Complexity and uncertainty have been constants within Asia’s FMCG landscape over the last couple of years. The brands that have thrived are those that made a strategic decision to embrace these conditions as opportunities for growth.

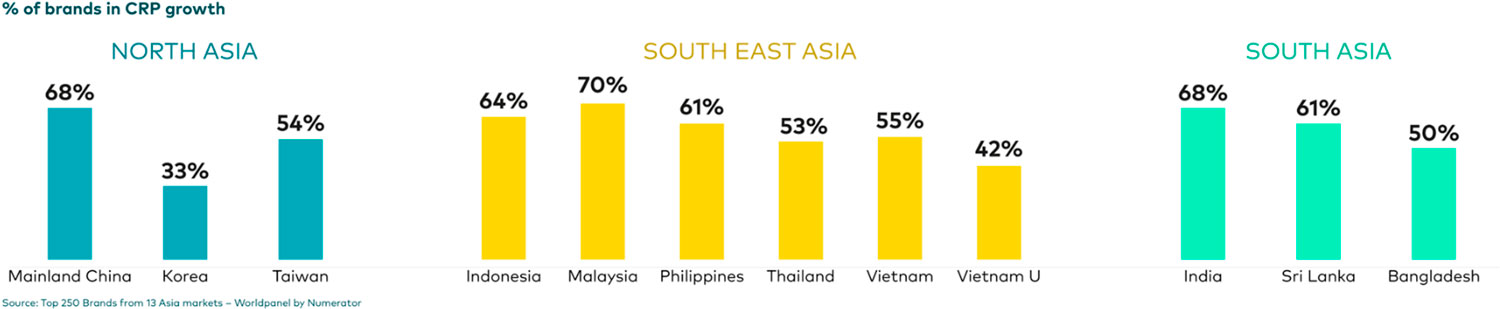

The most-chosen FMCG brands in Asia have outperformed their peers in the majority of regions around the world, for the second year in a row. According to Worldpanel’s new Brand Footprint Asia report, 56% of brands managed to increase their Consumer Reach Points (CRPs) in both 2023 and 2024. This beats the global average, which has remained at around 50% since the launch of Brand Footprint in 2012.

At the top of the Asian ranking in 2025 sit two Indian food giants: Parle, with a 7.8% increase in CRPs, followed by Britannia, with a rise of 3.8%. Rounding out the Top 5 are Omo (pan-Asia), Clinic Plus (pan-Asia), and Tata (India).

Different markets, diverse paths

The last year has been characterised by resilience, swift change, and renewed optimism across Asia’s markets.

In North Asia – covering Mainland China, Taiwan, and South Korea – the FMCG brands that have flourished excel at rapidly and continually adapting to consumers’ evolving needs. Brands entering this market should target Chinese shoppers as a priority, while keeping in mind that local brands have an extremely strong presence there.

In Southeast Asia – encompassing Indonesia, the Philippines, Malaysia, Thailand, and Vietnam – brands achieved growth by reliably delivering value and consumer-centric innovation. Competing in this market offers promising opportunities, but can bring more challenges than others.

Across South Asia – India, Sri Lanka, and Bangladesh – the most successful brands were those that mirrored shoppers’ resilience and agility, expanding and innovating with purpose despite ongoing volatility. Here, winning in India will definitely help a brand to conquer Asia as a whole.

The nuances in brand performance between these three markets emphasise the importance of building a deep understanding of shoppers’ motivations, uncovering the factors behind their brand choices, and creating tailored local strategies.

The power of penetration

There is one truth that remains consistent not only across markets within Asia, but across the world: the brands which realise the strongest growth are those that attract the highest number of new buyers.

Globally, on average around 80% of brands that expand their footprint do so by increasing penetration. In Asia, this figure is almost 88% – and in China it rises to 100%. The rule remains true whatever a brand’s size.

In a nutshell, making a lasting impact on Asia’s FMCG landscape has nothing to do with luck. It requires brands to define a strategy that is focused on growing CRPs chiefly through shopper recruitment.

Read the full Brand Footprint Asia 2025 report to discover the shifting patterns of consumer behaviour, the three key levers for expanding penetration, and fresh ideas from the regional powerhouses that are dominating the rankings.