The economic context within the Latam region plays a fundamental role in people’s consumption behaviours. Significant growth in gross domestic product (GDP), accompanied by a decrease in inflation and a historic reduction in unemployment rates, has created favourable conditions for the mass consumer goods market.

However, looking at the future of consumption involves understanding not only the economy, but also the market’s demographics. Analysis of Worldpanel data on the youngest and oldest segments of Latin American consumers has uncovered major differences in not only their level of spending, but also which products they purchase with their FMCG budget, and how they buy. The region is facing a rapidly aging population, which is transforming consumer choices, Worldpanel's Consumer Insights report for the end of 2023 shows. In 2025 we will see the number of consumers in the over-50 group surpass the number of children, and by 2050 they will make up almost 40% of the Latin American population.

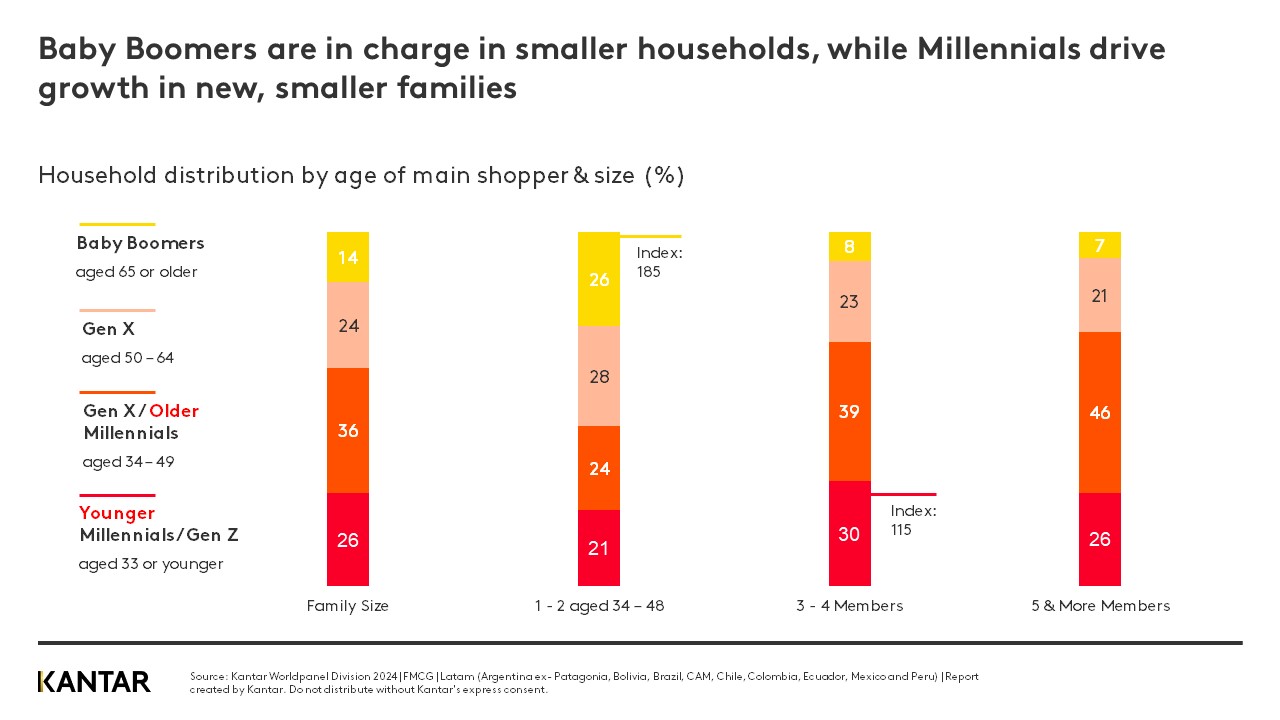

Furthermore, the number of households is growing at a much faster rate than the population: in the last 10 years, the number of people in the region has grown by 12%, while the number of households has grown by 29%. The impact on FMCG is huge. While one additional person per family contributes an average of US$300 in spend to the basket per year, each new home generates an average of US$1,557.

Baby Boomers and Generation Z: what are their characteristics?

With fewer children and longer life expectancy, we are seeing a decline in the average household size in Latam. Baby Boomers – those aged over 65 – now represent almost a quarter of all households with up to two people. This group spends more time shopping for FMCG, which translates into high purchase frequency and smaller baskets, and tends to visit hypermarkets and supermarkets. They like to eat and drink well and go beyond the essentials, especially in the dairy and drinks categories.

Among the new households, younger Millennials and Generation Z also stand out. Under the age of 34, they are the ones who make up the smallest families, with just one or two children. Many work outside the home, 30% have children, and 63% are of low socioeconomic status. To save time, they buy in large quantities, and make their purchases through local channels, while 27% use ecommerce. They prioritise the most basic items, especially in the hygiene categories, which represent 13% of all their FMCG spend.

While Baby Boomers and younger Millennials/Gen Z are relevant to the future of consumption, they are not the main drivers of FMCG growth today. Instead, it is the intermediate groups, especially those aged 35 to 64, who contribute most significantly.

An important factor in this trend is the lower economic development that persists in the region. Despite demographic similarities with European economies, GDP per capita in Latin America remains considerably lower, which affects the purchasing power of consumers, especially young adults.

For brands, understanding the needs, lifestyles and financial capabilities of Baby Boomers and Gen Z is critical to establishing meaningful connections and unlocking growth potential. At Worldpanel, we can help you adapt to changing consumer choices. Contact our experts for more information.