The environment in which you place your ads is as crucial as the ad itself. There is no one-size-fits-all approach to choosing channels and platforms. Finding the right fit for your brand’s message and campaign objectives is vital for effective brand communications. Understanding the media landscape allows you to identify which touchpoints and publisher partners to utilise for different objectives and helps you build predisposition towards your brand. Similarly, it gives publisher brands an understanding of what they should provide to their advertiser partners for their own brand growth.

Media Reactions helps you make informed marketing decisions, by drawing on insights from over 21,000 global consumers across 30 markets and more than 1,000 marketers worldwide. It serves as a guide for advertisers and agencies to better understand how to achieve their marketing goals, and for publisher partners to learn how their platforms are perceived by both consumers and marketers, enabling them to showcase their strengths more effectively. We also explore regional variations to uncover differences among diverse global audiences.

In a sea of change, ensure you are future-ready to navigate the evolving media landscape. Now in its sixth year, Media Reactions remains the only global equity evaluation of media channels and brands from both consumer and marketer perspectives. Using Kantar’s Ad Equity metric, it identifies environments where consumers are most open to advertising and least likely to respond negatively.

Despite the rapid emergence of new media channels and platforms, both marketers and consumers still feel there is a lack of innovation in the media space. Only 14% of marketers find ads innovative in general, and according to consumers there are no media channels that stand out as innovative. Nevertheless, marketers continue to embrace new opportunities: 53% plan to increase spend on social commerce ads. These are ads in social media spaces where products and services can be purchased directly, without having to go to an ecommerce platform. Influencer/creator content continues to be an exciting opportunity as well, with 61% of marketers globally expecting to boost their budgets in this channel next year.

Additionally, the emotive topic of GenAI in advertising was revisited this year, revealing an overall increase in positivity towards its use. However, marketers still have a role to play in addressing consumers trust issues, with 57% expressing concern about GenAI being used to create fake ads. 70% of marketers already use GenAI to create efficiencies in their work, and effectiveness and creativity areas are not far behind. Educating consumers on the uses of the technology and maintaining transparency is key to overcome the current hurdles.

Consumer preference is a major element that needs to be factored into media planning. Marketers’ views are equally important, especially when it comes to their trust in a media brand. So, where are the preferred and safe spaces in today’s media environment?

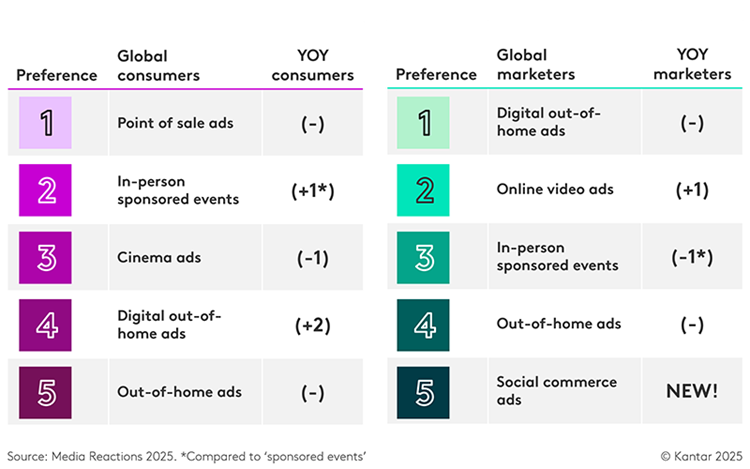

Point-of-sale ads continue to lead consumer rankings in 2025 offering trustworthy, relevant and useful ads where consumers need them most in their purchase journey. Meanwhile, in-person sponsored events rank second, and online sponsored events come in seventh, the highest ranking ever for a native online channel. Out-of-home ads, both digital and traditional, are favoured among consumers and marketers. They make the top five for each group. And notably, the new social commerce channel entered the marketer top rankings straightaway - one to watch in the evolving media landscape.

Top ranking media channels among consumers and marketers

Meanwhile, marketers tend to favour platforms they trust. YouTube, Instagram, Google, Netflix and Spotify make up their top five, with each brand keeping their spot from last year, and ranked in the exact same order for marketer trust. Interestingly, marketers do not always allocate the most spend to their preferred platforms, as they also consider consumer preference. In 2026, 64% of marketers globally plan to increase spend on TikTok, a long-time consumer favourite.

Top ranking advertising brands among consumers and marketers

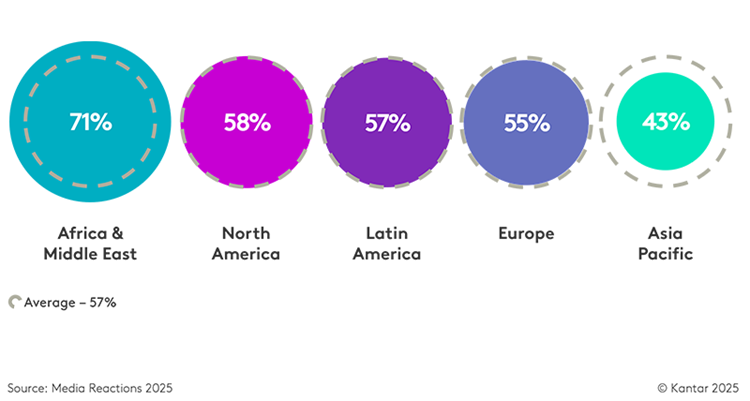

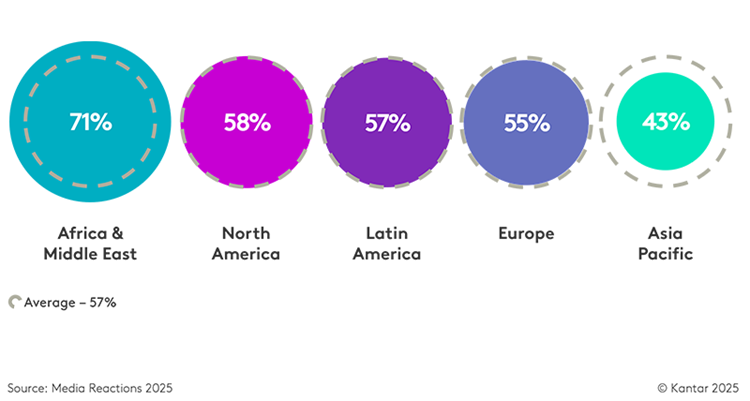

Average media channel receptivity among consumers by region

Across channels, further differences emerge. Point-of-sale advertising tops consumer ad preference in Europe, as well as Argentina, Germany and Turkiye. In-person sponsored events lead in North America, along with nine other markets including China, Indonesia and Poland. Cinema ads rank highest in Asia Pacific, and at a market level in Japan and the UK. Digital out-of-home is the most preferred format in Africa & Middle East, as well as Australia, Ecuador and Saudi Arabia. Meanwhile, traditional out-of-home leads in Brazil, the Philippines, Singapore and South Africa.

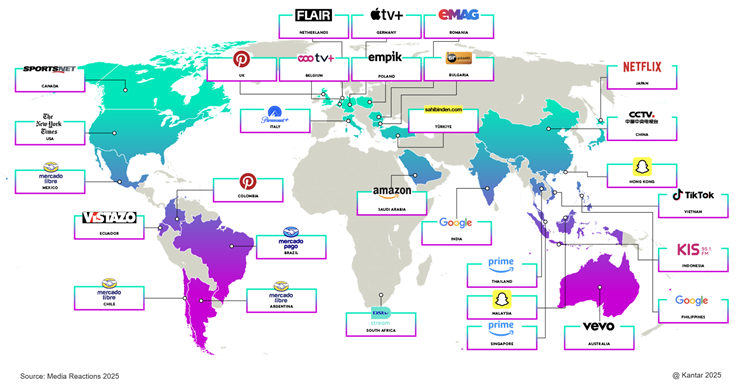

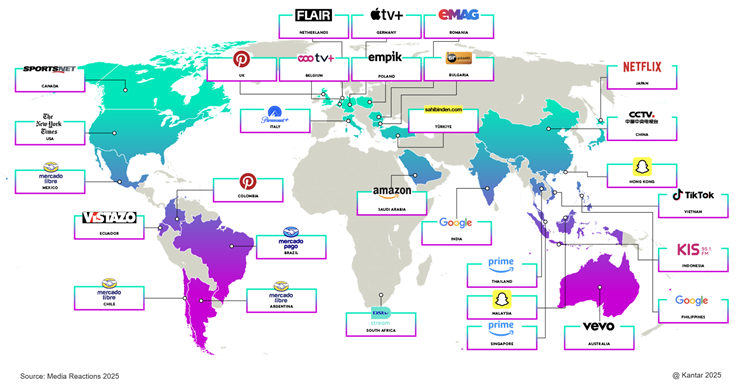

While global brands dominate in many markets, local brands also perform strongly. For example, regional ecommerce giant Mercado Libre leads in Argentina, Brazil, Chile, and Mexico, with its portfolio showing strength across Latin America. Among the market leaders, there is representation from various different channels, including other ecommerce brands, news & magazine brands, radio stations, and video brands including TV.

Top-ranking advertising brands among consumers per market

The media landscape is constantly evolving, adapting, and is often disorientating. No one knows what’s coming next or how long it will last. With marketing budgets under pressure and proof of ROI essential, marketers may feel reluctant to take risks on the next big thing. However, Kantar believes that staying ahead requires a commitment to innovation, adaptability, and a deep understanding of consumer behaviour across different audiences.

We offer valuable guidance to help you navigate the rocky seas of the media world and guide you to make more confident media decisions than ever before.

Download the free guide now to learn more about the winning brands in each market and start optimising your media strategy and planning for 2026.

Get in touch to discuss how Kantar’s media experts can support your brand’s media strategy and click to learn more about our Media Effectiveness solutions.

Media Reactions helps you make informed marketing decisions, by drawing on insights from over 21,000 global consumers across 30 markets and more than 1,000 marketers worldwide. It serves as a guide for advertisers and agencies to better understand how to achieve their marketing goals, and for publisher partners to learn how their platforms are perceived by both consumers and marketers, enabling them to showcase their strengths more effectively. We also explore regional variations to uncover differences among diverse global audiences.

In a sea of change, ensure you are future-ready to navigate the evolving media landscape. Now in its sixth year, Media Reactions remains the only global equity evaluation of media channels and brands from both consumer and marketer perspectives. Using Kantar’s Ad Equity metric, it identifies environments where consumers are most open to advertising and least likely to respond negatively.

Key 2025 Media Reactions findings

Since 2020 average consumer receptivity towards advertising has been on a consistent upward trajectory, with 57%, now expressing a positive attitude towards ads in general. We’re also seeing evidence that consumers perceive campaigns as more cohesive nowadays, with 66% feeling ads are more integrated within campaigns, an increase of 8% from 2017. Although consumers are satisfied with marketers’ improvements in ad and campaign executions, marketers themselves are less confident. 64% of marketers feel campaigns are well-integrated, but this is down from 89% in 2017. This is due to the ever-expanding media landscape which can often feel disorientating. Marketers need to keep up with more platforms than ever, but consumers appreciate their efforts.Despite the rapid emergence of new media channels and platforms, both marketers and consumers still feel there is a lack of innovation in the media space. Only 14% of marketers find ads innovative in general, and according to consumers there are no media channels that stand out as innovative. Nevertheless, marketers continue to embrace new opportunities: 53% plan to increase spend on social commerce ads. These are ads in social media spaces where products and services can be purchased directly, without having to go to an ecommerce platform. Influencer/creator content continues to be an exciting opportunity as well, with 61% of marketers globally expecting to boost their budgets in this channel next year.

Additionally, the emotive topic of GenAI in advertising was revisited this year, revealing an overall increase in positivity towards its use. However, marketers still have a role to play in addressing consumers trust issues, with 57% expressing concern about GenAI being used to create fake ads. 70% of marketers already use GenAI to create efficiencies in their work, and effectiveness and creativity areas are not far behind. Educating consumers on the uses of the technology and maintaining transparency is key to overcome the current hurdles.

Top-Ranking Global Media Channels

Consumer preference is a major element that needs to be factored into media planning. Marketers’ views are equally important, especially when it comes to their trust in a media brand. So, where are the preferred and safe spaces in today’s media environment? Point-of-sale ads continue to lead consumer rankings in 2025 offering trustworthy, relevant and useful ads where consumers need them most in their purchase journey. Meanwhile, in-person sponsored events rank second, and online sponsored events come in seventh, the highest ranking ever for a native online channel. Out-of-home ads, both digital and traditional, are favoured among consumers and marketers. They make the top five for each group. And notably, the new social commerce channel entered the marketer top rankings straightaway - one to watch in the evolving media landscape.

Top ranking media channels among consumers and marketers

Top-Ranking Global Media Brands

Three of the top five ad platforms preferred by consumers this year, are Amazon brands. Amazon ranks first, thanks to its relevant and useful ads, while Twitch and Prime Video take fourth and fifth place, respectively. Twitch has the most trustworthy ads among global brands measured, while Prime Video ads are seen as high quality. Snapchat ranks second, having climbed four spots compared to last year, with its ads perceived as less intrusive and more fun. TikTok is in third place, and continues to capture consumer attention, retaining its position as the most fun and entertaining brand.Meanwhile, marketers tend to favour platforms they trust. YouTube, Instagram, Google, Netflix and Spotify make up their top five, with each brand keeping their spot from last year, and ranked in the exact same order for marketer trust. Interestingly, marketers do not always allocate the most spend to their preferred platforms, as they also consider consumer preference. In 2026, 64% of marketers globally plan to increase spend on TikTok, a long-time consumer favourite.

Top ranking advertising brands among consumers and marketers

Regional Differences across Media Channels and Brands

Globally, consumers have shown increased positivity towards advertising; however, the picture varies across regions. Consumers In Africa & Middle East report being significantly more positive towards advertising than the global average at 71%. Conversely, ad receptivity is lower in Asia Pacific, with the more negative responses driven by Australia, Hong Kong, Japan and Singapore. In contrast, other Asian markets such as mainland China and the Philippines are notably more positive towards ads.Average media channel receptivity among consumers by region

Across channels, further differences emerge. Point-of-sale advertising tops consumer ad preference in Europe, as well as Argentina, Germany and Turkiye. In-person sponsored events lead in North America, along with nine other markets including China, Indonesia and Poland. Cinema ads rank highest in Asia Pacific, and at a market level in Japan and the UK. Digital out-of-home is the most preferred format in Africa & Middle East, as well as Australia, Ecuador and Saudi Arabia. Meanwhile, traditional out-of-home leads in Brazil, the Philippines, Singapore and South Africa.

While global brands dominate in many markets, local brands also perform strongly. For example, regional ecommerce giant Mercado Libre leads in Argentina, Brazil, Chile, and Mexico, with its portfolio showing strength across Latin America. Among the market leaders, there is representation from various different channels, including other ecommerce brands, news & magazine brands, radio stations, and video brands including TV.

Top-ranking advertising brands among consumers per market

Navigating the media landscape in 2026

Marketers are doing a great job, as reflected in the continued rise in consumer positivity towards advertising. However, confidence must be increased through ongoing testing and learning, especially as new channels and formats emerge, and established platforms continue to evolve. Customisation is also evolving; it’s no longer just about adapting the same creative to different contexts. Instead, it must begin with a clear, connected brief rooted in an understanding of each platform’s unique capabilities. The development process should be synergistic feeding into the needs of a diverse global audience.The media landscape is constantly evolving, adapting, and is often disorientating. No one knows what’s coming next or how long it will last. With marketing budgets under pressure and proof of ROI essential, marketers may feel reluctant to take risks on the next big thing. However, Kantar believes that staying ahead requires a commitment to innovation, adaptability, and a deep understanding of consumer behaviour across different audiences.

We offer valuable guidance to help you navigate the rocky seas of the media world and guide you to make more confident media decisions than ever before.

Download the free guide now to learn more about the winning brands in each market and start optimising your media strategy and planning for 2026.

Get in touch to discuss how Kantar’s media experts can support your brand’s media strategy and click to learn more about our Media Effectiveness solutions.