The COVID-19 pandemic has transformed many aspects of consumers’ lives and brought numerous sectors of the world economy to a halt. As of mid-April, over 90% of Americans are under “shelter in place” restrictions, over 22 million have filed unemployment claims and leading economists estimate that US GDP will decline by 30% from April to June.

During this chaotic and stressful time, marketers are desperately searching for ways to maintain their businesses and brands. TV advertising has always been an important way for brands to connect with consumers, and continues to remain one even now. Drawing on its ad intelligence services and ongoing COVID Barometer study, Kantar has found that the TV advertising landscape is changing.

While some sectors are cutting back significantly, many brands are still making strong use of TV advertising – and incorporating crisis themes in ads as they look to connect with consumers in new, meaningful ways. As noted by J. Walker Smith, Chief Knowledge Officer for Kantar’s Consulting division, “Crises offer a focused and short-lived moment when a particular sort of message can resonate. It is a moment to celebrate others, and to let the light of others shine on the brand.”

Opportunity in chaos?

While marketers may be concerned about whether it’s appropriate to advertise during a crisis, it’s clear that consumers are open to it. According to the most recent wave of Kantar’s COVID-19 Barometer, just 5% of consumers surveyed from April 9-12 stated that brands should stop advertising – a decline from the 7% stated in mid-March.

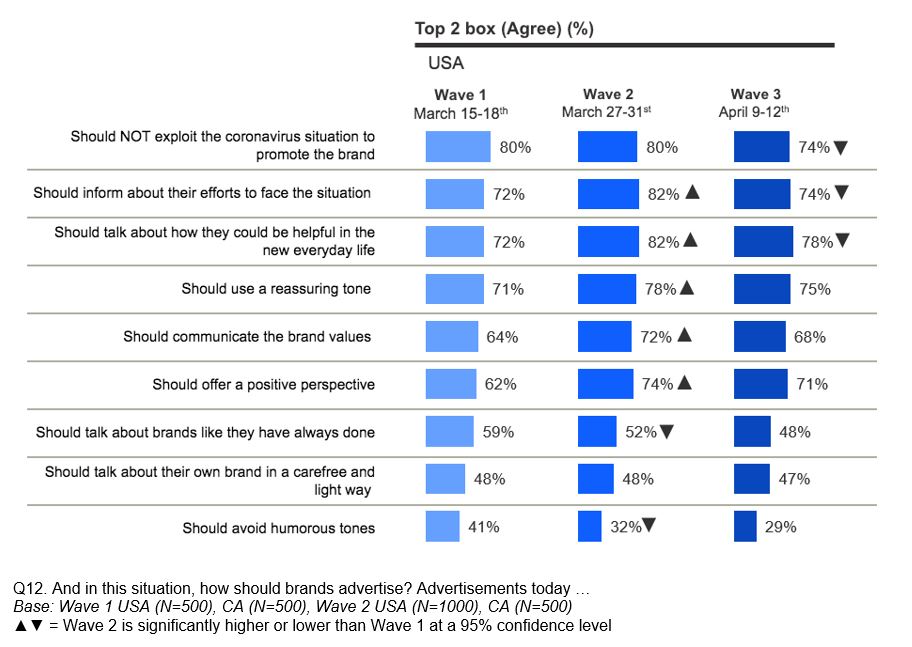

Consumers also have clear ideas about what they want from ad messaging today. Close to three-quarters of consumers agree that brands should not exploit the current crisis for their own benefit, while a similar share would like to be informed about what brands are doing to address the situation and how brands could help. A reassuring and positive tone is preferred over a light-hearted approach, although consumers don’t rule out humour: Less than a third of those surveyed agreed brands should avoid a humorous approach.

Notably, consumer views are clearly evolving as the pandemic crisis wears on. While consumers were particularly sensitive about exploitative ads in March and were particularly eager to get information from brands in late March, these concerns faded slightly by mid-April. As time goes on and consumers get more and more accustomed to a “new normal,” they will likely become increasingly more open to hearing promotional messages from brands. They may also welcome some more light-hearted advertising as a break from ongoing stress, although again managing the right tone will be critical.

TV ads decline – but stabilise?

Television is a particularly strong platform for advertising now, with 48% of consumers spending more time watching TV according to the Barometer; while web surfing, social media and other digital channels also saw comparable increases, usage levels for print, radio and other media were far lower. Video formats also offer a higher-resolution experience than print or digital display, making them a good choice for communicating nuanced messages at a time of crisis. Indeed, according to Kantar’s MarketNorms study, television is more than twice as effective as standard online advertising from a brand impact perspective.

However, TV advertising is also comparatively costly, and companies navigating an inevitable recession will understandably be making cuts. As seen in Kantar’s analysis of national TV advertising, starting from mid-March spending on national TV advertising across key categories declined by 40% on average compared to the previous year. Although this marks a significant decline, it does seem that the decline has plateaued at this level, with spending declines remaining slightly above 40% through late April.

More changes may lie ahead, especially if the national shutdown remains protracted: TV ad buys often take place weeks or months in advance, and brands may simply be finishing off previously committed budget. Meanwhile, the cancellation of TV sports and numerous other events may be leading TV networks to offer makegoods, giving brands continued ad impressions without any additional payments.

Strategies are also varying significantly by sector and by brand. With most businesses at a near standstill, travel companies have made the deepest cuts in ad spend: As of the last week of March, spending on travel ads was an astounding 99% below 2019 levels, indicating advertising had basically stopped. However, other sectors have cut spend far less, and some advertisers – like P&G – have stated that they may even increase spend to maintain their relationships with consumers during this difficult time.

Meanwhile, many advertisers have been breaking ads that reflect the new reality. While it has taken time for brands to create updated ads – and several have had to rely on stock footage, still photos or animation – many have done so. Indeed, according to Kantar’s creative attribution analysis, approximately 35% of national TV ads that ran during the week of April 13 had crisis themes. A look at three different sectors – automotive, quick serve restaurants and retail – shows what approaches are emerging from both a spend and creative messaging perspective.

Automotive: Business (Not) as Usual?

The current economic insecurity is creating a difficult environment for automotive companies. According to Kantar’s COVID-19 Barometer, 49% of consumers agree their income has already been affected by COVID and 71% are being more proactive about financial planning. It’s therefore not surprising that automotive companies have been cutting spend on advertising, and that this sector has been making deeper cuts than advertisers overall.

Indeed, automotive brands were spending close to a third less than last year even in late March; after some fluctuations, declines hit a steep drop of 80% in the first week of April; spend then rebounded somewhat from the low of $16.3 million in spend seen that week, but still remained far below last year’s levels. Automotive brands are particularly likely to advertise during sporting events – for example, the auto category $151 million on March Madness ads in 2019, or close to 17% of overall ad revenues from the tournament. It’s likely they had significant amounts of makegoods to leverage, meaning spend could fall even further if the national outlook worsens.

Looking at the messaging from some of the brands, Kantar’s J. Walker Smith notes that “the bulk of these ads are about deals, and are just a continuation of standard operating practice.” Many ads were similar to this example from Cadillac, referencing “uncertain times” and offering payment flexibility, free OnStar and online appointment service scheduling. While ads like these do acknowledge the current situation and attempt to offer helpful solutions, they don’t say anything truly new.

Even ads that don’t explicitly encourage consumers to buy may find it difficult to make an impact. One ad from Honda did reference community and show a healthcare worker, but focused overall on its “power of dreams” tagline, which simply doesn’t seem very relevant to the current situation. Referencing the current situation in ways that could seem self-serving definitely risks getting a poor reception from consumers, as seen in Kantar’s COVID-19 Barometer findings.

QSR: Delivering on value

QSR (Quick Service Restaurant) companies are in a very different position from automotive brands. Restaurants are still able to operate on a delivery/takeout only basis throughout most of the country, and value oriented QSRs can position themselves as one of few indulgences consumers can still enjoy. While these brands have cut back significantly as well, recent year-over-year declines of approximately 50% are still lower than the hits taken by automotive. During the week of April 13 this sector spent $42.1 million on national TV ads or over 80% more than automotive, indicating they may remain something of an opportunity for media sellers.

While QSR may not be cutting as deeply as automotive, their ad messaging has some similarities – emphasising deals and solutions like contactless delivery/pickup. As also seen in other sectors, “the most common language used is about 'taking care' of people - let our brands keep taking care of you,” observes Smith. This approach can clearly be seen in this Burger King ad which explicitly states, “Let us take care of you while you take care of yourself.” However, the lower purchase prices of QSR make a lighter approach also possible. For example, this Taco Bell ad positions itself as a solution for people feeling “boxed in” and shows lots of people eating Taco Bell at home in a Zoom-like experience – noting you can get “a Chalupa Supreme and all this love for only $5.”

Retail: From shopping to an essential service

Although retail advertising took longer to decline, it is now experiencing declines in the 56-57% range, reflecting cuts that are somewhat deeper than QSR but still far below automotive. The first major cuts began taking place on the week of 3/16, when the first widespread lockdowns were announced, and then immediately settled into sharp declines of over 40%.

The retail advertising sector has been buoyed by companies who are considered essential – in particular Amazon, which more than doubled its year-to-date spend compared to 2019. While retailers such as apparel companies may have shut down their TV campaigns along with brick and mortar stores, mass merchandisers, drugstores, hardware stores and office supply stores are still operating in many areas and thus still advertising in many cases.

However, there are particularly complex issues for retailer ads to navigate. Whether they are working at checkout counters or in warehouses, retail workers are of course facing heightened risks. As seen in Kantar’s COVID-19 Barometer, consumers will want to know what companies are doing to keep their workers safe. Meanwhile, promoting frivolous or luxury items will seem particularly tone deaf at a time when workers’ lives may be put at risk to fulfill orders.

Accordingly, brands are trying to position their products as essential – something you need, not just want. As one example, Best Buy created an ad that’s quite a departure from its usual focus on fun and cool tech. Instead, it emphasises on how its products make it possible to work and learn from home and stay connected, while showing a box left on a doorstep with no delivery person in sight.

Meanwhile, Amazon has made a substantial investment in TV ads to help address current PR challenges, including workers staging protests, sick-outs and walkouts over safety conditions. This Amazon ad from mid-April shows workers wearing masks and gloves and having their temperature taking while stating, “To everyone who makes staying home possible, thank you.” While Amazon workers certainly do deserve to be celebrated, there’s a risk that this approach can seem defensive as well as self-serving – as noted by J. Walker Smith, “This is all about self-promoting the brand by celebrating people who work for the brand.”

Missed opportunities and the path forward

Ultimately, many of the crisis-themed ads across these three verticals are similar. “The ads acknowledge that things have changed, and within that context the ads spotlight what brands are doing to help people keep doing business with them,” said J Walker Smith from Kantar’s Consulting division. “In this way, these ads are reassuring. However, there’s a lost opportunity for brands to be inspirational. A lost moment for speaking to a broader sense of need and togetherness and sacrifice and bonding.”

As an alternative, Smith recommends that brands consider the idea of “public.” “The Era of the Public has been an on-going shift in brand expectations and is now likely to be accelerated by this crisis,” he observes. “The question for brands to ask is how they can step up into a public role to contribute to a better society, particularly the kinds of public things needed right now.”

As one example, Smith points out Steak-Umm’s Twitter account, which has become an unlikely source for reliable COVID-19 information. As the company tweeted on April 10, “We are just a frozen meat brand tweeting into the void hoping to provoke thought, inspire unity, and relay useful information. We are not an expert in anything or some beef god. We are a company with a bottom line being run by people. Stay safe and be good to each other out there.”

Dove offers another good example of a brand reaching for a higher message. One recent Dove ad shows closeups of healthcare workers’ faces, many deeply marked and scarred due to wearing PPE. The ad states that ”Courage is beautiful” and notes that as a thank you Dove has donated to Direct Relief to support front-line workers. It also drives viewers to dove.com/besafe, a site that outlines Dove’s charitable work and provides links to safety tips and tools for supporting young people’s mental health while schools are closed. The campaign is a natural evolution from Dove’s well-received “Real Beauty” campaign and celebrates those truly making a difference rather than those who work for the brand.

As the crisis continues, forward-thinking brands will quickly realise that now is not the time to retreat. Instead, brands that are able to thoughtfully adapt to the new reality while remaining true to their brand values will need to advertise to convey new messages. The brands that can go beyond simply helping consumers and instead inspire them will be able to benefit both now and well into the future. Kantar will continue monitoring this space as it evolves.