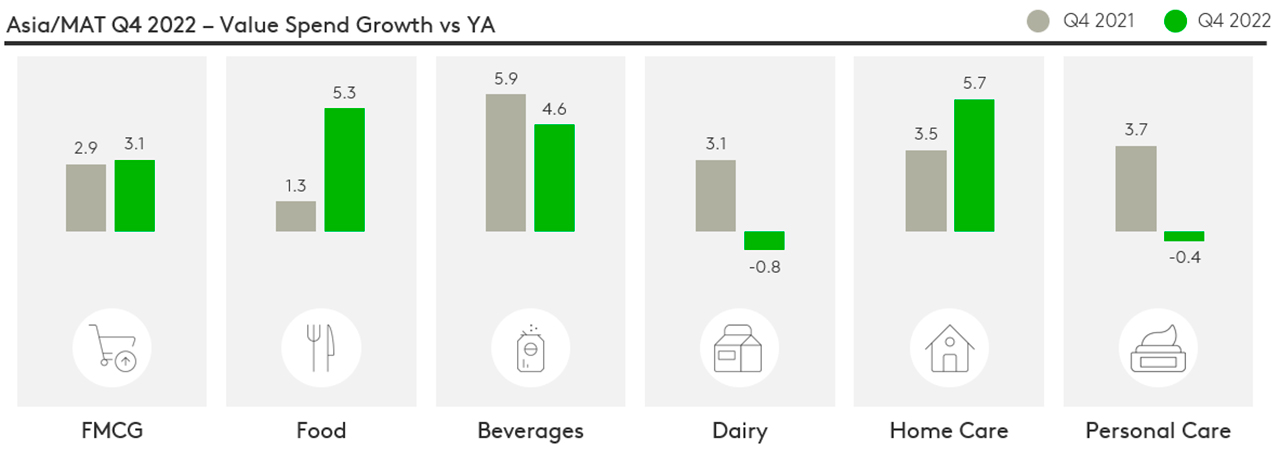

Worldpanel's latest Asia Pulse report reveals that Asia's FMCG sector maintained growth at a stable rate in Q4 of 2022 compared to the previous year, with a 3.1% increase in value amid inflationary pressures. This growth was primarily fuelled by the home care and beverages sectors, which grew by 5.7% and 4.6%, respectively.

In China, consumer FMCG purchases in major cities rebounded rapidly at the end of 2022, with Q2 of 2023 expected to offer opportunities for brands that meet shoppers’ needs for health, convenience, pleasure and indulgence, particularly in lower-tier cities.

Taiwan experienced a 20% increase in online FMCG sales during Q4 of 2022, with health supplements and facial skincare driving growth. In India beverages was the only sector with a strong increase in both volume and value, while categories including chocolates, soft drinks, and ready-to-eat mixes achieved the highest value growth.

The mature digital infrastructure in South Korea enabled online FMCG sales to reach a 35% share of total market value, against subpar performance in other channels. Despite a potential slowdown in oil GDP in the UAE in the first half of 2023, government agendas and Dubai's transformational projects are supporting non-oil sectors, including FMCG. Indonesia's FMCG growth relies primarily on price increases, while the home care sector is increasing in volume sales, possibly due to the adoption of smaller packs. Malaysian consumers continue to prioritise savings, with cautious FMCG spending, and making fewer shopping trips.

In Thailand, convenience stores have grown in the in-home FMCG market, due to their proximity, promotions, and convenient shopping experience. Conversely, local channels – which benefited from government subsidies during COVID – lost some share to hypermarkets.

The Philippines saw higher FMCG spending during the 2022 holidays, but shoppers deprioritised personal care due to inflation. Lastly, Vietnam experienced an impressive 8% GDP growth in 2022, the highest in over a decade. However, the country faced inflation pressures, with the consumer price index (CPI) rising significantly and further increases expected in 2023.

Asia Pulse is a quarterly publication from Kantar Worldpanel in Asia. The report examines the in-home FMCG market in 11 countries, offering insights into economic performance and industry trends. For more insights into the FMCG industry in the Asia region, access the latest edition of Asia Pulse.