The personal care sector in Asia has rebounded relatively quickly following the height of the pandemic. In China, before COVID-19 hit, the personal care market was forecast to grow 9% in 2020, but is now on track for a -5% decline. In South Korea, the market has shrunk by -8%, compared with expected growth of 4.8%. The impact has been lower in Thailand, where the sector was expected to remain flat, but has declined by -2.1%.

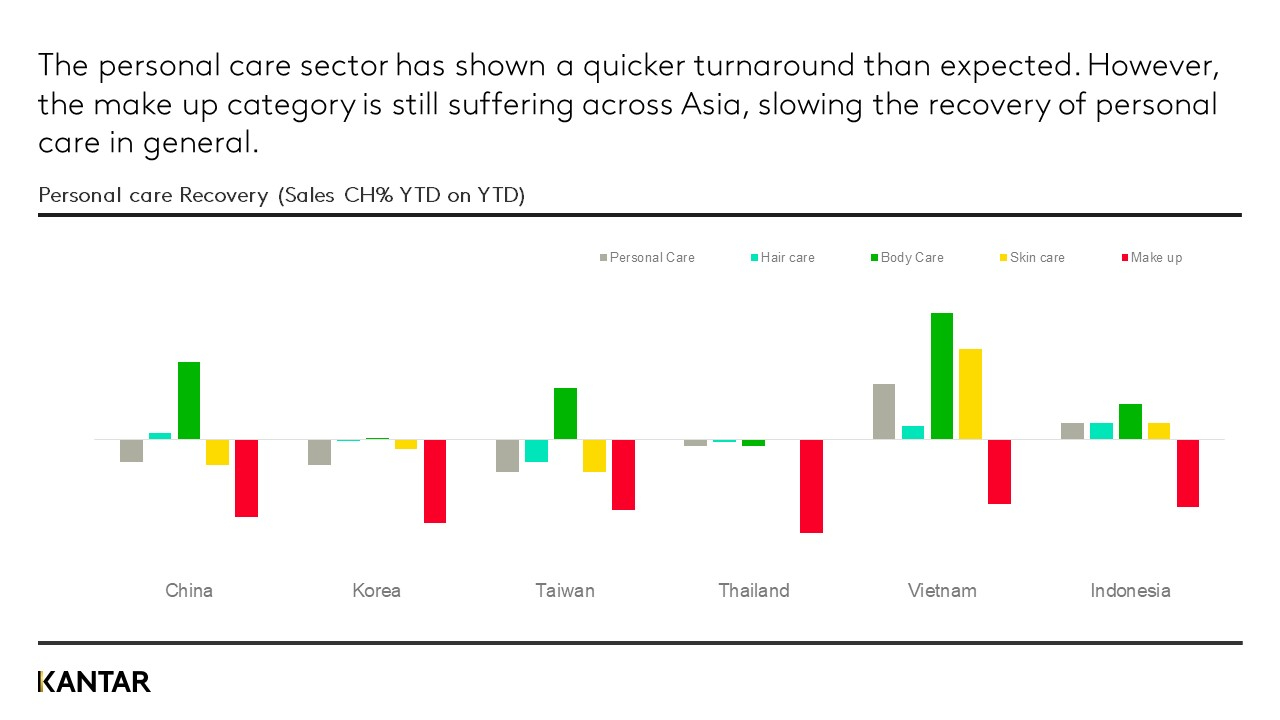

Across Asia, we see different categories recovering at different rates:

- Growth categories: sectors that are doing better than before the pandemic due to increased awareness of hygiene, including bodywash, handwash and sanitiser.

- U-shaped recovery: necessities, including skincare and haircare, which endured a steep fall as occasions reduced, but are now rebounding quickly.

- L-shaped recovery: discretionary sectors that are taking longer to bounce back. Make-up in particular is still struggling, slowing the overall rate of recovery.

The disruption caused by the pandemic has impacted personal care brands the world over – changing consumer behaviours, accelerating trends and presenting new challenges.

In Asia, COVID-19 pressed ‘fast forward’ on developments that were expected to take five years to unroll. These shifts point the way for brands in the rest of the world: not only is Asia a trailblazer in the beauty sector, it is further along the recovery curve than many other regions.

Consumers are thinking beyond ‘skin deep’

Increased concerns around health and leading a safer life have changed consumers’ expectations of beauty: they expect brands to help them feel and live better, not just look better. Priorities have shifted from fixing issues – such as erasing wrinkles – to building a strong foundation.

Consumers want personal care products to be highly effective, and offer more sophisticated functions. Already gaining in popularity before the outbreak, derma-care products have gained further traction, and the trend is spilling over from skincare into body care and make-up. The leading country for derma is Korea, with 56% penetration.

Clean beauty has also risen in importance, with brands expected to be safe and environmentally responsible. Complex ingredients are falling out of favour, as consumers look for those that are natural, gentle and vegan, for example. In China, products that claim ‘repair and recovery’ qualities are seen more and more frequently.

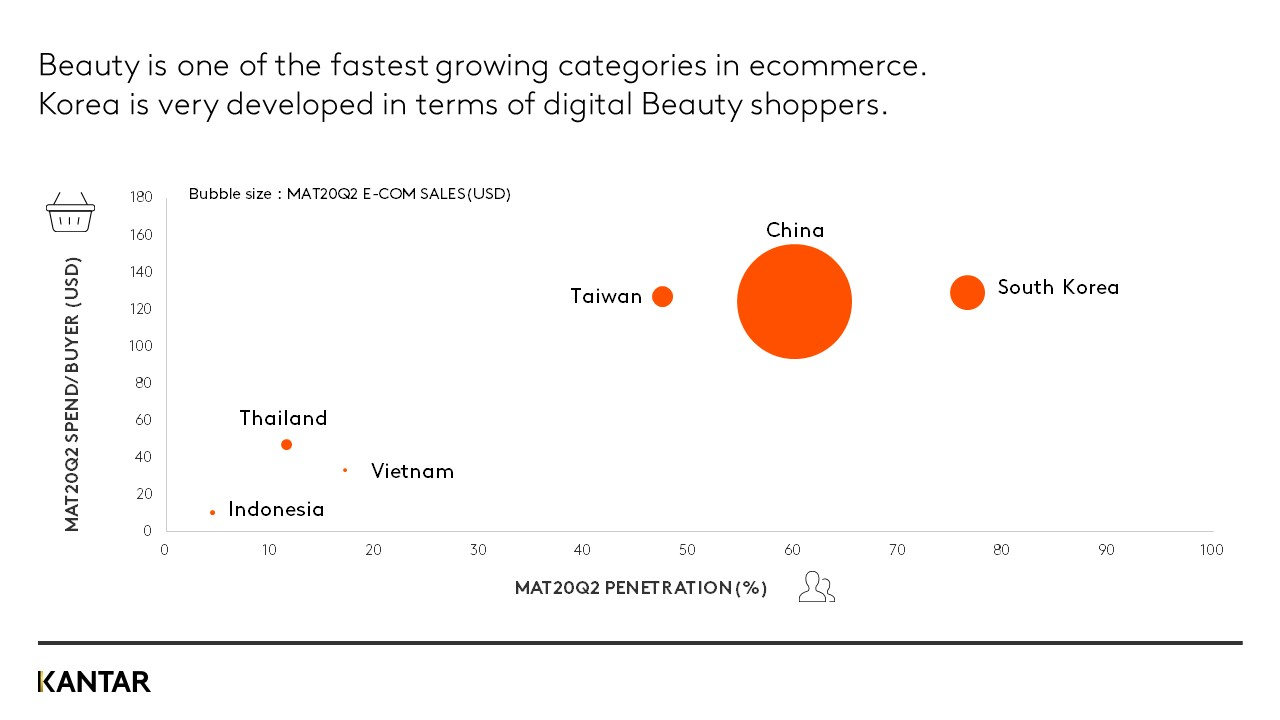

Ecommerce is now a part of daily life

Restrictions on physical movement have forced a shift in spend from offline to online platforms. Consumers are not expected to move away from online channels now they’re able to visit stores again, as they’ve ‘tasted’ advantages such as convenience, greater accessibility and lower prices.

Offline channels remain important, however – in Thailand, offline traffic is still 19 times higher than online traffic – and this channel is recovering, albeit slowly.

In markets where ecommerce is more mature, whereas shoppers once used one or two platforms for their beauty purchases, the landscape is diversifying with different platforms catering for different shopping missions.

The rapid development of ecommerce has given smaller ‘long tail’ brands greater reach, and helped them gain traction. These include local brands, which have excelled due to being ‘ecommerce ready’, combined with their understanding of local consumers’ needs: 70% of China’s top growing cosmetics brands are domestic in origin.

Shoppers seek sensible pricing and good value

With the pandemic hitting incomes hard, most Asian consumers are paying more attention to getting maximum value for their personal care spend. This doesn’t mean they’ll go for the cheapest option, however; they evaluate their choices based on benefits.

Whereas premium beauty was on the rise before coronavirus, mass and ‘masstige’ brands are now growing their market share. Their appeal lies in offering an exciting unique proposition, building a distinct area of expertise, or matching the benefits offered by premium products at a more accessible price.

Demand for luxury has remained strong in some markets, despite increased price sensitivity, due to the fact that the highest income consumers have been least affected by COVID-19.

The rapid changes we have witnessed in the Asian beauty sector are here to stay. To remain competitive, beauty brands across the world must capture new consumer expectations and behaviours, and respond to the ways in which their markets have evolved. In particular, they should:

- Review their product portfolio and innovation – to embrace a wider perspective that meets consumer demands for safety, health and being ‘green’.

- Provide value-seekers with a reason to buy – creating and demonstrating good value, for instance by improving efficacy and functions, or using new technology.

- Adapt communications – to emphasise health benefits, active ingredients or scientific or medical credentials.

- Build their ecommerce offer – making purchasing easier and more routine, through developing the supporting infrastructure and payment systems, and improving delivery, for example.

- Reach consumers online by addressing their beauty missions – understanding the main mission types and how each platform meets them, to decide which are most appropriate for the brand to penetrate.

- Build a consistent and complementary online-to-offline (O2O) experience – to maximise exposure and availability.