Ultra-fast fashion retailer Shein first shot to prominence during the COVID-19 pandemic. Sales of the online-only retailer rose 250% compared to the year before as consumers predominantly switched to online shopping. That growth has continued as the brand’s popularity has skyrocketed, particularly with younger consumers. In 2023, Shein was the top newcomer in the Kantar BrandZ Top 100 Most Valuable Global Brands ranking, at No.70 with a brand value of $24.3bn.

Zara, a leading Spanish brand, achieved great success by quickly borrowing fashion ideas from the runways of Milan, Paris, and New York. They produce low-cost replicas within a few weeks, which enables them to stay ahead of the fashion industry's ever-changing trends. In contrast, Shein aims to meet consumer demand in just a matter of days, making them a go-to for those who want to keep their wardrobe up-to-date with the latest styles. To do so, the company analyses social media and search trends to identify likely fashion trends, then leverages its huge supplier network to design and produce a limited number of each item. Shein launches thousands of new items on its app each day, testing demand using a system it calls “the large-scale automated test and reorder (LATR) model.” If an item proves successful, Shein directs the manufacturer to ramp up production. Purchases ship directly to customers in over 200 countries worldwide.

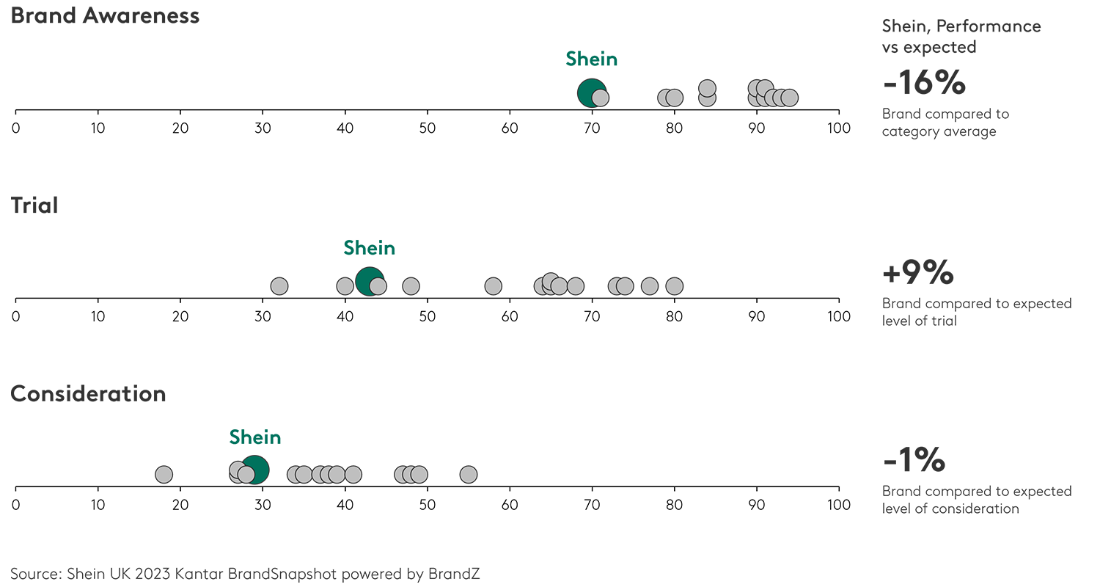

Shein’s success with consumers rests on the key benefits of variety, speed, and affordability. Kantar’s BrandSnapshot tool demonstrates that these benefits resonate with potential customers. In the UK last year, 70% of shoppers recognised Shein, 16% less than the category average. However, 43% of shoppers have tried the brand, which is 9% higher than the expected level of trial for its level of awareness. This indicates strong interest among those who are familiar with the brand.

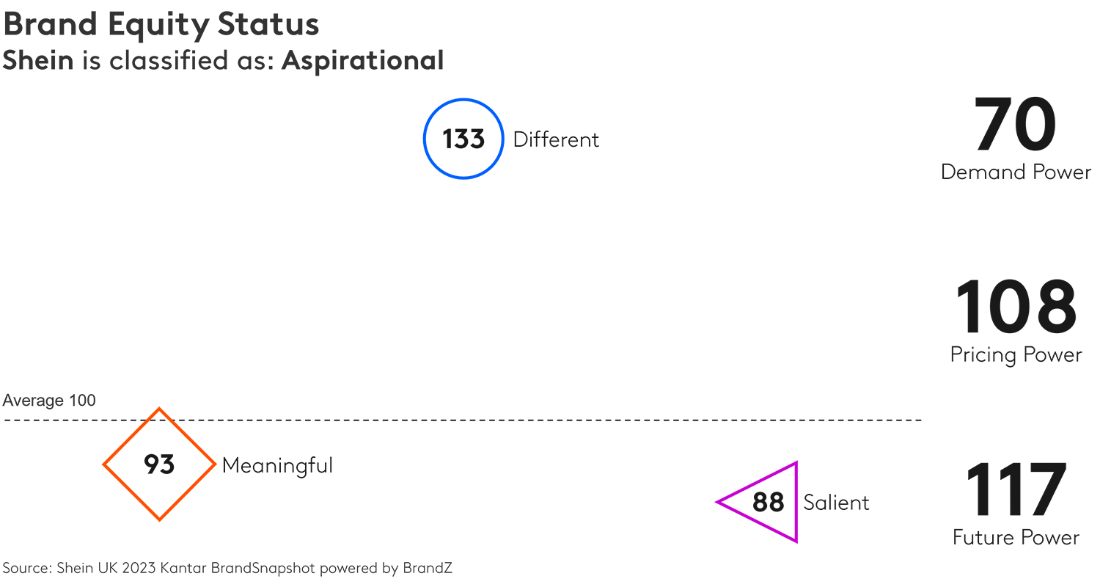

Strong brands have three important qualities:

- Meaningful: meeting peoples’ needs both functionally and emotionally

- Different: offering things others don’t, and leading the way in their category

- Salient: coming to mind readily at key decision-making moments

Shein stands out from other fashion retailers as being Different, indexing at 133 against a category average of 100. Perhaps not surprisingly for a relatively young brand, its current Demand Power was lower than the category average, but Future Power was above average, indexing at 117. This implies that Shein has significant growth potential, particularly as consumer perceptions position the brand as Great Value.

Shein’s success with consumers is based on more than just the right product at the right time. The company has taken a style of marketing familiar in China and used it successfully elsewhere to make the brand the talk of social media. With a TikTok following that far outstrips competitors, Shein takes influencer marketing to another level, collaborating with thousands of micro-influencers to reach its audience in the format of “#SheinHauls,” whereby influencers show off the brand’s merchandise, share discount codes with their followers, and earn a commission on sales. The result is that Demand Power among consumers aged under 35 indexes above the category average at 123, while among the over 35s demand remains low at an index of 34.

While highly successful, Shein’s business model is not without risk. Its Chinese origins and primarily Chinese supply chain mean the company faces pressure from U.S. lawmakers. Moreover, the company has faced multiple allegations of copyright infringement. As the largest fast-fashion retailer in the world, Shein has also come under criticism for promoting excessive consumerism.

Shein claims to be working to mitigate these risks, including localising its supply chain outside China. In an interview with CNBC Marcelo Claure, Group Vice Chairman of SHEIN, stated,

“…we are getting as close as we can to our customers with a very simple intent and that is, the closer we are to our customers, the faster we can fulfill their needs.”

Assuming Shein addresses concerns successfully, BrandSnapshot profiles it as a brand ready to grow even further. Shein’s unique business model seems destined to propel it further up in the Top 100 Most Valuable Global Brands ranking in years to come, particularly if it can extend its visibility to older fashion buyers.

To help you understand what drives brand equity for your brand and competitors, Kantar has launched a free interactive tool powered by BrandZ’s wealth of data and Meaningful Different Salient framework. Kantar BrandSnapshot delivers intelligence on 10,000 brands in 40+ markets, offering a quick read on a brand’s performance in a category. Explore for free on Kantar Marketplace today.