Kantar’s Entertainment on Demand study in the US uncovers the following behaviors within the video on demand (VoD) market over the 3 months to March 2023:

- From December 2022 to March 2023, the number of households with video streaming declined 0.3M, reaching a total of 115.3M households. Household penetration of video streaming is now 89%.

- Stacking continues to climb. The average household uses 5.5 different streaming services, up from 5.4 in Q4’22.

- 6% of US households used a new streaming service in Q1’23, down from 7% in Q4.

- With the introduction of both Netflix AVoD (paid, ad-supported video on demand) and Disney+ AVoD in Q4’22, the AVoD category is now the fastest growing in streaming, closely followed by FAST (free, ad-supported video on demand). SVoD (paid video on demand without ads) declined for the third straight quarter, losing nearly 2.2M subscribers in Q1’23.

- Losses in SVoD subscribers in Q1’23 can be traced to Apple TV+, Netflix, and Discovery+.

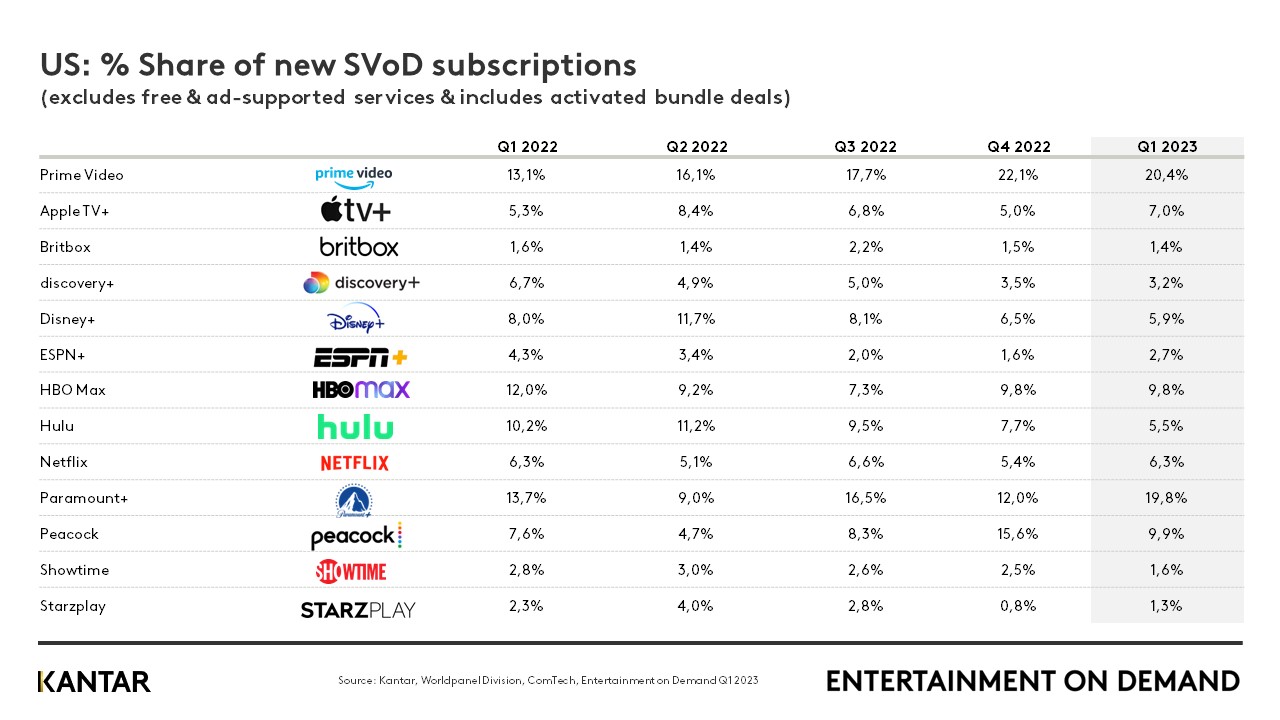

- Among new services used in Q1’23, Amazon Prime Video, Peacock, and Paramount+ had the largest gains for the third quarter in a row.

- Children’s content is increasingly driving sign up, now at roughly the size of sports. For paid streaming, children’s content now drives 8% of new subscriptions.

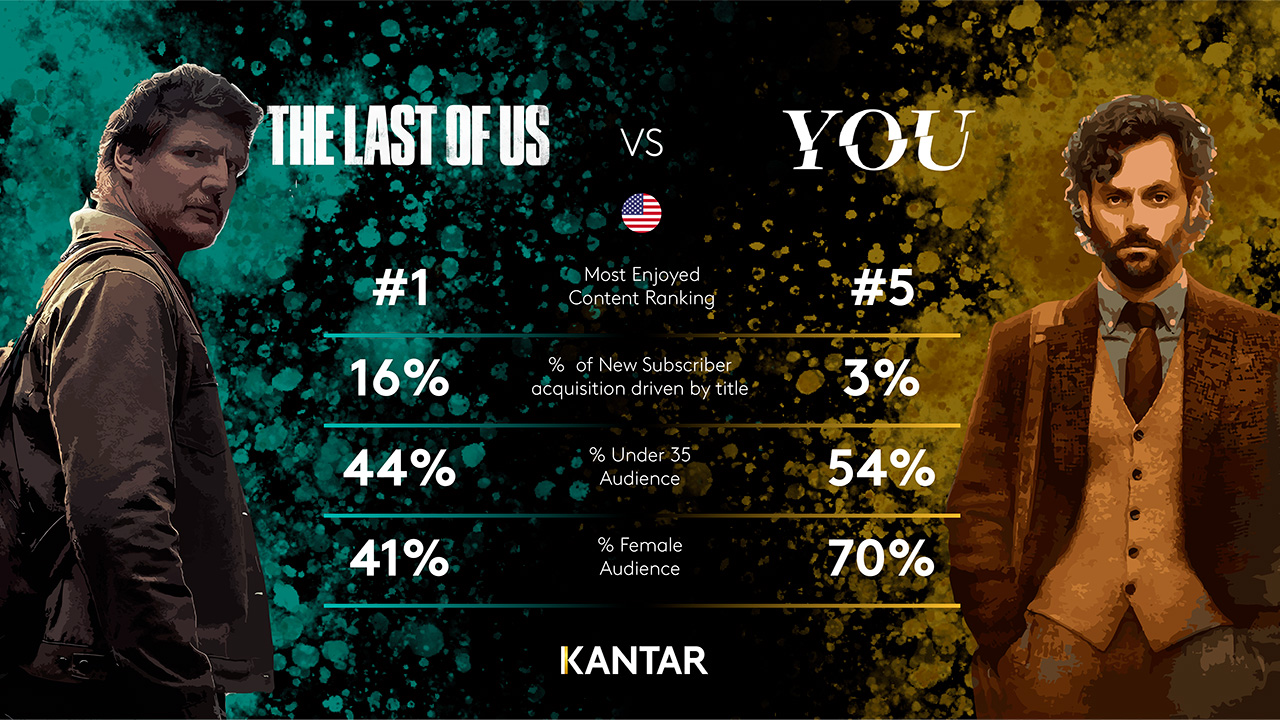

- The Last of US on HBO Max, Wednesday on Netflix, and Yellowstone (purchased episodically on Prime Video or streamed on Peacock), were the three most enjoyed titles in Q1’23.

Value impacts streaming: trade down and cancellations are driven by value

Despite inflation beginning to cool in the US, cost of streaming has caught up with the industry. In the last two quarters of Entertainment on Demand data, value has appeared to be more of an important factor in sign up, satisfaction, and cancellation.

In Q1’23, SVoD (paid, ad-free streaming) lost 2.2 million subscribers, while AVoD (paid, ad-supported streaming) gained 2.6M subscribers, and FAST (free, ad-supported streaming) gained 1.7M users. Consumers are opting to trade down to less expensive options or sign up at a lower price point to find the right balance of value across all of their services.

Two case studies point to what drives value for streamers: Netflix and Discovery+.

Netflix suffers as streamers look to save money

In the case of Netflix, prices rose in 2022, and a lower cost AVoD tier was introduced. Both have contributed to its perception of value driven by costs. Since its price increase, Netflix has seen a consistent portion of cancellations driven by the rise in costs. Roughly 1 in 5 Netflix cancellations have been driven by the rise in costs over the last year, while 1 in 3 have been driven by saving money.

The introduction of Netflix with ads has also led to trade up and trade down behavior among its existing subscriber base. In Q1’23, roughly 6% of Netflix SVoD subscribers traded down to ad-supported. This is a significant slowdown compared to the quarter of its launch. Netflix has prevented cancellations through trading down to AVoD, but it still lost a net of 5% of its subscribers in Q1’23.

In the same time period, 1 in 4 Netflix ad-supported subscribers traded up to ad-free. Netflix is proving it has value at all price points, offering a solution for those looking to save money, and an ad-free experience for those willing to spend more. Despite its slow start, the Netflix with Ads may help bring the service back into growth in the US.

Looking ahead, services with ad-supported and ad-free options may also see more trade down behavior as streamers look to balance the cost of their high stacking. But as Netflix has proven, ad-supported is also a tool to trade up if the value of no ads is proven.

Content and technical difficulties are driving down the value of Discovery+

When looking at planned cancellation of Discovery+ in the next 3 months (Q2’23) compared to competitors, it is more likely to be cancelled because it’s hard to find content to watch and because there is not enough new content. This is reflected in actual cancellations of Discovery+ in Q1’23. Discovery+ was more likely cancelled due to difficulty finding content and technical difficulties. 25% of Discovery+ cancellations in Q1’23 were driven by difficulty finding content to watch.

When there are technical difficulties or a challenging interface, it often makes it harder for streamers to find content they enjoy. Even with an expansive catalogue, like that of Discovery+, it creates the perception that there is not enough content and diminishes the perceived value of the service.

Understanding what drives the perception of value is key to reducing churn and driving engagement. Without this understanding, streaming services risk losses beyond trading down.

Streamers compete on a new genre: children’s content

In the last year, streamers having been racing to acquire sports rights as a key differentiator against competitors. While this race continues, streaming services are looking for the next genre to drive increased engagement and subscriptions. In the last six months, that genre has been children’s content. For paid streaming (SVoD and AVoD), sign ups driven by children’s content have risen 36% in the last six months, and 21% in the last quarter.

Children’s content now drives 8% of new paid subscriptions, roughly equal to that of sports. Without having to plan the logistics of live sports, children’s content is a much easier genre to invest in.

The strategy behind focusing on children’s content is that a service becomes much more indispensable to the household when it provides quality entertainment to children. When multiple members of the household can find content they enjoy, it may prevent churn and increase the value of a given service. Apple TV+, which lost subscribers in Q1’23, is growing their catalogue of children’s content and making it easier to discover. For the second quarter in a row, Apple TV+ has over-indexed on driving sign ups due to children’s content. Future churn of Apple TV+ will be an indicator of the success of this strategy and focus.

HBO Max has also announced a new focus on children’s content in alignment with the newly announced Max service. In a recent presentation about the future of Max, the expansion of children’s content received significant attention. If this is any indication, expect other streaming services to follow suit, focusing more on their children’s catalogue in the future.

Leading titles span audience in Q1

The Last of Us was the most enjoyed title in the month of March. It beat out YOU despite the later having an established audience from its first three seasons. They key difference among the audience of the two trending titles is the proportion of women who rated it as their top titles: YOU viewers were almost 2x as likely to women than The Last of Us viewers. The Last of Us had a more equal distribution of audience demographics, spanning both gender and generations, which helped it become the #1 title in March.