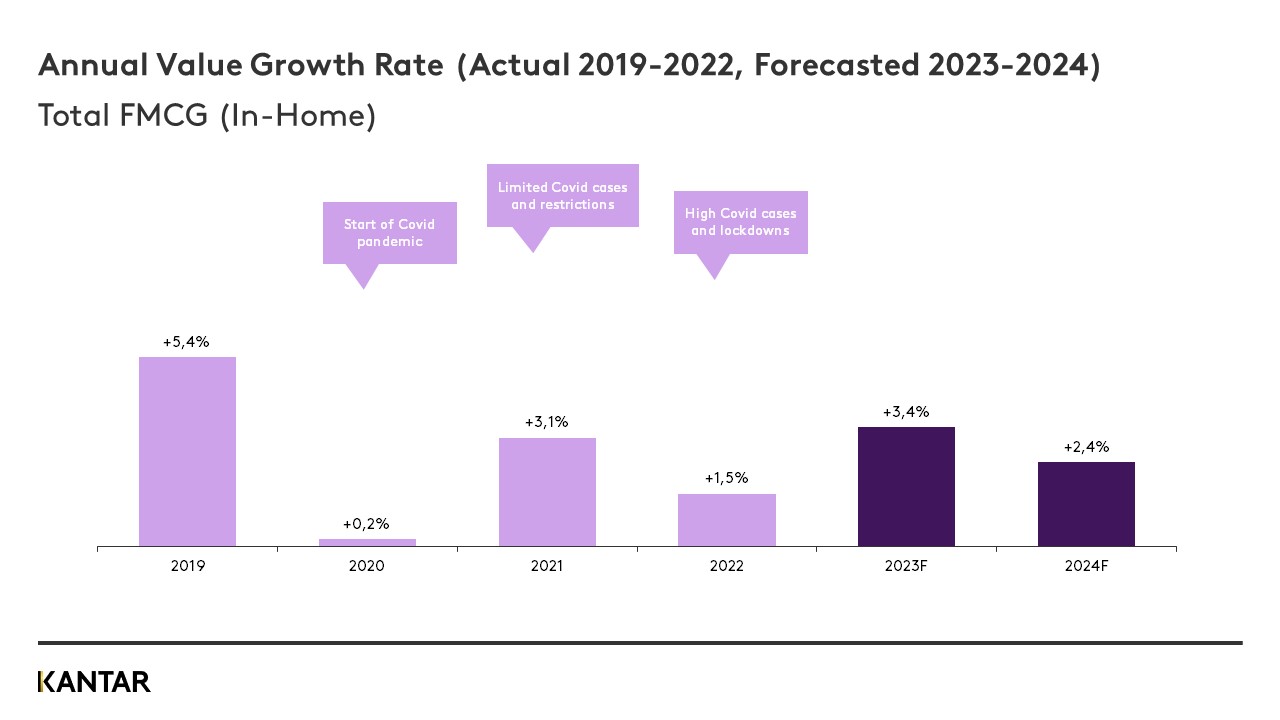

Mainland China’s FMCG market has faced a number of challenges over the last three years due to the Covid pandemic, which resulted in a significant slowdown in the pace of growth. In 2019, FMCG was experiencing a robust annual growth rate of over 5% but this had more than halved by 2022. Now that life has returned to normal, how do we expect the market to perform?

To answer this question, the Expert Solutions team at Worldpanel ran a forecast model using historical sales data for the last five years. We looked at the relationship between the four-weekly category performance and Covid case numbers to predict how the category will perform over the next 18 months, during a time without the impact of Covid.

The results show that the Chinese FMCG market is likely to achieve a growth rate of 3.4% in 2023, which is higher than 2022. Growth in 2024 will be slightly lower at 2.4%. This year’s higher growth is driven mainly by the rebound effect from very low value sales in Q4 of 2022, when the significant increase in Covid infections severely restricted mobility and spending. This means that while FMCG performance will be stronger compared to the Covid years, it will not yet return to pre-Covid levels.

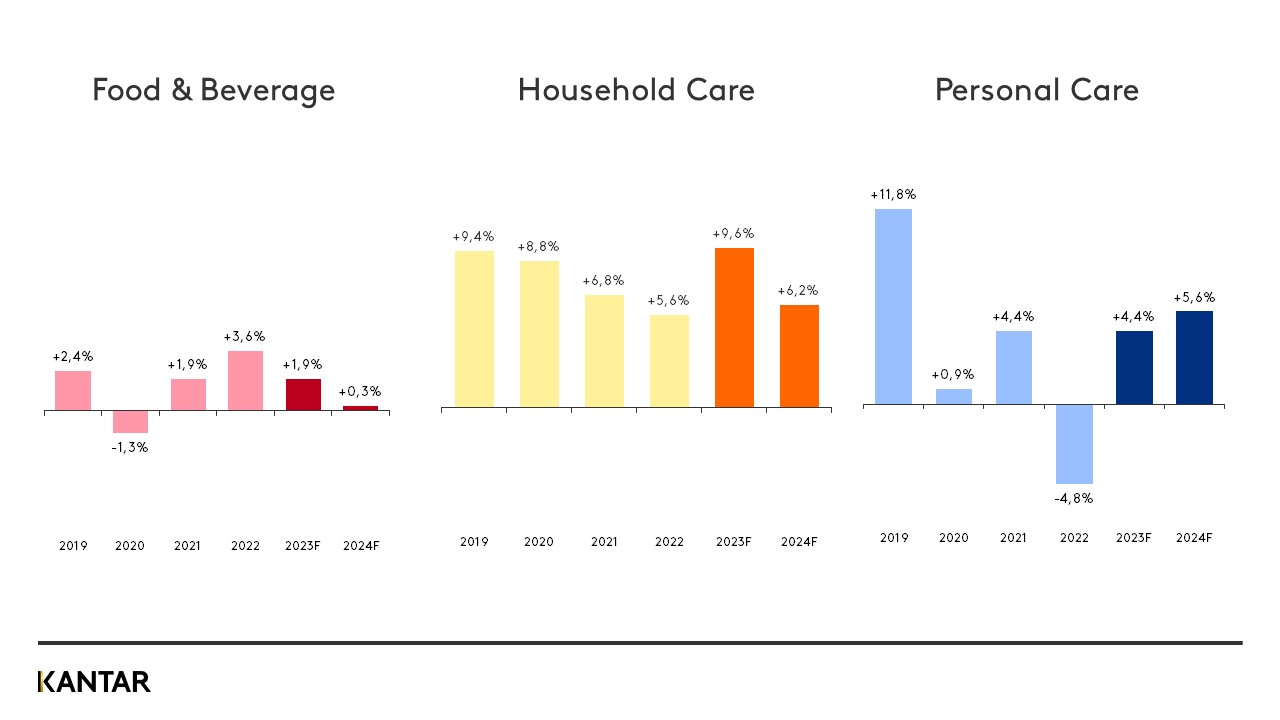

We expect to see different recovery paths for different sectors, due to how consumer needs and habits changed during Covid.

Food & Beverage categories generally performed quite well during 2022, as many shoppers were not able to eat and drink out of the home. This meant they stocked up on things like instant noodles, soft drinks and frozen food. Now that there are no restrictions we expect there to be fewer in-home F&B occasions, and therefore growth will be lower in 2023 and 2024 for these categories. However, some – like herbs & spices and cooking oils – are likely to maintain their growth as the ‘cooking at home’ habits formed during Covid continue for many households.

Household Care was experiencing relatively strong growth prior to Covid, but this slowed gradually from 2020 to 2022 as consumers looked to manage their spending and switch to lower priced products. However, in general this sector has not been heavily impacted, as consumers still need to clean their homes and clothes. We expect household care to perform well over the next two years as consumer confidence improves and shoppers become more willing to trade up to premium products with added sanitisation benefits to protect them from future Covid variants.

Personal Care was growing in double digits before Covid, but suffered during the pandemic – particularly skincare and cosmetics – due to consumers spending more time at home. In the post-Covid era we expect personal care to achieve a robust growth rate of 4-6%, but the sector will not be able to reach pre-Covid levels by the end of 2024. This is likely due to the higher price point of these categories, and the fact that some shoppers will remain cautious in their spending.

The future holds a lot of opportunity for FMCG manufacturers and retailers in Mainland China, but some uncertainty is still to be expected, and many new needs and habits formed during Covid are likely to remain important. In this context, the best ways to capture growth in the post-Covid era are:

- Understand how consumers’ needs and preferences have changed. New needs, such as safety, health and convenience, may be permanent, or on the other hand consumers may return to their previous habits and lifestyles. Brands must understand this within their category, then tailor their innovation and messaging accordingly.

- Understand how the channel landscape has evolved. Covid has accelerated the growth of channels such as O2O and social commerce. Brands that are able to leverage these channels to get their products in the hands of consumers quickly, safely and in an engaging way will stay ahead of the competition.

- Anticipate demand, and understand the role marketing levers play in growing penetration. Capturing new shoppers will remain essential. Forecasting demand for their category, and the role that pricing, promotions, distribution and media play in driving penetration, will help brands to optimise their marketing spend throughout the year.

Kantar Worldpanel is uniquely placed to help you understand how consumers’ needs and the way they shop has changed. Through advanced machine learning techniques, we can help you forecast demand for your categories and brands over the next two years and advise how you should invest your marketing spend to capture more new shoppers and maximise growth.