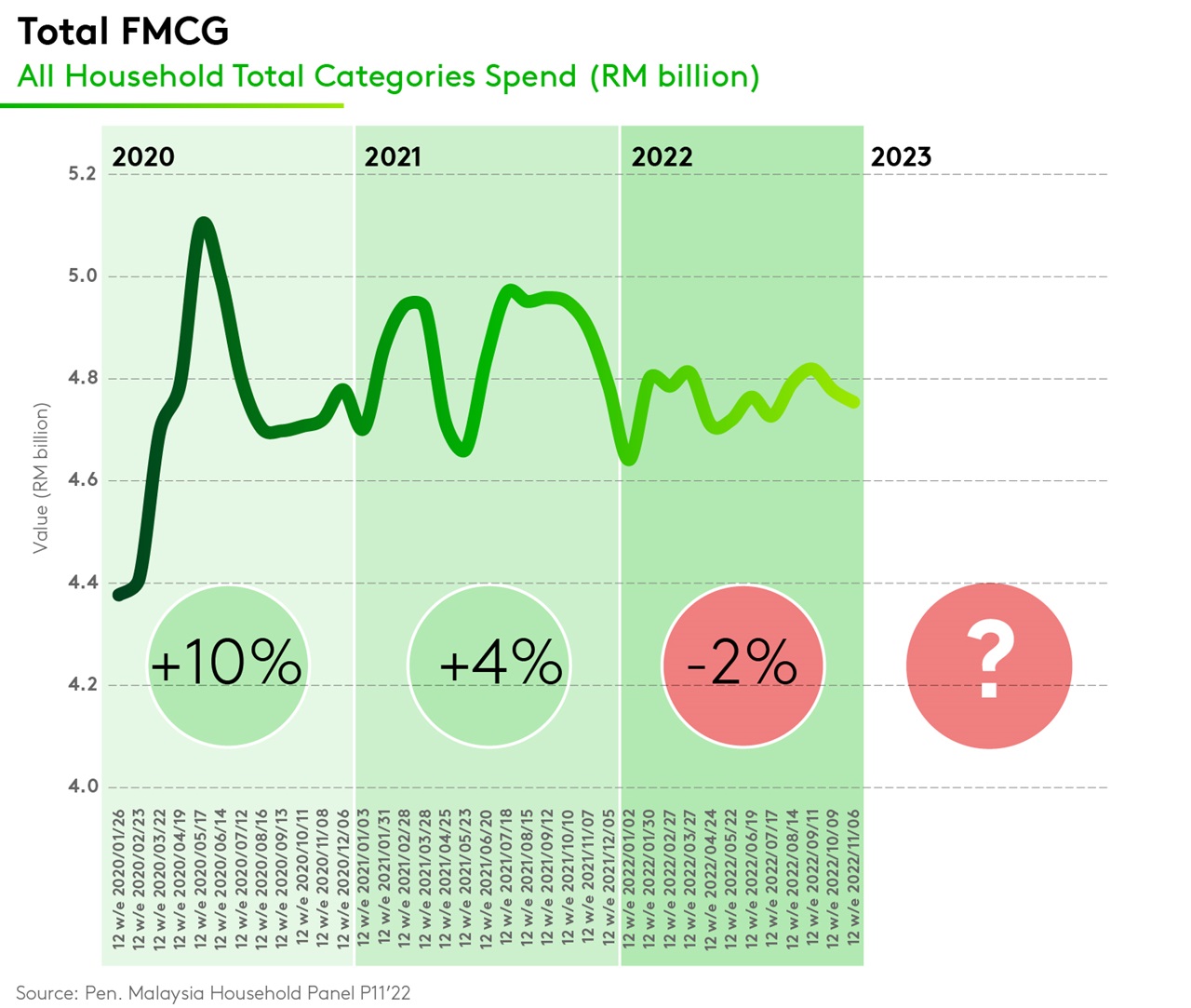

Hopes have been high in Malaysia, as the market finally reopened after two years of pandemic restrictions. But the fact is, there will always be new challenges dropping by to say “hi”! We expected huge growth when shoppers returned to their regular pre-pandemic FMCG shopping behaviours – but the data indicates that this has not been the case. In fact, we registered a -2% decline in value for total in-home groceries in 2022, looking at the Peninsular Malaysia market alone.

Now we need to consider what’s going to happen in 2023. We know for certain that the market will be more challenging this year, and as a result we expect a further decline in value, for two simple reasons:

- The normalisation of shopping behaviour, as consumers become more cautious in their spending, coupled with lower demand in-home.

- Shoppers prioritising out-of-home occasions and non-grocery spending.

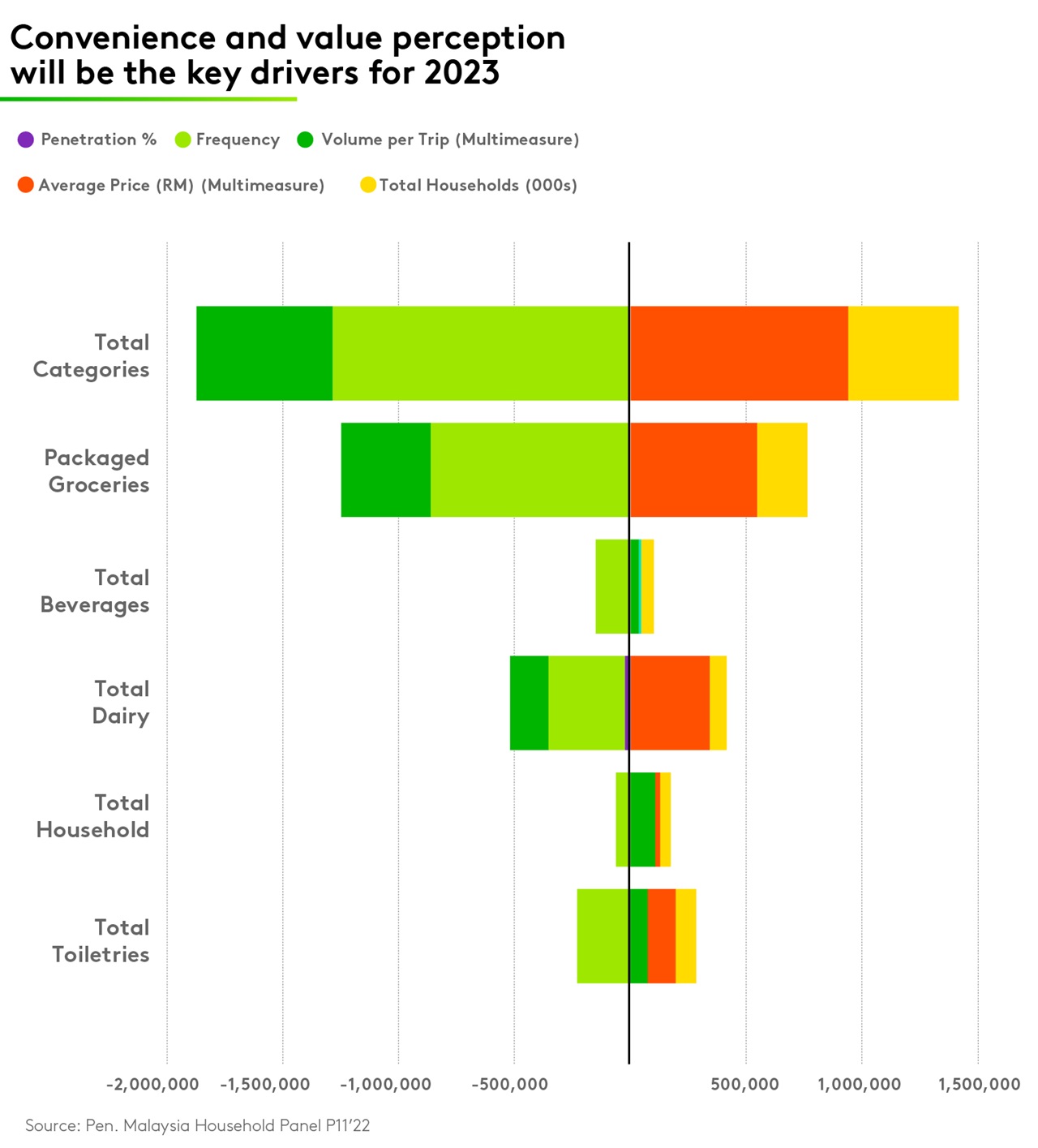

In 2022, the performance of the food sector was basically driven by the normalisation of behaviours, while the performance of the non-food sector was largely driven by increased demand for cosmetics, personal care and household products as the market reopened.

Both food brands and non-food brands are likely to face a tougher market in 2023. There’s a saying in Malaysia: “when the tide is out, we know who is swimming naked”. The top priority should be to remain competitive, whether through pricing, product proposition or product assortment.

Brands must be laser focused and very precise in their activations and investments – based on the two main growth drivers we have identified for 2023: (1) convenience and (2) value perception.

There are two simple reasons why these will be the key factors this year. First, shoppers will be more willing to pay for convenience which helps them to save time or avoid hassle. Second, they will be more willing to choose or pay for a brand if the product gives more value and is more relevant to them, due to the experience it provides or the occasions it serves, for instance.

In our new report – 2023 Malaysia FMCG Outlook – we explore the impact post-COVID normalisation of shopping behaviour and rising inflation will have on the market. We can already see

evidence that consumers are becoming more cautious and selective in their spending, and a trend for ‘buying less and shopping more’ is emerging. You will learn about:

- The key drivers motivating Malaysian shoppers right now

- How to ensure they consider your brand – and then convert them in store

- Understanding how relevant your brand or category is to shoppers

- How different income groups are responding to market dynamics

- The evolving channel landscape

- Three top tips for thriving in 2023