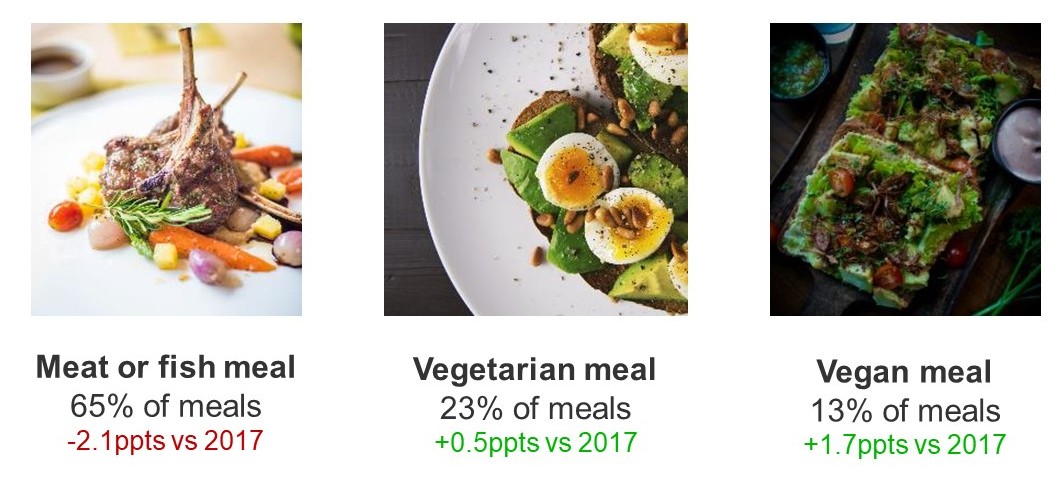

We’re increasingly opting for meals without any meat, fish or dairy in them. Vegan meals now account for 1 in 8 meals we prepare at home, according to our usage panel data. This equates to an additional 350 million plates of food that are now vegan-friendly, compared to 5 years ago.

However, just 1.9% of households include someone who follows a vegan diet.*

Looking at our TGI data, 11% of adults in Britain (6 million people) agree with the statement ‘I prefer vegan food and drink’ and this has remained relatively static over the past five years.

Who is going plant-based?

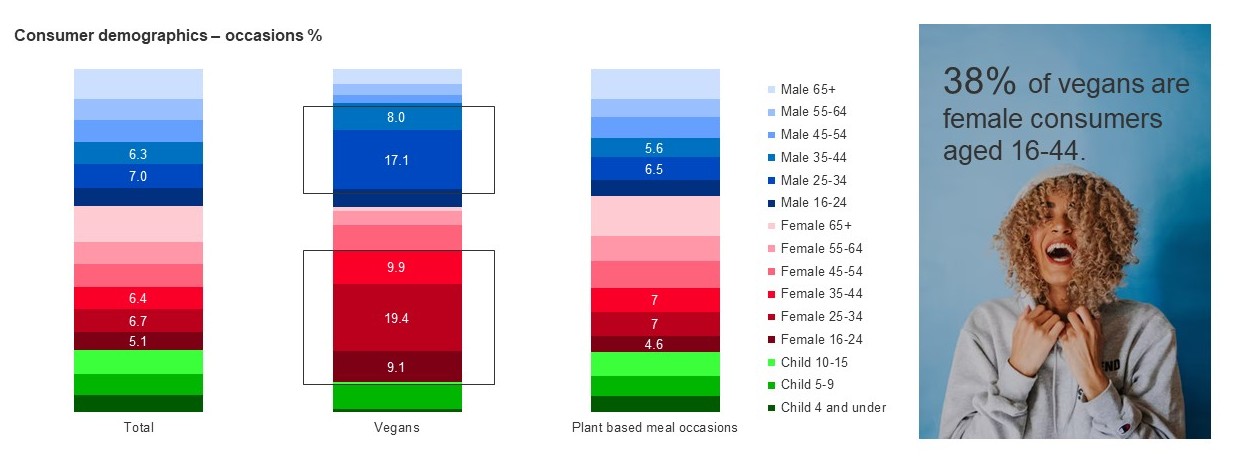

It is important to note that the rise in the consumption of plant-based meals is not driven solely by vegans.

Millennial consumers are a key demographic when it comes to veganism… 36% of vegans are aged 25-34 years old (index 266 vs total population). Whilst young females are another significant target group for veganism, plant-based meals are eaten by a far broader demographic and one representative of the wider population.

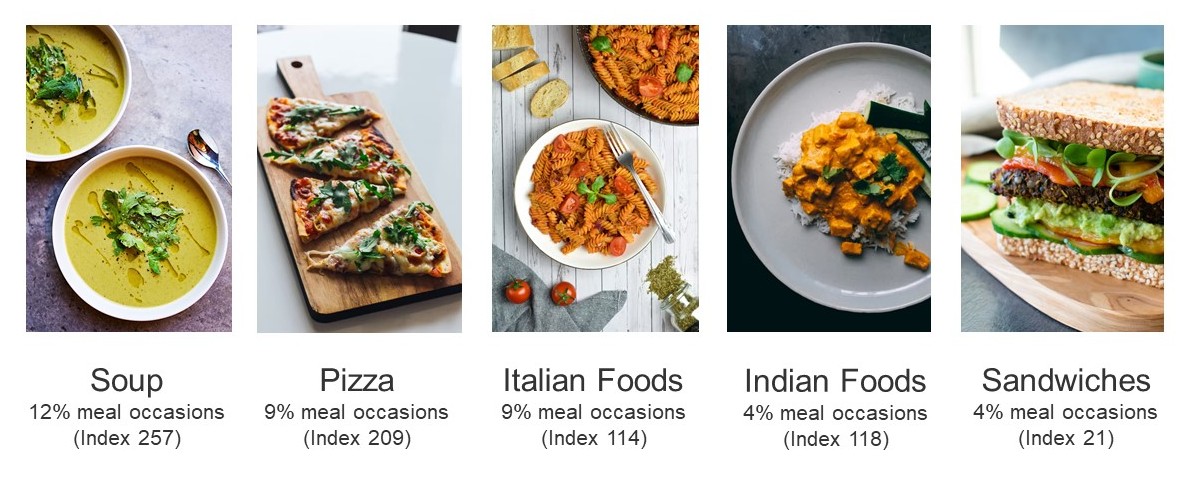

Soups are the most popular choice for when we opt for plant-based meals. World cuisines such as pizza, pasta and Indian dishes are also favoured.

Why are we switching to plant-based cuisine?

- Health: There is a desire amongst consumers to improve their health by reducing their consumption of red meat. This is an underlying trend that has been gaining momentum for years. COVID-19 has softened the shift, but it’s likely to continue.

- Society: There is some societal and media pressure to go vegan… but the noise surrounding red meat consumption and shifts towards plant based eating is louder than the reality! (1 in 5 of us claim to be buying less red meat, but even prior to lockdown our red meat consumption had dropped just 3% vs 2017.)

- Innovation: There is a surge meat alternatives and new product development in this space. Availability is helping to make it easier for consumers go meat free. Compared to 2017, +1.1m more people are eating meat substitutes in an average week. 9% of the population now do so on a weekly basis.

- Affordability: Removing meat or fish from the overall plate saves consumers money, which may become more of a consideration if we enter a recession. Value for money will be a key message. The average cost of a meat-free evening meal is £0.95… vs. £2.02 if meat or fish is on the plate.

It’s not just food and drink

10% of adults agree ‘I always buy vegan products (excluding food) where possible’. Those who agree with this statement are over three quarters more likely than the average adult to be aged 15-24 (a quarter are in this age group compared to 14% of adults generally). They are also more likely to come from a relatively well-off background – they are 44% more likely than the average adult to have a family income of £75,000 or more (8% do so vs 6% of adults generally).

Targeting vegans

Attitudinally, fans of all things vegan are particularly likely compared to the average adult to admit to being influenced by celebrities, and wish to stand out. Amongst those who agree ‘I always buy vegan products (excluding food) where possible’:

- 26% agree ‘Celebrities influence my purchase decisions’, compared to 7% of adults generally

- 37% agree ‘I like to stand out in a crowd’, compared to 16% of adults generally

- 27% agree ‘My car should catch people’s attention’, compared to 12% of adults generally

- 32% agree ‘I spend a lot on clothes’, compared to 15% of adults generally

In terms of engaging vegans, there are a variety of media of which these users of vegan products are particularly likely to be amongst the top fifth of consumers. These include cinema (81% more likely than the average adult), outdoor media (53% more likely) and social media (48% more likely).

SOURCES

- Kantar Usage panel, 52w/e 05 Sep 2021 vs Sep 2017

- GB TGI data (fieldwork August 2021 – July 2021)

- *Kantar FMCG Purchase Panel, N=18,670, Diets of Britain LinkQ Survey October 2020, 52 w/e 01 Nov 2020