Portugal is already at the high alert and control phase of the pandemic, but even before the height of the crisis caused by COVID-19, Portuguese consumers’ shopping pattern had already started shifting.

In the first two months of 2020, before the virus had arrived in Portugal, we could see a difference in the way Portuguese consumers were shopping. They were buying more per trip with an increase in spend of 11% per occasion and shopping less frequently with one less shopping trip than in 2019. This was a completely different pattern from 2019, when shoppers went to stores more than they had in several years.

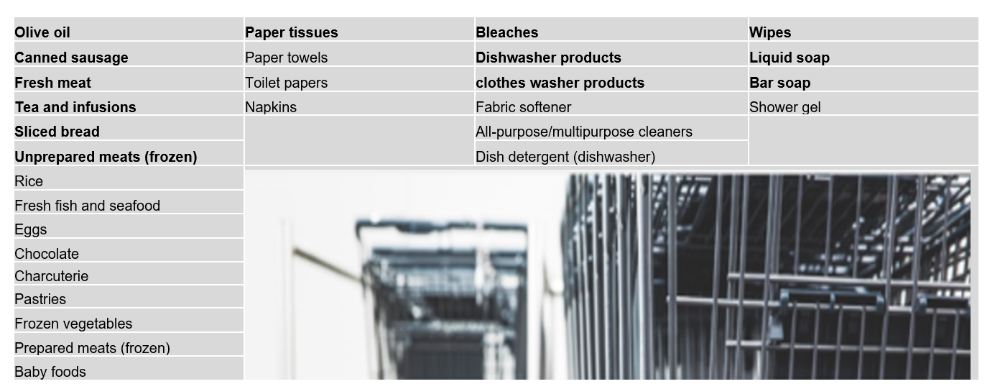

In this shift towards stocking up, it was the food and beverage categories that initially emerged as the top priorities for the Portuguese (+10%), but were quickly followed by home care products (+7%) and paper products, such as tissues, toilet paper and paper towels (+8%), in a clear response to the virus’s possible quick arrival to Portugal. In the food sector, in addition to the noticeable preference for convenience products such as canned and frozen foods, the Portuguese shopper also prioritised essential fast-moving categories at the point of purchase, such as fish, meat, and eggs.

In personal care, although there was a growth of +3% there were some important changes in the items chosen. Products not regarded as a priority such as body moisturiser, hair conditioner and hair-styling products, were replaced by soaps, both liquid and bars, shower gel and wipes, all key products for personal hygiene.

At this point, the online channel also started gaining importance for those looking to stock-up and in February recorded the highest spending per transaction in the past 12 months. In direct comparison to the month of January 2020, Portuguese shoppers started spending +19% more per basket, on average, and also increased the number of categories purchased, from 10 to 13.

Over the next few weeks – or maybe months – there will be many uncertainties before a new “normal” is been reached. At this point the reaction of all players, brands, and retailers will have to be swift and responsive to people’s changing needs.