Inflation worries consumers because their income won’t buy as much. It worries businesses because it squeezes their margins. The first thing to recognise is that brands cannot promote their way out of trouble. Starting a price war erodes margins faster, re-educates consumers about where the price point should be in a category, and immediately destroys value.

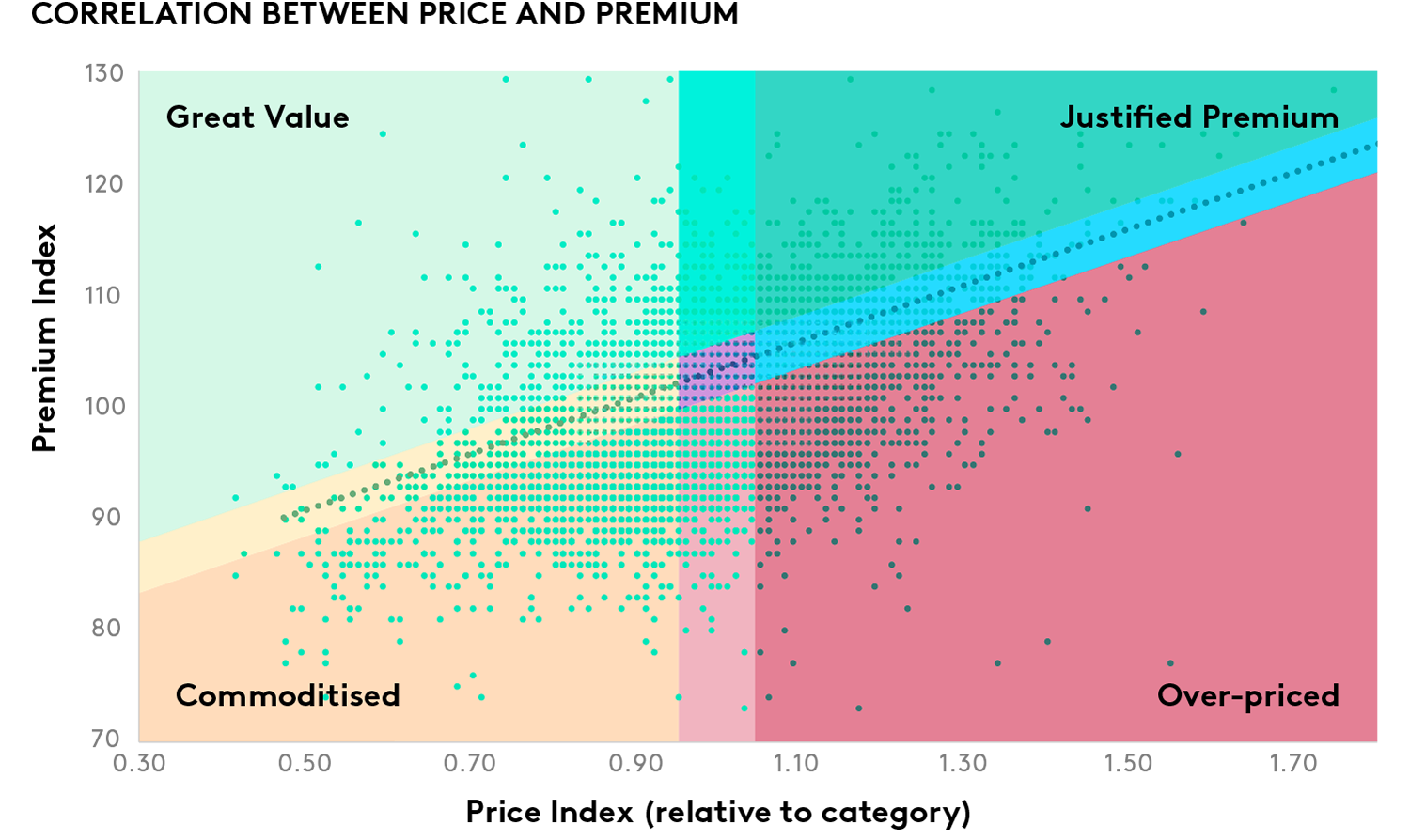

Marketers need to understand a brand’s specific situation. Brands exist because they allow a business to command a higher price point than an unbranded product. As inflation bites, you need to protect that margin. You can measure the strength of a brand’s ability to do this by comparing the relative price the consumer sees for your offering against the breadth and depth of their positive perceptions: we call this measure Premium, based on how meaningfully different a brand is in the mind of the consumer.

Kantar BrandZ’s database has these measures for over 40,000 brand cases. And around one third of these cases show brands whose equity does not support their perceived price. In this illustration, it’s the bottom three zones from Commoditised to Over-priced Brands.

Source: Kantar BrandZ Global Database

Source: Kantar BrandZ Global Database

If your brand sits in the upper zones, it’s well-placed to defend its price, and even has room to manoeuvre. As Jamie Peate of McCann Worldwide says, “Continue to invest in your brand. A brand with a clear and relevant meaningful role and an emotionally resonant platform will be much more likely to retain its price premium”.

Even in the best situation, of course, brands need to take care when faced with rising prices. Analysis by Nielsen shows that relative expensiveness only drives a part of a brand’s price elasticity. Making a brand unaffordable in an absolute sense will also reduce volume sales.

It’s the brands in the orange-to-red zones that face the greatest risk under inflationary pressure. There are a wide variety of responses available to businesses, and swift action is essential. The first, and perhaps easiest of these, is to turn the threat into an opportunity to review your products and portfolio, as Oded Koenigsberg, marketing professor at London Business School suggests, to reduce less profitable SKUs or lines and removing features that add more cost than the value they deliver to consumers. This may allow you to move price perceptions more in line with the reality of your brand perceptions. A historical imperative for innovation needs to be focused on less, not more.

Other actions are more specific to individual situations. Kantar BrandZ’s database reveals more insights by segmenting the “at risk” brands into three groups: Commoditised (orange in the diagram above), Over-Priced (red) and Margin Risk, sandwiched between the two.

Over-priced Brands are on average the strongest of these three groups. Up to now, consumers have paid the asking price for these brands, albeit somewhat grudgingly. They over-index on having something different – superior performance, a specialism or another quality that other brands lack. Marketers must zealously support this difference to defend pricing, and the potential threat of alternatives meeting the same needs from adjacent categories.

Commoditised Brands have much less flexibility and our evidence suggests they are already reliant on promotions. Consumers buy and use them habitually, because they are there. Such brands need to exploit this habituation, maximising physical availability: make them easy to buy and hence not worth considering alternatives. Going further, there may be an opportunity to reposition them as democratic brands, there for everyone, even if they are not the cheapest.

Margin Risk Brands may have the hardest job. They lack the reservoir of positive associations in the minds of consumers that can remind them of the brand’s benefits; and data show they are at greatest risk of losing their current buyers. They may be lacking in leadership, in purpose or in personality, but overall, they are lacking in a relationship with the consumer that marks them out – they are too easily substituted.

Communication with consumers is the key. With production costs rising, too many businesses historically have tightened their belts and cut marketing spend. These brands have suffered deeper and for longer than brands which have bravely maintained support. Communication at this time needs empathy, more than a rational emphasis on price or benefits. As my colleague J Walker Smith recently pointed out, inflation is an unknown for many, catching them at a time of increased vulnerability, and adding to the uncertainty of the future. Jason Cobbold of BMB says “it gets into the psyche. It is unsettling. The most effective business will respond not just with value, but with empathy and understanding”.

Make sure your brand has a voice and uses it to reassure, to empathise and show concern. If prices have to increase, be open and transparent, explain how you’re doing it and why. Above all, continue to build consistent memories of your brand through your actions, your words and your tone.

Get in touch to understand how well your brand can defend its price point.