Consumers across the world are feeling the squeeze of economic pressures and rising inflation in the real estate market in addition to the cost of eggs at the grocery store. But is it really preventing new home sales, and influencing the rental market?

Kantar recently conducted research on the attitudes, sentiments, and behaviors of global consumers. In the study, we explored the reasons consumers are motivated to move, how they make decisions about their housing, and why they might opt to rent rather than buy a home.

Gen Z prefers renting, or living at home

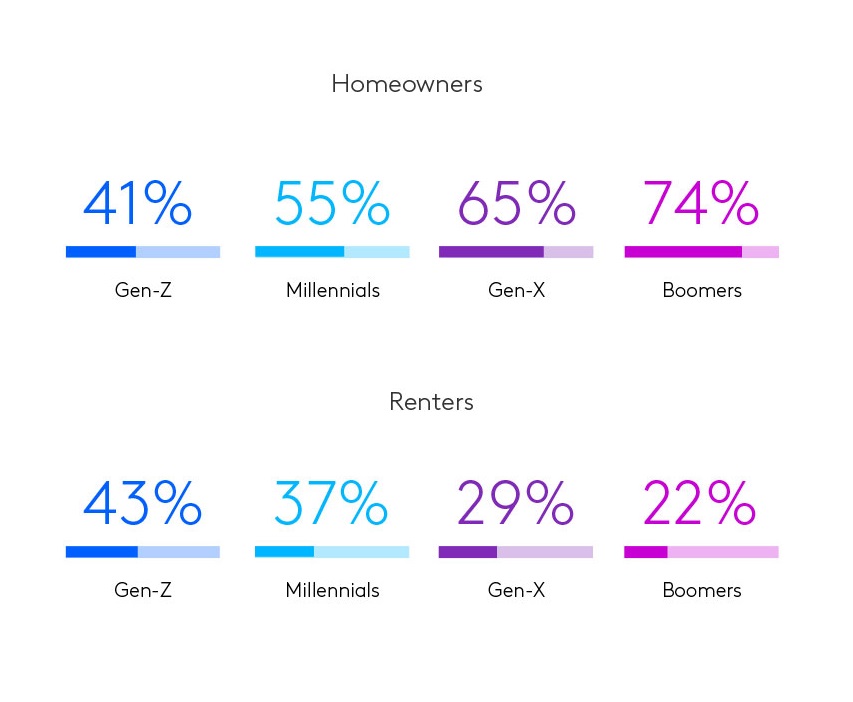

By generation, consumers approach homeownership differently as the motivators, drivers and actions vary across groups. Older generations are much more likely to own homes, with homeownership declining as consumers get younger. 3 of 4 Boomers own homes compared to 2 of 5 in Gen Z.

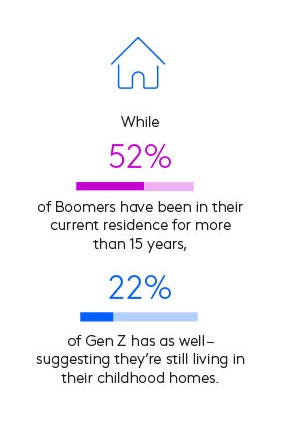

Additionally, older residents tend to have been in their current home longer, and less likely to have moved recently. 52% of Boomers have lived in their current residence for 15 years or longer. However, 22% of global Gen Z consumers report the same. This is a likely indication that they are still living in their childhood home with their parents and have not yet moved out to live on their own.

Personal economic comfort level also plays a role in being able to afford buying a home versus renting or living with family. Homeownership is far more likely among those who comfortably manage their monthly expenses. 72% of consumers who are easily meeting their monthly budgets and expenses own their homes, compared to 51% of those who struggle each month.

Gen Z and Millennials most likely to relocate for a new job

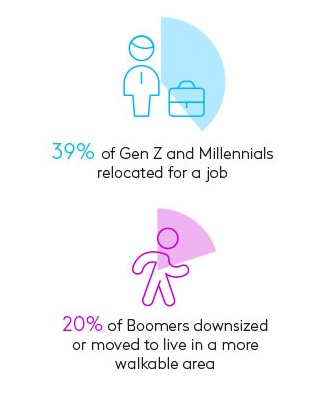

People move for all kids of reasons – a desire for more space, job relocation, change in lifestyle, and those reasons change as people move through different stages in their lives. Globally, the top reason consumers moved last year was to accommodate a job change for themselves or a family member. However, there are some notable differences across generational groups in the drivers behind moving to a new home.

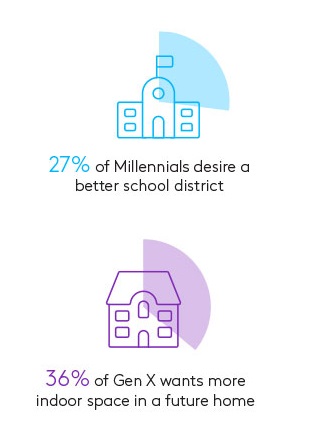

32% of Boomers moved last year in order to “live closer to family,” where 39% of Gen Z and Millennials moved to “accommodate a job.” Older generations are also more likely to downsize – 15% to a smaller space and 20% to a more walkable neighborhood. Perhaps faced with growing families, Millennials were most likely to seek a larger home – 23% of Millennials wanted more indoor space, compared to only 11% of Boomers, and 14% of Gen Z.

Millennials are also most likely of all generations to consider moving or purchasing a new home in the near future. 32% of Millennials say they’ll purchase a new home in the next six to 12 months, compared to the 22% global average. Millennials and Gen X value more indoor space (36%) in a new home, while Millennials also keep an eye out for better schools (27%).

When thinking about moving, consumers often report favoring an apartment or flat, and this is highest among the youngest age groups. 43% of Gen Z would opt for an apartment unit compared to 30% of older generations.

Home buying is not for everyone

Not everyone is looking to buy a new home. Globally, over half (52%) of consumers simply have no need or desire to purchase a home. And 33% report either personal financial limitations or homes priced out of budget are blocking their opportunity to buy a home this year.

Get more answers

For more findings from this study, access the complete Connecting with Consumers report. Read about how global communities are managing their expenses, travel and making financial choices.

About this study

This research was conducted online among 10,001 respondents across ten global markets: US, UK, France, Germany, India, Singapore, Spain, South Africa, Mainland China and Brazil between 29 March and 10 April 2023. All interviews were conducted as online self-completion and collected based on controlled quotas evenly distributed between generations and gender by country.

Respondents were sourced from the Kantar Profiles Audience Network.