In the whirlwind world of ever-evolving media channels — where even your fingernails can now host QR codes — it’s easy to feel like you’re always on the hunt for the next big thing. What is popular with consumers? What platforms do competitors use? What works?

Every year, Kantar dives into the complexities of the media landscape through our Media Reactions study, exploring the ad preferences of both consumers and marketers. Around the globe habits and preferences vary widely — from tech-savvy consumers who quickly embrace innovative technologies and digital platforms to those who prioritise privacy, transparency and ethical practices.

Our new Media Reactions 2025 project is in full swing, but before this year’s launch on 23 September, let’s look back at last year’s results and the variations observed across different regions.

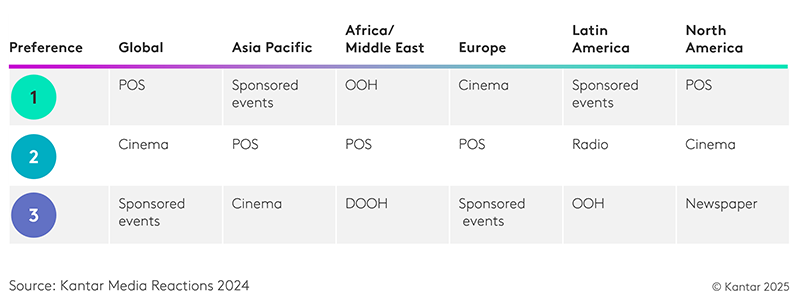

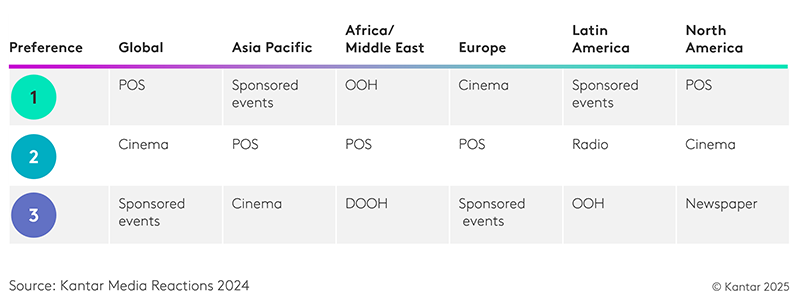

Consumers’ most preferred media channels by region

Globally and in North America, POS (point of sale) ads topped the ad preference rankings in 2024. Seen as relevant and useful, they help consumers through their purchase journey and are a great indicator that the brand is present. They were also seen as trustworthy and attention-grabbing by US consumers. Cinema and newspaper ads were also well-received, both seen as relevant and entertaining.

POS ads did not top the rankings in any other region but were still strong across the globe. However, in Latin America (Latam) the picture was different. Sponsored events engaged audiences with their innovativeness and trustworthy feel. Sponsored events can be culturally relevant and help bring communities together via immersive experiences, which resonates well with Latin American consumers. Radio also stood out as a preferred channel here, considered relevant and useful, while outdoor (OOH) ads were the most attention-grabbing channel in this region.

OOH also came out strong in Africa & Middle East—both posters and digital formats. These channels were considered innovative and captivating, with digital OOH being seen as particularly high quality in this region.

European and Asia Pacific (APAC) consumers were the most similar in terms of channels they welcomed advertising on. Their top three consisted of sponsored events, POS, and cinema ads, with sponsored events leading in APAC as trustworthy and innovative advertising, and cinema ads leading in Europe as high quality, entertaining and attention-grabbing.

Although native online channels did not show up in the top rankings in any regions, some were still growing and outperforming others. Globally, consumers’ most preferred online ads were podcast ads, as well as leading in both North America and APAC, where they were considered high quality. In North America, podcasts were also regarded as the most trusted and relevant online channel, while in APAC they were seen as the most innovative. They also ranked highly in Europe and Latam, where they were perceived as trustworthy and innovative. Additionally, Europeans rated them highest for entertainment value.

Ecommerce ads topped the online rankings in Latin America and Africa & Middle East and were considered to offer the most relevant and useful content in most regions. Globally, ecommerce ads were viewed as attention-grabbing, and in North America they were recognised as the most innovative channel.

In Europe, the most preferred online channel was influencer content. Influencer ads were ranked highest globally for being fun and entertaining and the most trusted. Europeans also perceived influencer content as the most relevant and useful to them.

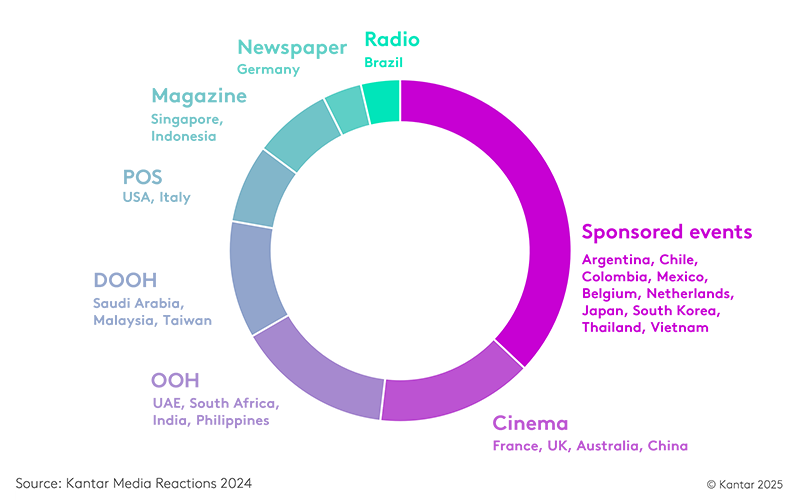

Consumers’ most preferred media channels by market

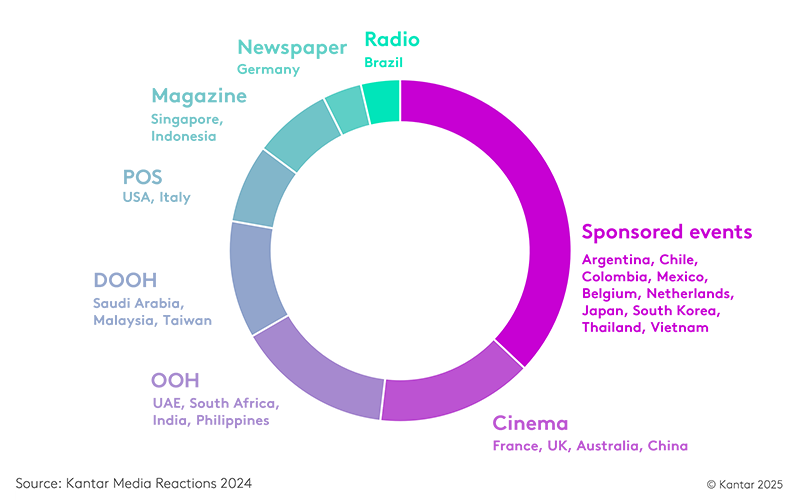

Diving into market level data, sponsored events topped the ad preference rankings in eight markets across APAC and Latam. In addition, Belgian and Dutch consumers ranked them highly due to their innovative and trustworthy nature. POS ads were number one in the US and Italy, while in Australia, China, France and the UK, cinema stood out as the winner. Looking at other channels, radio rose to the top in Brazil last year, newspapers were highly trusted in Germany, and magazines were considered high quality in Singapore and Indonesia.

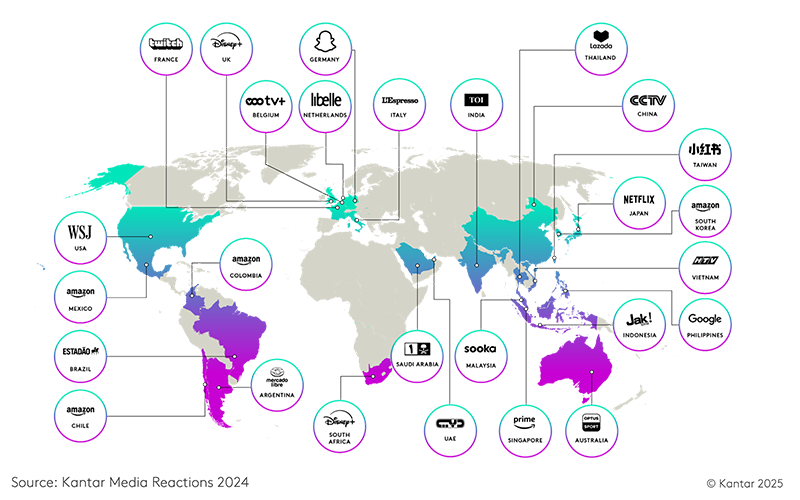

Most preferred ad platforms by market

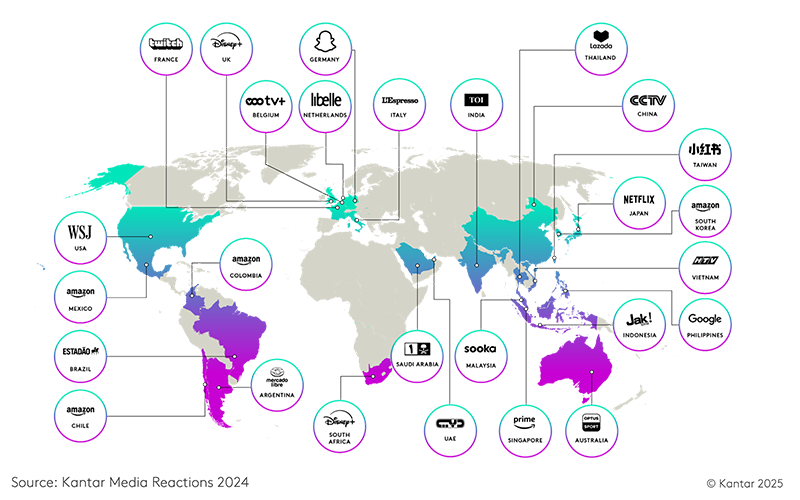

Further market-level insights highlighted the most preferred media brands across twenty-seven markets. Global brands like Amazon topped the rankings in Mexico, Colombia and Chile—bringing their wide-spanning network and high-tech infrastructure to the table. In France, Twitch diversified its content to engage a young and growing audience, while Snapchat was the media brand of choice in Germany, its ads considered of high quality and trustworthy. Disney+ was popular in South Africa and the UK where it thrived supported by strong content partnerships, rapid subscriber growth, and high viewer satisfaction.

However, local platforms also proved powerful, topping the rankings in many markets. Regional ecommerce giant Mercado Libre was the top media brand in Argentina; the state-owned TV brand CCTV in China; and the weekly women’s magazine Libelle ranked highest in the Netherlands. Diverse cultures have different expectations and desires when it comes to advertising, and they all need to be considered carefully.

With a record number of 30 markets surveyed this year including new additions Poland, Canada, Turkiye, Hong Kong and more, and more media channels like social commerce and online print explored, the study will provide a better grasp of the global media landscape. This expansion also includes deeper analysis across a broader range of global media brands, including Disney+, Prime Video, Twitch, and Pinterest.

Understanding these regional preferences is crucial for marketers looking to optimise their media decisions in a locally relevant way to a diverse consumer base. To find out more through our fresh 2025 data, sign up here for this year’s Media Reactions webinar on 23 September 2025.

Click to learn more about our Media Effectiveness solutions or get in touch.

Every year, Kantar dives into the complexities of the media landscape through our Media Reactions study, exploring the ad preferences of both consumers and marketers. Around the globe habits and preferences vary widely — from tech-savvy consumers who quickly embrace innovative technologies and digital platforms to those who prioritise privacy, transparency and ethical practices.

Our new Media Reactions 2025 project is in full swing, but before this year’s launch on 23 September, let’s look back at last year’s results and the variations observed across different regions.

What media channels were most preferred in which regions?

Since Kantar Media Reactions launched in 2020, channels traditionally considered as offline have consistently topped consumer ad preference rankings across all regions. However, each region still has its own distinct flavour.Consumers’ most preferred media channels by region

Globally and in North America, POS (point of sale) ads topped the ad preference rankings in 2024. Seen as relevant and useful, they help consumers through their purchase journey and are a great indicator that the brand is present. They were also seen as trustworthy and attention-grabbing by US consumers. Cinema and newspaper ads were also well-received, both seen as relevant and entertaining.

POS ads did not top the rankings in any other region but were still strong across the globe. However, in Latin America (Latam) the picture was different. Sponsored events engaged audiences with their innovativeness and trustworthy feel. Sponsored events can be culturally relevant and help bring communities together via immersive experiences, which resonates well with Latin American consumers. Radio also stood out as a preferred channel here, considered relevant and useful, while outdoor (OOH) ads were the most attention-grabbing channel in this region.

OOH also came out strong in Africa & Middle East—both posters and digital formats. These channels were considered innovative and captivating, with digital OOH being seen as particularly high quality in this region.

European and Asia Pacific (APAC) consumers were the most similar in terms of channels they welcomed advertising on. Their top three consisted of sponsored events, POS, and cinema ads, with sponsored events leading in APAC as trustworthy and innovative advertising, and cinema ads leading in Europe as high quality, entertaining and attention-grabbing.

What about online media channels?

Although native online channels did not show up in the top rankings in any regions, some were still growing and outperforming others. Globally, consumers’ most preferred online ads were podcast ads, as well as leading in both North America and APAC, where they were considered high quality. In North America, podcasts were also regarded as the most trusted and relevant online channel, while in APAC they were seen as the most innovative. They also ranked highly in Europe and Latam, where they were perceived as trustworthy and innovative. Additionally, Europeans rated them highest for entertainment value.

Ecommerce ads topped the online rankings in Latin America and Africa & Middle East and were considered to offer the most relevant and useful content in most regions. Globally, ecommerce ads were viewed as attention-grabbing, and in North America they were recognised as the most innovative channel.

In Europe, the most preferred online channel was influencer content. Influencer ads were ranked highest globally for being fun and entertaining and the most trusted. Europeans also perceived influencer content as the most relevant and useful to them.

Consumers’ most preferred media channels by market

Diving into market level data, sponsored events topped the ad preference rankings in eight markets across APAC and Latam. In addition, Belgian and Dutch consumers ranked them highly due to their innovative and trustworthy nature. POS ads were number one in the US and Italy, while in Australia, China, France and the UK, cinema stood out as the winner. Looking at other channels, radio rose to the top in Brazil last year, newspapers were highly trusted in Germany, and magazines were considered high quality in Singapore and Indonesia.

Most preferred ad platforms by market

Further market-level insights highlighted the most preferred media brands across twenty-seven markets. Global brands like Amazon topped the rankings in Mexico, Colombia and Chile—bringing their wide-spanning network and high-tech infrastructure to the table. In France, Twitch diversified its content to engage a young and growing audience, while Snapchat was the media brand of choice in Germany, its ads considered of high quality and trustworthy. Disney+ was popular in South Africa and the UK where it thrived supported by strong content partnerships, rapid subscriber growth, and high viewer satisfaction.

However, local platforms also proved powerful, topping the rankings in many markets. Regional ecommerce giant Mercado Libre was the top media brand in Argentina; the state-owned TV brand CCTV in China; and the weekly women’s magazine Libelle ranked highest in the Netherlands. Diverse cultures have different expectations and desires when it comes to advertising, and they all need to be considered carefully.

What’s next?

As we await the results of Media Reactions 2025, we can reflect on the patterns observed so far - what has happened until now and where each region may be heading. Will POS, cinema, and sponsored events continue to be the most globally preferred ad platforms, or will outdoor ads gain more traction in other regions? When will native online channels become among the most preferred by consumers? Will influencers continue to gain trust, or will the rise in shopping directly through apps trigger a boom in ecommerce ads across all regions?With a record number of 30 markets surveyed this year including new additions Poland, Canada, Turkiye, Hong Kong and more, and more media channels like social commerce and online print explored, the study will provide a better grasp of the global media landscape. This expansion also includes deeper analysis across a broader range of global media brands, including Disney+, Prime Video, Twitch, and Pinterest.

Understanding these regional preferences is crucial for marketers looking to optimise their media decisions in a locally relevant way to a diverse consumer base. To find out more through our fresh 2025 data, sign up here for this year’s Media Reactions webinar on 23 September 2025.

Click to learn more about our Media Effectiveness solutions or get in touch.