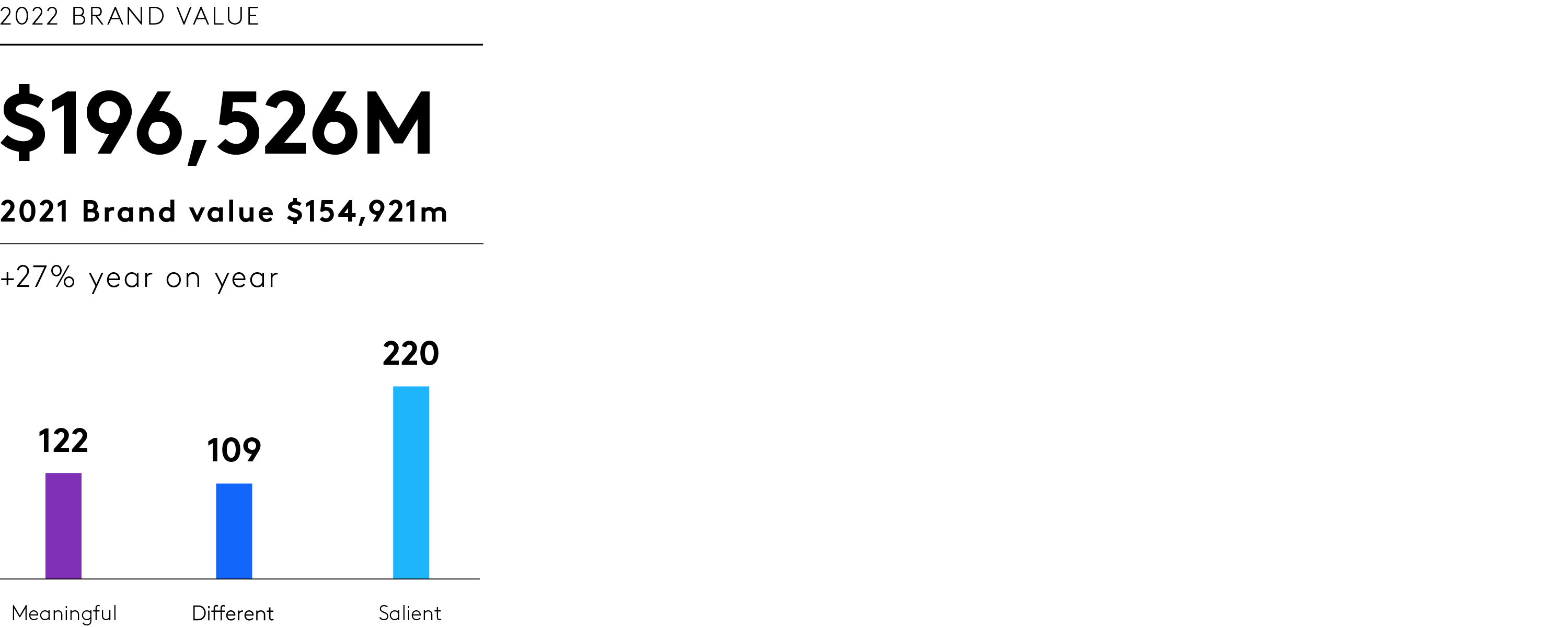

For fast food companies, the pandemic proved extremely challenging due to store closures, supply chain issues and staffing shortages. McDonalds, the brand that defined the category globally, used this time to hone their digital operations and turned in a jaw dropping $23 billion in revenue for 2021 with profits rising 59% during the year. They more than earned their sixth place finish on the Kantar BrandZ Most Valuable Global Brands 2022. They experienced a year-on-year brand value change of 27%. But it wasn’t all about ordering via apps and technology, they turned a brand partnership with Korean boy band and phenomenon BTS into a global sellout..

Stacking up against the competition

McDonald’s, the #6 global brand in Kantar’s BrandZ list at a brand valuation of $196.5 billion, dwarfs their nearest competition, Starbucks, which tops out at $61.8 billion, and KFC at $22.3 billion. As a category, the world’s top fast food brands grew a combined 18%, with nine out of 10 brands posting year-on-year growth in the 2022 BrandZ rankings. This is no small feat after a COVID-19 pandemic that forced these brands to operate well outside business as usual: less in-store dining, less workday lunch demand, less high street walk-in business.

In response to these challenges, top fast food brands have accelerated their pivots toward delivery, takeout, and online ordering. And these pivots worked especially well for McDonald’s. Today, more than a quarter of their sales revenue in its top six markets worldwide come through digital channels.

Arch-rival Burger King posted impressive earnings for 2021, but had several misses in the U.S. market which influenced their significantly lower rank (#9 among global fast food chains) on the Kantar BrandZ list. They cut menu items to improve drive through times during the pandemic as well as store hours which may have also hurt the brand.

U.S. experience leads to global rollout

McDonald’s didn’t start the pandemic in such an innovative position. They took a page from Starbucks loyalty app experience and used the pandemic in the U.S. as a time for focusing on digital ordering and delivery channels. After a successful launch in the U.S., McDonald’s is expanding its loyalty and rewards app globally, with the goal of holding on to customers who tried online ordering for the first-time during pandemic – while driving more of these customers to order in-house rather than through third-party platforms. If you look at the various metrics Kantar uses to assess experience, McDonald’s had year-on-year gains in every area.

Kiosks were purpose built for a pandemic

In 2020, self-service ordering kiosks were implemented at all U.S. locations, a long time coming considering this innovative initiative began in 2015. They proved remarkably successful to the point that 30% of their sales now come through these kiosks. When you combine the fact that people just didn’t want to be in the face of a clerk during COVID-19, it added up to a blockbuster technology for the brand. The kiosks are also remarkably more effective than a human at suggesting: “do you want fries with that.” No guilt here if only the machine understands your true cravings.

Logistics deliver

Logistics is a related area where the need for ongoing transformation is clear, but for fast food brands there are many options. While McDonald’s renewed deals with brands like Doordash, Uber Eats, Grab (Southeast Asia), and Swiggy (India), it also built out new ways for people to order delivery within the McDonald’s app itself. These app orders can then be fulfilled either by third-party platforms, or sometimes by McDonald’s own, in-house delivery fleets (which it currently operates some Asian markets).

Cute boys = many Happy Meals

One big story in branding today is the use of collaborations as a shortcut to creating a cultural “moment” around a product. This includes creative partnerships between a brand and a celebrity, Here, McDonald’s scored big by connecting with the Korean cute-boys-who-dance phenomenon, BTS. This was their first-ever international celebrity tie in. The BTS meal was chicken nuggets, fries and a Coke with two new dipping sauces — sweet chili and Cajun flavors — inspired by McDonald's South Korea recipes. They also sold BTS merchandise in the band’s signature purple married with Golden Arches yellow in limited edition with a gradual roll-out online. How well did it work? Not only were they selling out meals, fans were collecting their BTS branded bags and even those dipping sauces and selling them on eBay.

Brand can best inflationary woes

As fast food brands like McDonald’s continue to chart their technological futures, they are also contending with the here-and-now challenge of inflation. While the cost of many food ingredients has gone up in ways they cannot absorb, without adjusting menu prices upward or adjusting portion sizes downward, higher prices in other consumer sectors like gas have squeezed household budgets. The result is a new focus on value. Value doesn’t have to mean rock-bottom prices. Indeed, the days of fast food brands competing to have the cheapest “budget menu” are long gone. Quite the opposite. Part of McDonald’s soaring profits in 2021 come from raising prices.

Especially in the context of delivery (and delivery fees), for many customers, large fast food brands no longer represent the absolute cheapest or quickest option for any given meal. In some markets, the cost of fast food delivery may approach that of restaurant takeout. But even as family’s budgets are becoming squeezed by inflation, fast food revenues have thus far held up because their products are still valued. They provide a Meaningfully Different dining experience. {Meaningful and Different are two of the three key factors Kantar uses to assess brand value.} Even as people can endlessly scroll through dining options in a delivery app, only McDonald’s has that Big Mac and those distinctive skinny fries.

While technology matters, so does product, especially if that product can be embedded in marketing moments like the BTS tie-in that enhance its intrinsic meaning. McDonald’s takes itself seriously for its food, but also the experiences and culture and that add up to powerful brand value.