One of the great effects of digital is bringing brands closer to the purchase moment. But recent developments in digital retail are throwing the brand-retailer-consumer triangle off balance. While some digital retail has distanced brands from shoppers, other digital retail models have brought shoppers uncomfortably close.

Retailers seek omnichannel success

Omnichannel is now business as usual, whether you are a digitally native brand or have been around for a century. Evolving a mostly offline brand to online sales is and remains a brand challenge, because the digital world comes in many flavors and shape-shifts like gods in Greek mythology. How to show up on the many forms of social media and online retail is a topic brands have and will continue to focus on. Recently, for example, the majority of high-end fashion labels changed their logos to black all-caps, in an effort to be more easily identifiable on social media. With mixed results for the high-end shopping districts where store signs are now a sea of same.

Conversely, online-first brands face their own issues as they venture into bricks and mortar. Merchandising and point-of-sale communications are completely different digital vs IRL (in real life). Standing out among 40,000 products in a supermarket or expressing your brand via your own branded physical store is no small feat. Amazon is gradually opening more GO stores, having raised their game from owning Whole Foods. Still, walking through the store reminds us of their origin in the online shelf: very linear and clean, with limited human interaction.

Digital sets new standards

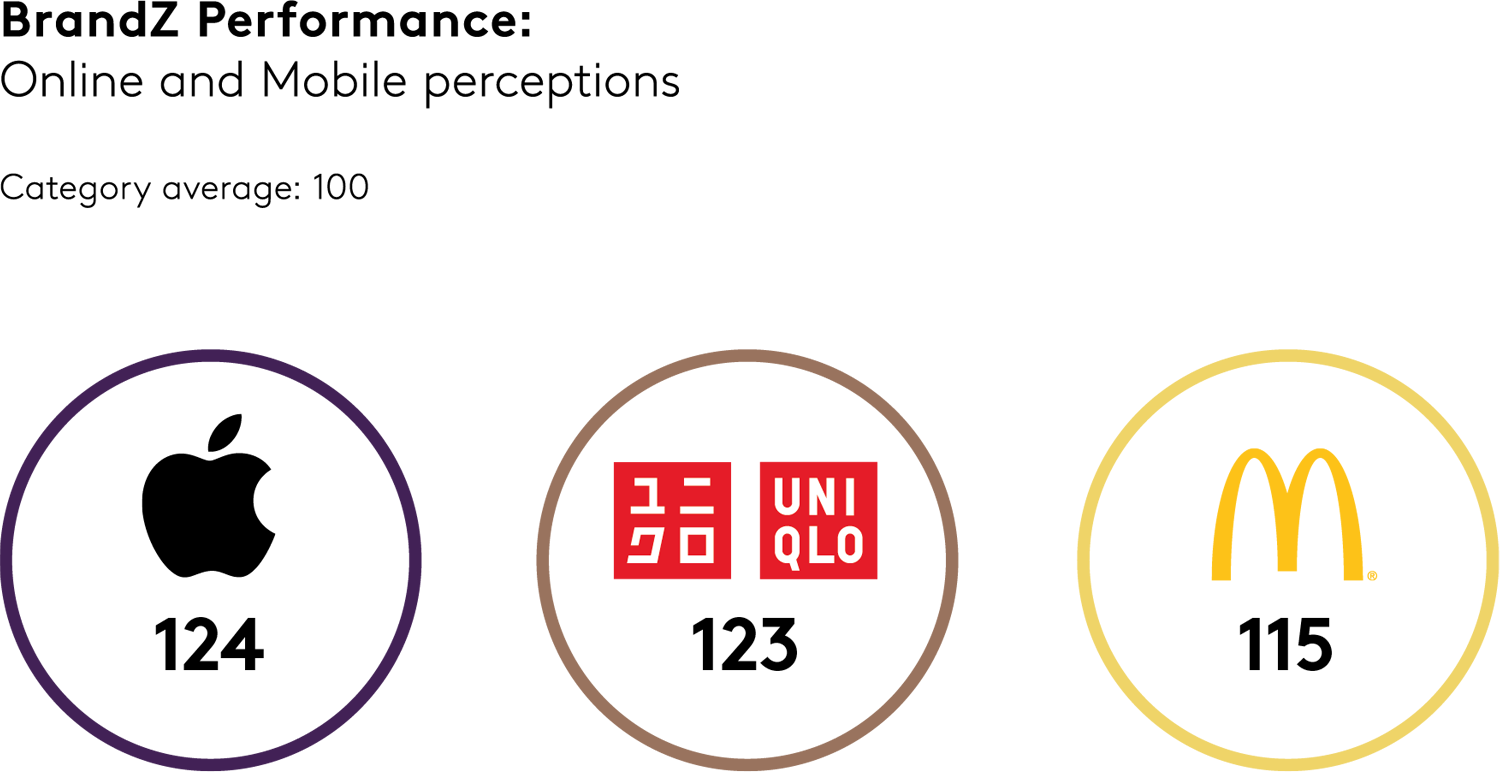

Certain brands that are very successful online and on mobile – thanks to the interface, the brand experience, the ease of finding products or features – let people see what is possible, and changes their expectations of other, non-related brands and products. Look at Apple, Uniqlo and McDonald’s who all perform highly on online and mobile aspects according to Kantar BrandZ data, setting new standards across their respective categories. Amazon wrote the rulebook on online shopping but is now perceived to be trailing other leading global brands in important activation areas of distinctiveness and product design - something to watch out for. Consumers who have a best-in-class experience with their bank will quickly raise their standards for apparel shopping or ordering a ride.

However, the delightful digital world is also playing tricks on brands. Most recently what we might call multiple layers of retail are causing brands to lose their grasp on selling spaces. This can manifest itself in a couple of ways, but always with additional degrees of separation from consumers. For one, quick delivery apps are muddying the brand waters, especially in FMCG categories. Functioning as a middleman between retailers and product brands, quick delivery platforms distance brands from the person buying (not to mention the consumer).

A quick delivery example

Thandi orders six items via a quick delivery app: how particular can or will she be about the brand of each item? Maybe she cares about 1-2 of those brands - perhaps her favorite cereal - but she’s willing to compromise on the yogurt and hand cream. Is yours a priority brand for Thandi? The data being collected by the delivery apps will tell the story, but already these heavily funded start-ups are opening small distribution centers in the middle of cities in order to supply products on the most wanted list in ten minutes or less. Are your brands and products on those shelves?

But it doesn’t stop there: does Thandi care which retail brand is fulfilling the order? What is more important to her: the quick service app or her favorite supermarket? Retailer-delivery app partnerships and acquisitions are already underway, and the brand-retailer-delivery tangle will eventually be unknotted, but not without a few casualties.

Trends in commerce

The history of commerce tells us middlemen are eventually dispensed with unless they provide real value. Convenience alone won’t suffice because it’s hard to own: what else keeps people coming in? I’d argue brands. At the same time, brands need to understand the implications of convenience. Convenience in its various guises is paid for, ultimately, by the consumer. The rise of quick delivery shopping (and meals) has an effect on people’s wallets – and hence the economy – not dissimilar to inflation. Consumers are forced to prioritize. And keep in mind the competition of Brand A isn’t just Brand B. It’s different categories, products and experiences brawling for the same consumer budgets.

Kantar research shows that one of consumers’ top ‘coping’ mechanisms is to buy private label. What does that mean for your brand and category? Retailers are on top of these trends and in it for the long haul. They plan for their private labels to play in higher price tiers, so careful of dismissing them as down market. Some private labels are prioritizing sustainability and/or organic, further upping the ante. And there is nothing stopping quick delivery apps from identifying vulnerable categories in which to launch their own brands.

Outside the FMCG space, we see other, new challenges. Take a look at the circular economy, formerly known as second-hand and dismissed as an irrelevant niche (unless you are eBay).

For reasons such as sustainability, economics and scarcity, the commerce of recycled goods has become a notable market of its own, as evidenced by Pinterest buying second-hand C2C platform Depop. Other examples include Porsche attempting to edge into the passionate trading of their vintage cars, Rebag scouring the used luxury accessories market via their bricks and mortar stores, while second-hand phones have literally become their own commodity market.

What does this mean for brands?

How is the Gucci image affected by listings on C2C platforms? Or flipping the question around, how can Gucci shape posts on C2C platforms? How does Porsche create a win-win situation for lovers of old 911s? These are topics brands must face head on, as the C2C platforms own the data, are publishing their own rankings, setting prices for their brands’ products and offering consumers ’investment’ advice.

This goes beyond influencer marketing. We’ve moved from user generated content to user generated sales. Are the very consumers who most love our brands also competitors? Distributors? It will be crucial for brands to figure out how harness this energy and brand commitment.

Read more about how ecommerce is evolving and get in touch to discuss your commerce challenges.