In 2023, 10 million electric vehicles (EVs) were sold globally, over five times the number sold just five years earlier. This dramatic change is, in large part, due to Elon Musk’s determination to make the Tesla brand a success. The introduction of the Model S in 2012, followed by the Model Y and more affordable Model 3, has helped Tesla become the market leader in the growing EV market.

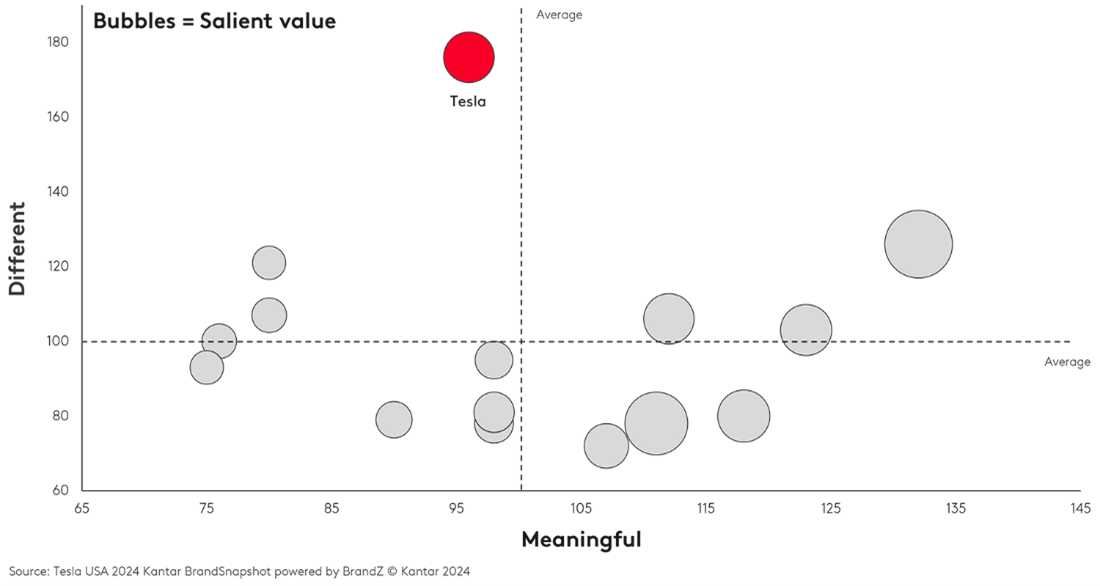

Kantar BrandSnapshot finds that in its home market of the US, Tesla is a Star, but the brand’s trial is somewhat below what might be expected based on its awareness. Strong brands have three important qualities that can help us diagnose why this might be:

- Meaningful: meeting peoples’ needs both functionally and emotionally

- Different: offering things others don’t and leading the way in their category

- Salient: coming to mind readily at key decision-making moments.

On average, Tesla’s difference score is nearly twice the category average, but it trails the average on being meaningful. This low score suggests that not everyone is convinced that an EV will meet their needs.

Tesla stands out as gaining importance, with strong purpose, specialisation, and distinctive looks. It is classified as having a Justified Premium, which suggests the brand can still grow while sustaining a price premium over its competition. Intriguingly, however, Tesla chose to boost volume at the expense of margins and cut prices on its two most popular models in 2023, which resulted in a 35% year-on-year increase in sales. This move may have got more drivers behind the wheel of a Tesla and discomforted competitors who felt they must drop their own prices. But it may have also reduced Tesla’s ability to invest for the future.

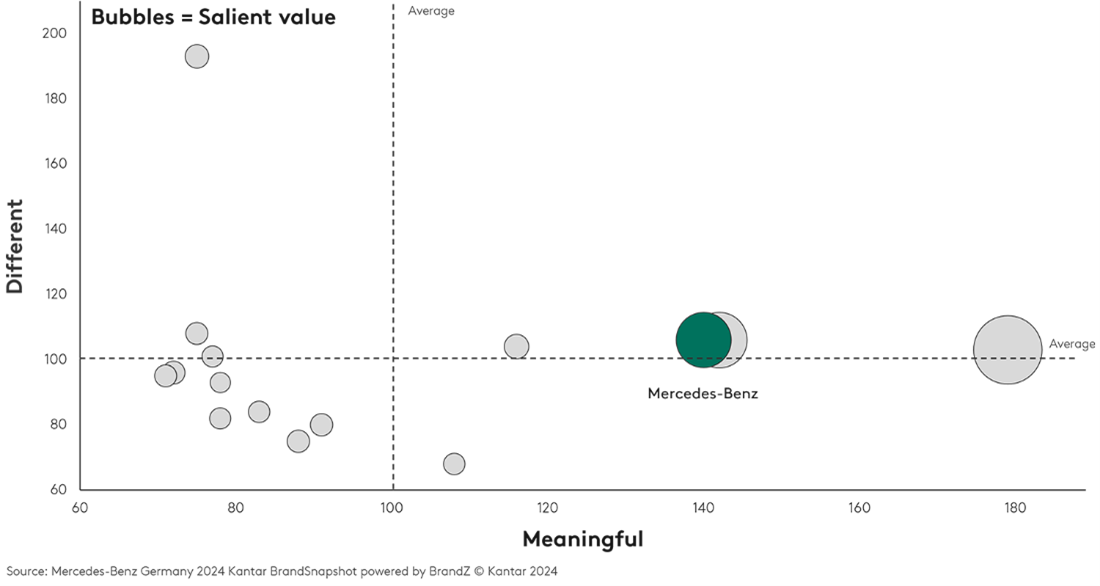

By contrast, in its home market of Germany, Mercedes is an insider, a well-established automotive brand with origins dating back to the first internal combustion engine. As a mainstream luxury brand, Mercedes is perceived as meaningful and salient compared to many brands.

In the context of luxury cars in Germany, Mercedes’ trial is higher than might be expected, and it is classified as Great Value compared to the likes of Ferrari and Porsche. It stands out as an everyday car, but it is also well-designed and more enjoyable.

So, what will the future bring? Mercedes and Tesla face different challenges if they are to remain successful. What can they learn from each other’s triumphs and setbacks to reign supreme in the automotive market?

Mercedes must navigate the shift to an EV world without undermining its existing brand strengths and losing its customer base. Radical innovations in technology or design might help the brand gain share in the EV market, especially in competing with the likes of Tesla with its off-the-chart difference score. However, this approach may alienate drivers wedded to their internal combustion engine, particularly if the innovation comes at a higher price. Mercedes needs to strike a delicate balance between maintaining the trust and loyalty of its current customer base while also appealing to new buyers.

Tesla must make its difference meaningful to a larger audience. First, it must reassure potential customers that range anxiety is a thing of the past. Secondly, Tesla must expand its product portfolio to cater to the diverse needs of different types of drivers, broadening its appeal to compete with established brands like Mercedes. While the highly anticipated Cybertruck may boost the brand’s perceptions of being different, it remains to be seen whether it will capture the hearts and minds of a wider audience.

And both brands face a growing threat in the form of new competition. Leading Chinese automaker BYD is the second biggest EV brand in the world by volume. In China, Kantar BrandSnapshot classifies BYD as a Star, with lower prices resulting in strong demand and pricing power. If BYD can successfully establish its brand outside China, it could pose a challenge to both Tesla and Mercedes-Benz in the race for dominance in the EV market.

Read more about the Kantar BrandZ Most Valuable Global Brands in the latest report, available at www.kantar.com/campaigns/brandz/global.

To help you understand what drives brand equity for your brand and race ahead of the competition, Kantar has launched a free interactive tool powered by BrandZ’s wealth of data and its Meaningful Different Salient framework. Kantar BrandSnapshot delivers intelligence on 10,000 brands in 40+ markets, offering a quick read on a brand’s performance in a category. Explore for free on Kantar Marketplace today.