The distinction between online and offline advertising channels has become increasingly blurred in the eyes of consumers and media brands. Advertisers and agencies must align their marketing strategy with this new perspective. The crux lies in understanding how audiences interact with each channel and consume content, and tailoring advertising, because the 'traditional versus digital' frame is outdated.

The online media world is not a separate realm anymore, as digital and physical platforms are now interconnected. TV shows can be streamed online, books and magazines exist in digital forms, and many events are hybrid, reaching audiences both face to face and virtually. When a consumer is asked to think of an out of home ad they saw in a shopping mall, they don’t dwell on whether it was a digital one or not. In fact, both are among the top 5 advertising platforms for consumers according to Kantar Media Reactions 2023. So, it is important that marketers keep this point of view in mind while planning their campaigns, and not think of channels as silos. While each media channel will have distinct ways of engaging people and ads need to be customised accordingly, channels also interact with each other in ways previously not imagined. As the media and advertising industry evolve, media buying practices and effectiveness measurement need to move in the same direction.

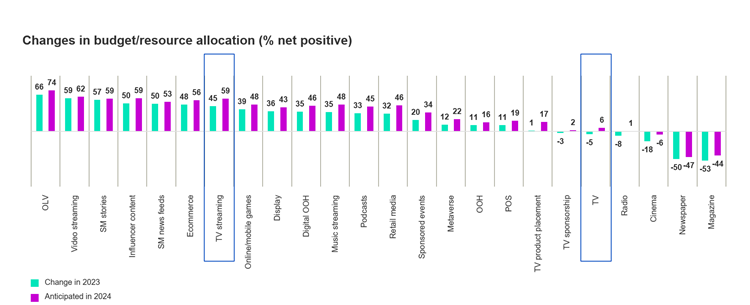

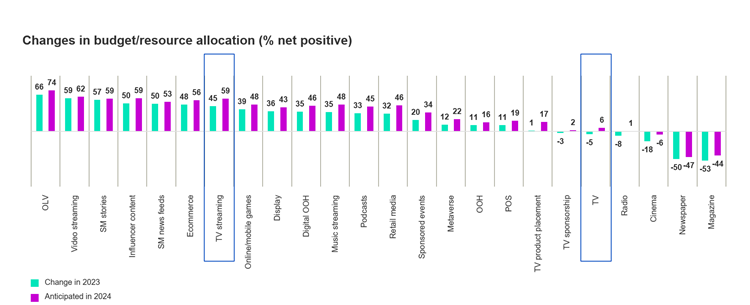

This evolution of TV has been reflected in budget allocations by marketers. According to Group M’s mid-year advertising forecast, while global traditional TV revenue had a 1.2% decrease over 2022, connected TV revenue showed a 13.2% increase. This reflects what we observed in Kantar Media Reactions 2023, as a net 5% of marketers said they decreased their spend on linear TV, while 45% stated they actually increased spend on streaming TV. In 2024, this gap looks set to increase further.

Despite the spend flow from linear TV to digital channels, linear TV spend continues to dominate the media mix, based on the Kantar’s analysis of around 2,000 client campaigns in our CrossMedia database. This can be also observed through marketers’ trust in TV, as again this year it was the most trusted advertising channel, according to Kantar Media Reactions 2023. Another analysis from Kantar’s CrossMedia database found that this large share of spend linear TV gets is justified, as it generates the most brand impact of all media channels.

TV streaming and on-demand video environments are also increasingly becoming prominent in the advertising scene. Marketers’ interest is high in newer formats, with online video being their most preferred media channel for four years in a row, with video streaming ads following closely in the fourth place this year. And meanwhile, SVOD brands are on the rise. Netflix, who has the biggest number of subscribers among video-on-demand brands globally, has started offering an ad-supported plan to its subscribers in 2023. These environments are the main video consumption sources for many consumers, especially younger generations. These are commanding more investment in media plans and should not be underestimated.

An interesting Kantar case study showcasing the power of a new video avenues comes from a CPG brand. The brand planned a video campaign with over-the-top TV service Tubi, where they wanted to improve the awareness of their snack product. The campaign was highly memorable, indicated by a 40% higher lift in ad awareness than the category norm. Exposure to the Tubi campaign also led to improved brand awareness, favourability, and intent to purchase.

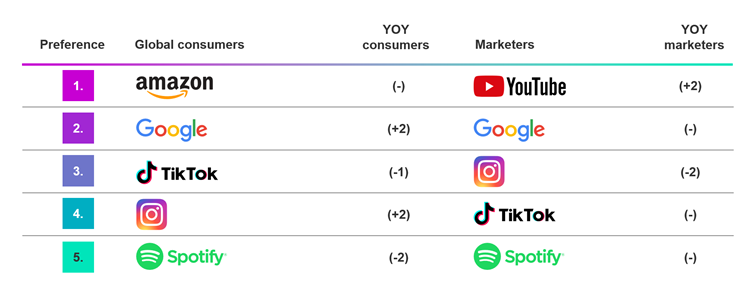

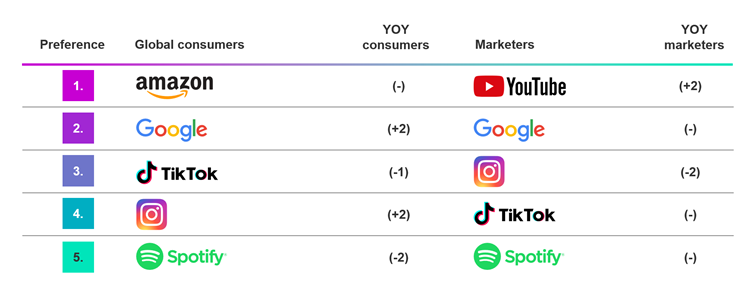

Among consumers, too, audio brands are nothing to scoff at. Japan’s digital radio aggregator platform Radiko, New Zealand’s Coast FM, and Greece’s Diesi Radio were the most popular ad enviroments in their respective market, according to Media Reactions. Podcasts are another advertising medium that boasts strong ad equity. Spotify, which provides both music streaming and podcasts, is among the top 5 of both consumers and marketers’ ad preference rankings, and the fourth most trusted platform by marketers globally. Digital streaming and podcasting-related services are increasingly essential aspects of media strategies, and audio can clearly hold its own in a fight against the ever-popular video.

Print consumption, on the other hand, has heavily moved to digital formats, and digital counterparts of physical print platforms are an equally acceptable way to consume print. Magazine and newspaper ads are at the bottom of marketers’ receptivity globally, and assumed to be the least attention-grabbing channels by them. This might stem from considering these channels “outdated,” without reflection on their digital evolution. Newspapers and magazines, in fact, are among the most trustworthy ad platforms by consumers, seen as providing high-quality and relevant ads. fd. is a daily newspaper from the Netherlands and it is the leading ad equity brand in the market, demonstrating how these media channels can still deliver for brands.

Apple is another brand that has embraced the hybrid concept, combining both in-person and virtual connections. They held their Worldwide Developers Conference (WWDC) online for the first time in 2020 due to the pandemic, and transformed the format into hybrid since 2022, where the entire conference is available online for all developers, with also a special in-person experience at their venue.

Considering these intrinsically interconnected platforms together while making marketing plans is essential. A well-integrated campaign works more effectively, and silos never help. So it’s vital to ensure that effectiveness measurement is looked at holistically too.

Ad preference is an important factor in media channel planning, as campaigns are seven times more impactful among more receptive audiences.

Reach out to us to learn more about different markets and winning brands, and how Kantar’s media experts can help your brand’s marketing strategy and media effectiveness measurement.

Get in touch to find out more

The online media world is not a separate realm anymore, as digital and physical platforms are now interconnected. TV shows can be streamed online, books and magazines exist in digital forms, and many events are hybrid, reaching audiences both face to face and virtually. When a consumer is asked to think of an out of home ad they saw in a shopping mall, they don’t dwell on whether it was a digital one or not. In fact, both are among the top 5 advertising platforms for consumers according to Kantar Media Reactions 2023. So, it is important that marketers keep this point of view in mind while planning their campaigns, and not think of channels as silos. While each media channel will have distinct ways of engaging people and ads need to be customised accordingly, channels also interact with each other in ways previously not imagined. As the media and advertising industry evolve, media buying practices and effectiveness measurement need to move in the same direction.

TV continues to evolve, with a better offline-online balance

TV is a great example of how offline and online spaces are intertwined in the current media landscape. Video consumption has long stopped being limited to linear TV and cinema. According to Kantar Media data, 86% of Brazilian consumers were consuming online video in 2022, compared to 34% in 2013. This change has been rapid. It’s not only the formats that have multiplied, but TV brands themselves do not identify with linear TV alone. Streaming (BVOD) is a big revenue avenue and a great way to reach younger consumers - and make up for the decreasing reach of linear TV. The device is no longer the content: for example, the TV set also allows viewers to stream content.This evolution of TV has been reflected in budget allocations by marketers. According to Group M’s mid-year advertising forecast, while global traditional TV revenue had a 1.2% decrease over 2022, connected TV revenue showed a 13.2% increase. This reflects what we observed in Kantar Media Reactions 2023, as a net 5% of marketers said they decreased their spend on linear TV, while 45% stated they actually increased spend on streaming TV. In 2024, this gap looks set to increase further.

Despite the spend flow from linear TV to digital channels, linear TV spend continues to dominate the media mix, based on the Kantar’s analysis of around 2,000 client campaigns in our CrossMedia database. This can be also observed through marketers’ trust in TV, as again this year it was the most trusted advertising channel, according to Kantar Media Reactions 2023. Another analysis from Kantar’s CrossMedia database found that this large share of spend linear TV gets is justified, as it generates the most brand impact of all media channels.

TV streaming and on-demand video environments are also increasingly becoming prominent in the advertising scene. Marketers’ interest is high in newer formats, with online video being their most preferred media channel for four years in a row, with video streaming ads following closely in the fourth place this year. And meanwhile, SVOD brands are on the rise. Netflix, who has the biggest number of subscribers among video-on-demand brands globally, has started offering an ad-supported plan to its subscribers in 2023. These environments are the main video consumption sources for many consumers, especially younger generations. These are commanding more investment in media plans and should not be underestimated.

An interesting Kantar case study showcasing the power of a new video avenues comes from a CPG brand. The brand planned a video campaign with over-the-top TV service Tubi, where they wanted to improve the awareness of their snack product. The campaign was highly memorable, indicated by a 40% higher lift in ad awareness than the category norm. Exposure to the Tubi campaign also led to improved brand awareness, favourability, and intent to purchase.

Audio and print also progress in digital blend

Audio is another category that has evolved into a hybrid media channel, where online and offline advertising blend. Radio stations can be streamed, and businesses like Spotify offer functionally equivalent alternatives. In this climate, marketers’ trust in radio has remained strong and increased since last year globally.Among consumers, too, audio brands are nothing to scoff at. Japan’s digital radio aggregator platform Radiko, New Zealand’s Coast FM, and Greece’s Diesi Radio were the most popular ad enviroments in their respective market, according to Media Reactions. Podcasts are another advertising medium that boasts strong ad equity. Spotify, which provides both music streaming and podcasts, is among the top 5 of both consumers and marketers’ ad preference rankings, and the fourth most trusted platform by marketers globally. Digital streaming and podcasting-related services are increasingly essential aspects of media strategies, and audio can clearly hold its own in a fight against the ever-popular video.

Print consumption, on the other hand, has heavily moved to digital formats, and digital counterparts of physical print platforms are an equally acceptable way to consume print. Magazine and newspaper ads are at the bottom of marketers’ receptivity globally, and assumed to be the least attention-grabbing channels by them. This might stem from considering these channels “outdated,” without reflection on their digital evolution. Newspapers and magazines, in fact, are among the most trustworthy ad platforms by consumers, seen as providing high-quality and relevant ads. fd. is a daily newspaper from the Netherlands and it is the leading ad equity brand in the market, demonstrating how these media channels can still deliver for brands.

Sponsored events: Where the consumers’ and marketers’ preference intersect

Sponsored events are the most preferred channel by consumers to connect with brands. Pandemic brought a virtual element to gatherings, which also influenced how brands reach their audiences. MasterCard is one of the great examples of a brand using sponsorship marketing, supporting many sports, arts, entertainment, and culture events across the globe. Their partnerships with League of Legends esports championship, and World Rugy Cup are two examples of this.Apple is another brand that has embraced the hybrid concept, combining both in-person and virtual connections. They held their Worldwide Developers Conference (WWDC) online for the first time in 2020 due to the pandemic, and transformed the format into hybrid since 2022, where the entire conference is available online for all developers, with also a special in-person experience at their venue.

The world now sits at the intersection of physical and virtual

Hybrid events, new online forms of video and audio consumption, and move from paper to web pages are just a few examples to highlight that the modern world now sits at the intersection of physical and virtual. While consumers have embraced the duality of experiences in their media consumption, marketers might be missing a trick, overlooking the fact that what’s been traditionally offline is also evolving. According to GroupM data, while the internet constitutes 69% of global ad revenue, 16% of TV and 40% of newspaper ad revenues, among others, are coming from digital forms of these channels. So, the keyword for the industry is balance.Considering these intrinsically interconnected platforms together while making marketing plans is essential. A well-integrated campaign works more effectively, and silos never help. So it’s vital to ensure that effectiveness measurement is looked at holistically too.

Ad preference is an important factor in media channel planning, as campaigns are seven times more impactful among more receptive audiences.

Reach out to us to learn more about different markets and winning brands, and how Kantar’s media experts can help your brand’s marketing strategy and media effectiveness measurement.

Get in touch to find out more