Different have grown 46% more than those that aren’t.

The FMCG sector, in particular, has struggled with changing conditions, growing just 2% year on year, discovering as Indonesia’s economy changes and develops, increases in market penetration are no longer enough to achieve growth.

In contrast, Bango (No. 23, $588 million) is the fastest-growing Food and Dairy brand, up 9% year on year thanks to initiatives such as its long-running campaign to celebrate the high quality of its black malika bean and the farmers that grow it, which encompasses regular large-scale events to build brand equity and deliver authentic experiences to consumers.

Other trends highlighted in this year’s BrandZ Indonesian Top 50 study include:

- Banks and retailers are nation’s fastest rising categories: Brands in two of the most traditional business sectors – retail and banking – lead the growth, up 8% and 19% respectively. Retailer Ace (No. 32, $421 million) and grocer Alfa (No. 24, $566 million) have grown by 47% and 33% respectively. In the banking sector, where seven brands posted double-digit rises, BTN (No. 43, 242 million) led the way with 31% growth due to building its digital banking options and expanding the provision of loans to people with informal work arrangements.

- New national shopping day: Indonesia’s online shopping day Harbolnas is becoming increasingly critical for brands. Launched in 2012 and held on 12.12 (12 December) each year, Harbolnas is fuelled by deep discounts and other offers, such as free delivery. In 2017, it generated IDR4.7 trillion ($315 million), four times the equivalent level of spend in 2016.

- Travel beyond Jakarta: Indonesia’s capital is home to less than 4% of the country’s population. Brands need to tailor messaging to regional and local preferences, which – especially when it comes to food – can vary considerably.

- Unique and affordable. According the annual Best Countries report developed by BAV Group, Indonesia ranks 41st out of 80 countries. Consumers globally perceive its greatest strengths are affordability and low manufacturing costs, although they tend to have low opinions of the quality of the country’s infrastructure, its position on human rights and health.

Ranjana Singh, WPP Country Manager for Indonesia and Vietnam, comments: “Brands can no longer rely on increasing distribution to power growing profits, the economy is now too developed for that. Instead, they must focus on building strong brands that stand for something and have meaning for local consumers. Even in sectors that have grown slowly, the brands who are Meaningful and Different to their consumers have grown their brand value in relation to their peers.”

Commissioned by WPP, the valuation behind the BrandZ™ Top 50 Most Valuable Indonesian Brands was conducted by brand equity research experts Kantar. The methodology mirrors that used to calculate the annual BrandZ Top 100 Most Valuable Global Brands ranking, which is now in its 13th year.

The ranking combines rigorously analysed financial data from Bloomberg and Kantar with the opinions of over 27,100 Indonesian consumers gathered for over 509 brands in more than 38 categories. The BrandZ Top 50 Most Valuable Indonesian Brands is the most definitive and robust ranking of the country’s brands available, and the brands ranked all meet one of these two eligibility criteria:

-The brand was originally created by an Indonesian enterprise and is owned by an enterprise listed on a credible stock exchange; or

-The brand is owned by an enterprise listed on Jakarta Stock Exchange; or

-Unicorns (which have a valuation in excess of $1 billion) founded in Indonesia have their most recent valuation available in the public domain