365+ days later…and this pandemic is still testing our agility, with many marketers fearsome of making the wrong decisions. So, what are the early indicators of growth that can aptly point you in the right direction? These three marketing truths (accentuated by COVID-19) give us the answer.

What we predicted back in March 2020 as the most likely scenario of a ‘Brave New Reality’ is the one we’ve been living in for the last year or so. Our society has adapted to life with a pandemic. People have been moving in and out of lockdown mode, swiftly restricting and broadening their movement in line with social restrictions. Physical contact shrank throughout and, as a result, ecommerce pivoted into the spotlight, jamming nine years of share growth in only a few months**.

Businesses had to react quickly. At first it was about survival, but soon after, many brands realized that ‘thriving’ was up for grabs in our ‘living-with-COVID’, relatively stable and ‘can-turn-prosperous’ business environment. Our new state of affairs elevated three pre-existing marketing truths, so much so that they became a good omen for brand growth. To execute against them, successful brands have been making bold, confident and fast decisions even (or rather more so) in our times of uncertainty. Here’s how to do it:

1. Embrace the joys of a rediscovered ‘share of search’.

Fact: it reveals your brand’s current momentum, but also the ‘surprises’ – good or bad – in your funnel.

The more your brand is searched for, the higher your forthcoming sales will be. A truth that is accentuated with ‘search’ turning into our new bricks and mortar in the pandemic-ridden months. Share of search – your piece of the ‘search’ pie in your category – has been recently debated in our industry as a promising predictive metric for a brand’s market share, but also, possibly, as a potential metric to replace the difficult-to-calculate share of voice (i.e. the percentage of your media spending versus that of your competitors). The equation is simple: if you are searched, you come to mind, and if you come to mind, you become relevant in a purchasing decision.

But what decisions can you make on the back of it? By comparing your share of search to your share of market and/or your share of voice, plus how they’ve been evolving over time, you can decipher: 1. whether your brand is generating enough search interest (share of search vs. share of market), 2. your brand’s momentum (change in share of search vs. change in share of market), and 3. how much brand interest you are generating with your media spend (change in share of voice vs. change in share of search). Think of search as a brand’s thermometer of salience. And think of salience as a fundamental driver of brand growth, more so now than before and until our movement is fully reinstated.

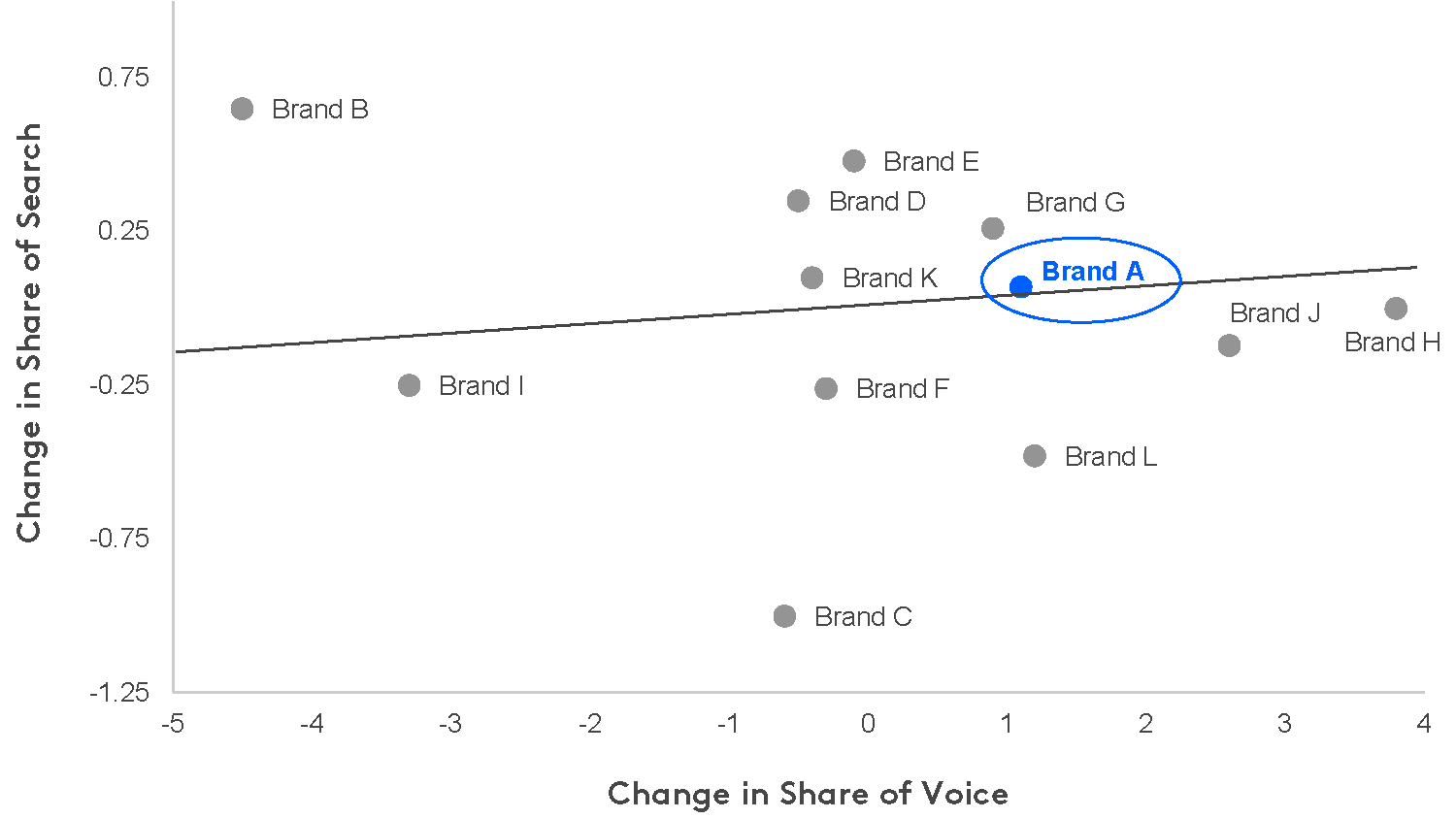

Share of search can help you point the finger in the right direction

In this chart you can see that Brand A is generating enough interest with their media spend. So, if sales are not following suit, there is another culprit in the journey from interest to sales; they have been able to see that their campaign is doing well, so media spend is not the problem here.

2. Keep your eyes on your creative content.

Fact: creative quality remains the most efficient route to brand impact.

Pandemic or not, gauging the zeitgeist of our times is like gold dust. The consumer mob is a discerning audience that finds advertising largely annoying – three times more annoying, in fact, than it did 20 years ago. And even those campaigns that are widely celebrated for their creative excellence are now less effective than ever – on record – before (Peter Field’s analysis of the 24 years of IPA data bank has revealed).

A few months ago, we revisited the findings in the 2014 paper: “Top 10 drivers of advertising profitability’ to get a clear view on what really matters and the message was clear: creative quality remains the single largest driver of brand impact*** (accounting for 50% of campaign effectiveness), whilst reach, frequency and media synergy are lagging behind.

Brand size, creative quality and budget allocation are the three key drivers of advertising payback

Rank |

Factor |

Profitability Multiplier |

|---|---|---|

1 |

Brand size |

18 |

2 |

Creative quality |

12 |

3 |

Budget setting across geographies |

5 |

4 |

Budget setting across portfolios |

3 |

5 |

Multimedia |

2.5 |

6 |

Budget setting across variants |

1.7 |

7 |

Cost/product seasonality |

1.6 |

8 |

Brand v product v season |

1.4 |

9 |

Laydown/phasing |

1.15 |

10 |

Target audience |

1.1 |

What should marketers focus on when planning their advertising? Alongside each factor is a multiplier that is calculated on advertising profitability (sales from advertising minus cost of advertising)

(Source: Top 10 Drivers of Advertising Profitability, Paul Dyson, Admap Sep 2014)

As COVID-19 recovery took hold, potent advertisers have been keeping their finger on the pulse to shift their media choices accordingly. But the biggest challenge – often downgraded by marketers – has not been the ‘how’ or the ‘where’ to reach people, rather what to say to them. People shut up at home have been on an emotional rollercoaster; responding initially to messages conveying compassion and generosity but, soon after, they were looking to brands to attack the crisis with power and command. Within months, they raised the bar even higher, looking to brands to guide the change they wanted to see in society. Which is a big, ever-evolving ask for creators, who have been mulling over unprecedented dilemmas seeking the right blend between sensitivity and lure, self and society, reward and altruism.

This is where technology serves as an enabler. More crucially than providing the answer, it simply removes tension by allowing information to get to creative thinkers at speed. By scanning consumers’ likely response within hours, assessing creative excellence and validating the optimal creative mix, technology has turned into ‘the kit’ to steer (rather than impede) creativity.

3. Mind the clues in consumers’ everchanging context.

Fact: category spill over is real: listen carefully, breaking down the traditional category barriers.

Categories’ blurry edges are nothing new. “My competitors aren’t Levi’s or Balenciaga”, Diesel’s CEO Massimo Piombini says. “My competitors are the gym; Netflix.” Mark Ritson’s drunken sailor analogy wittily makes the point too: “A customer does not walk into a supermarket looking for ‘ambient soup’; they are hungover and need a snack. In this situation the consumer in question criss-crosses the categories like a drunken sailor. Soup competes with noodles and with chocolate and with crisps.” Contrary to the marketers’ orderly perspective, consumers simply need to get a job done. For that, changes in attitude and lifestyles casually welcomed newcomers like smoothies, cereal bars and protein shakes in the breakfast category (traditionally dominated by cereals), or Uber and Airbnb that misplaced their category leaders with disruptive innovation overnight.

Over the past 12+ months, another factor played a critical role in the category outlining, stretching or shrinking forces – the context. Our context changed as life has been different: our home has become our re-discovered kingdom, our out-of-home occasions have largely moved into the home. We changed our spending habits, our drinking and eating habits; we elevated comfort and cared far less about appearance. We pressed pause and cherished little moments of joy. Our behaviours have overall shifted and will only revert when our lifestyles revert. Within this shakeup, a product/service – regardless of how intriguing it was – ought to be culturally relevant to be considered in a purchase situation. A brand’s biggest risk was that it could shift from essential to discretionary.

Those brands that looked for cues in people’s changing attitudes and behaviours mitigated that risk. And as our context will continually change for the remainder of 2021, it’s these brands again that will quickly surface threats and opportunities – from within and outside their category. Even more dexterously, though, they’ll be inspired in earnest to kindle their innovation agenda, they’ll feel nobly equipped to steer their comms to resonate with their consumers. Mind you, each consumer’s path back to normality will differ; for that, the brands that will remain cognitive of and sensitive to everyone’s changing context are precisely the ones that will stay meaningful and relevant.

Final thoughts

The singling out of these three marketing truths as the ones accentuated by the pandemic is, admittedly, a subjective exercise. A point of view backed up by years of experience and a plethora of articles and findings at my disposal distilled my thinking. What’s widely and more objectively recognised though is that agility – real, practical agility – was the crowned winner of our health crisis so far. Businesses that acted and reacted fast, weaved and altered their approach quickly, were the ones that demonstrated resilience during the storm and even thrived through it.

Jeff Bezos advises that, in business, “If you’re good at course correcting, being wrong may be less costly than you think. Whereas being slow is going to be expensive for sure.” Or if you are looking for a more uplifting quote for challenging times: “Never waste a good crisis,” Winston Churchill once said. “Nor its aftermath,” we add. Thriving is still up for grabs and relies, almost entirely, on fast decision making.

*Put simply, the fear of making the wrong decision

**Global: 2 years, Europe: 9 years, Asia: 1 year and 3 quarters, Latam: 4 years and 2 quarters. Source: Kantar Purchase Panels

***Brand size aside which is the biggest multiplier of ad effectiveness – 50% more than quality of creative

This article was originally published in Kantar BrandZ 2021 most valuable global brands.