Kantar’s recent report, Connecting with the Health & Wellness Community, is a wide-ranging consumer analysis of physical and emotional health in the post-pandemic era and a detailed snapshot of how consumers across ten countries are using technology to monitor their health and wellness and what they are willing to pay for.

We conducted a global survey of 10,000 respondents across ten countries in August 2022. In addition to the global results, we include analysis of how the variables of age, gender, and locale influence the results.

Our data shows that many consumers see significant benefits from the use of health and fitness apps. However, there is market potential for much greater consumer uptake of this technology.

Here we explore a few of the key insights.

Physical and emotional wellness improves with the use of health tech

Overall, 39% of people see improvements in their physical health and emotional health when they monitor their health with the support of technology.

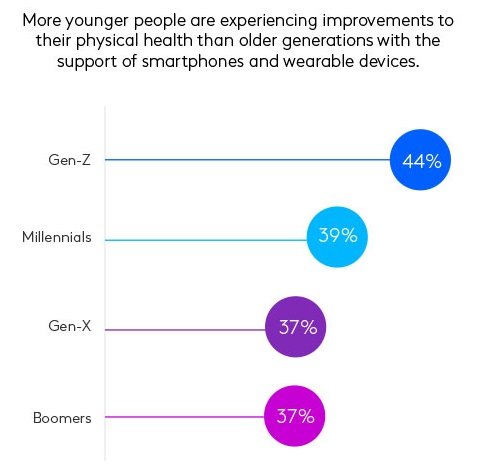

Age matters with respect to this issue. More younger people are experiencing improvements in their physical health with the support of smartphones and wearable devices than older generations.

44% of Gen-Z see improvements in their physical and emotional health when they monitor their health with the support of technology, versus only 37% of Boomers.

78% of health-conscious consumers believe that the social and community components embedded in fitness apps make it easier to practice healthy habits.

More people see improvements in physical health using a smartwatch

In terms of devices, the use of a smartwatch ranks highest in terms of self-reported health outcomes. Among those who see improvements in their physical health after monitoring it with the support of technology, 41% of people use a smartwatch; 38% use a smartphone only; and 35% use other types of wearable devices.

Health and fitness apps have the most significant impact on wellness

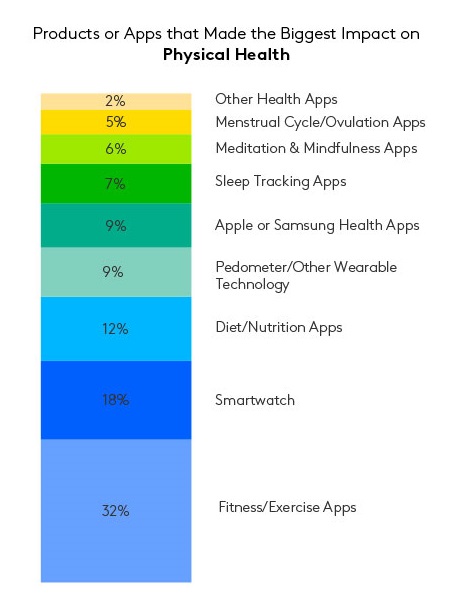

Health and fitness apps range in application from those that focus strictly on physical health to apps that address wellness issues such as sleep quality, menstrual cycles, and diet and nutrition.

Globally, 32% of the people in our study say that fitness and exercise apps have the greatest impact on their physical health.

Smartwatches (18%) and diet and nutrition apps (12%) followed, in 2nd and 3rd place.

The other apps that we tracked each ranked below 10% of respondents in terms of consumers believing that these options have significant impacts on physical health. For example, only 9% of respondents agree that sleep-tracking apps improve physical health, compared to 5% in agreement for meditation apps.

A third of health conscious consumers can't live without their subscriptions

Of those who pay for health-related apps, 63% hold paid-for subscriptions to fitness and exercise apps. The most likely paid subscription to hold is a fitness and exercise app (57%), followed by life coaching (34%), diet and nutrition (26%), and meditation and mindfulness (23%) apps.

Singapore, India, and China rank highest with respect to purchases within these four app categories. For example, 77% of respondents in China have a paid-for fitness and exercise subscription. Singapore places second for paid-for life coaching (43%) and meditation and mindfulness subscriptions (29%).

Respondents from the United States are the most likely to agree that they cannot live without at least one fitness and exercise app (48%), compared to Spain at 10th place (11%). Globally, 33% of those surveyed say that they cannot live without at least one fitness app.

Boomers are most likely to cancel a subscription if there was no longer a value (25%). Millennials are the most likely cohort to cancel if their cost of living was too high (15%), but still more likely to find a cheaper alternative (24%).

Get more answers

For more insights from this comprehensive study, access the complete Community Report: Connecting with the Health and Wellness Community.

Find more generational, gender, and country-specific insights on the impact of the pandemic and the cost-of-living crisis on emotional wellness and the ways in which respondents use digital technology to access wellness resources.

About this study

This research was conducted online using 10,000 respondents (1,000 per market) sourced from the Kantar Profiles Audience Network across ten global markets: US, Brazil, UK, Germany, France, Spain, South Africa, China, India, and Singapore. All interviews were conducted online in August 2022 and collected based on local census distributions for age and gender. The generational cohorts were defined as follows: Gen-Z (18-24), Millennials (25-39), Gen-X (40-55), Boomers (56-75).