Bakeries and sandwich shops lead growth through menu expansion

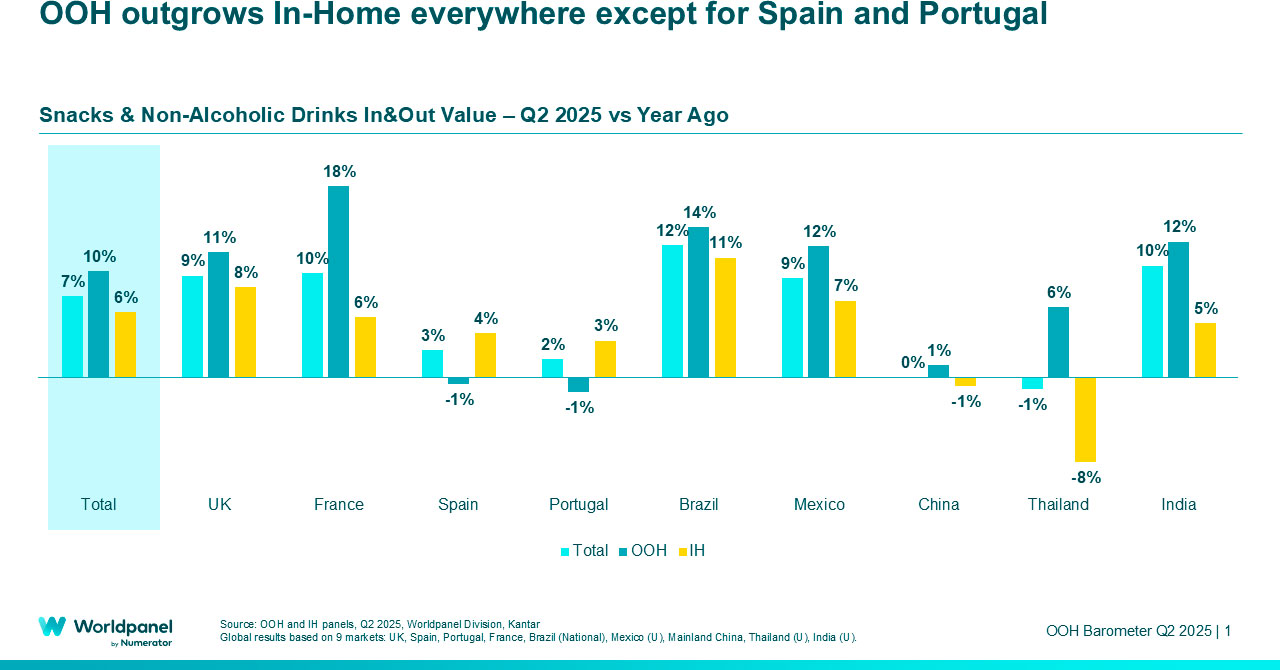

Total spend on snacks and non-alcoholic drinks to consume in and out-of-home (OOH) continues to climb globally, rising 7% in Q2 of 2025. Also sustaining a trend from previous quarters, OOH spend is outgrowing in-home in almost every market.

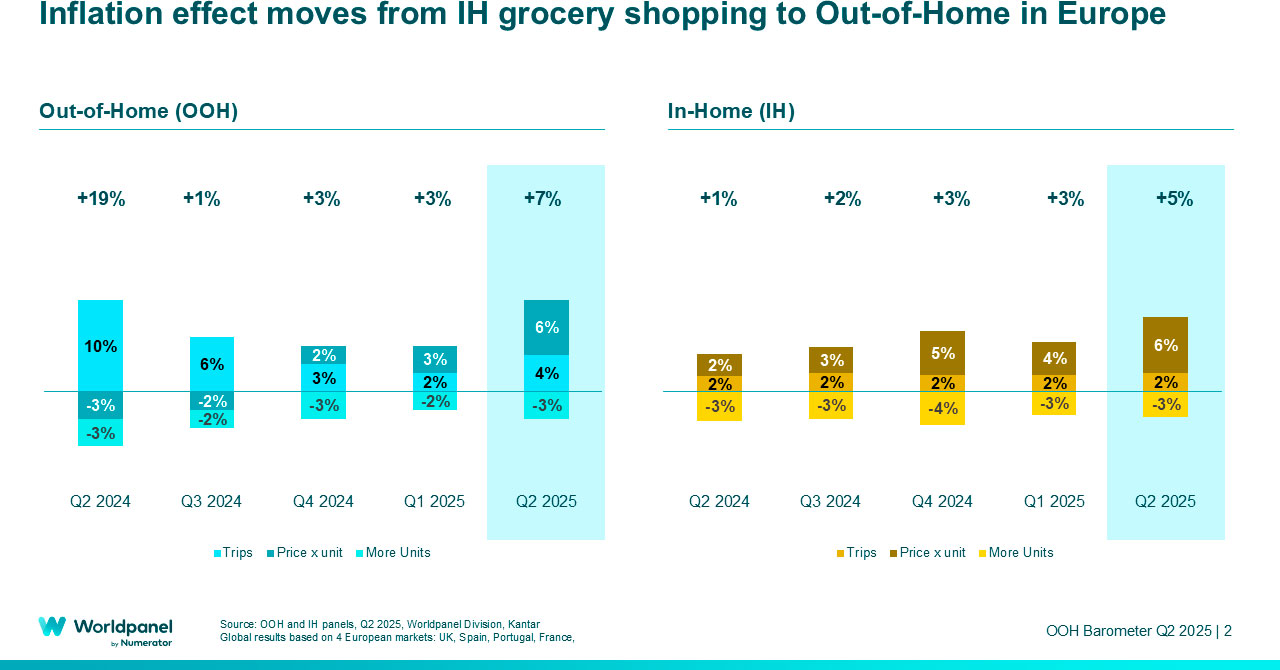

However, if we home in on the source of this OOH growth we see a major shift. For the first time, the biggest contributor is rising prices – not an increase in the number of trips, which had been the driver in recent quarters.

This change has had an impact on channel choices, as well as an evolution in retailers’ offerings, and the emergence of ice cream as the strongest category.

Globally, OOH value growth reached 10% in Q2, according to Worldpanel By Numerator’s latest OOH Barometer, compared with 6% for in-home. OOH expanded faster in every market except for Spain and Portugal, achieving double-digit growth in many.

The proportion of snacks and drinks spend contributed by OOH sales is also still growing – now accounting for 40% of total value globally, 1% higher than a year ago. This cements the critical importance of OOH to overall spend in these categories, especially in India where the contribution is 72%.

Freshly prepared meals and snacking food led growth in Q2, with spend on meals for immediate consumption increasing four times faster for OOH sales than in-home.

The inflation effect

Price rises have been the main catalyst for value growth in the take-home grocery sector for several years. This trend has now shifted to the OOH snacks and drinks market: price per unit has risen 6% quarter-on-quarter, making it the biggest contributor to the increase in spend.

Inflation is leading consumers to make smaller trips across all regions, with a 3% drop in the number of units bought.

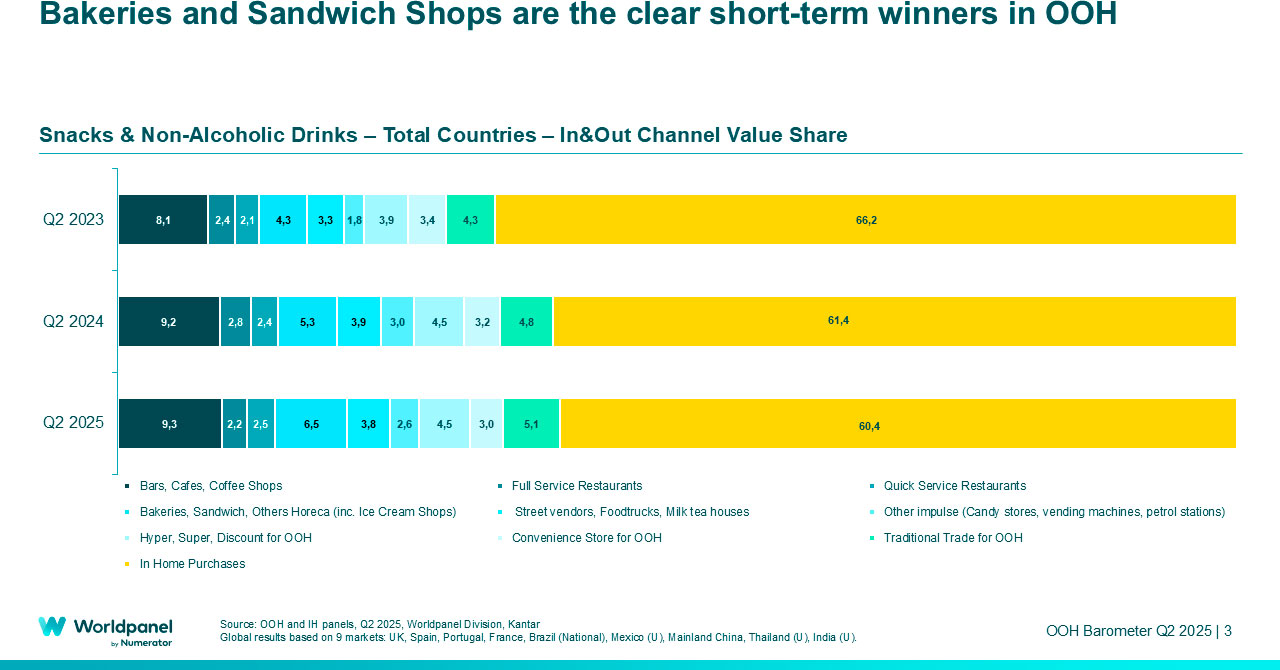

Ever-changing channel choices

While the channel structure for in-home snacks and drinks has remained the same, the OOH landscape seems to be experiencing at least a temporary transformation.

This latest quarter, the biggest penetration gains have been achieved by bakeries and sandwich shops, which have grown their share of spend from 5.3% to 6.5% year-on-year.

A decrease in importance of Horeca and impulse channels had opened up opportunities for modern trade channels to increase value from OOH snacks and drinks. In fact, OOH was their biggest growth lever for several consecutive quarters. However, momentum has now stalled – with spending growth shrinking from 9.3% in the second quarter of 2024 to 4.6% one year later.

Expanding the menu

The success of bakeries and sandwich shops is a consequence of a savvy change in strategy. Many outlets are broadening their menus with a more diverse and complete offering.

This is a response to the inflation effect, combined with an increase in impulse occasions as consumers continue to return to the office. By introducing freshly prepared meals for immediate consumption, for example, retailers can take advantage of the need for affordable, convenient options.

Among the brands that have expanded their repertoire is Greggs in the UK, which has added breakfast goods, sweet treats and freshly prepared hot meals to its traditional sandwich-based offering. France’s Ange, meanwhile, has built on its bread and boulangerie core menu with the addition of sandwiches and meals. OOH brands are also expanding into in-home occasions – for instance Greggs is selling cook-at-home versions of its products in Tesco.

There are new QSR (quick service restaurant) propositions emerging, too. H3 in Portugal has launched a concept – dubbed Not So Fast Food, True Food – offering premium burgers at a lower price point.

Not every channel is leveraging the increase in impulse occasions by enhancing their OOH offer, however: hypermarkets and supermarkets have yet to do so.

Of those channels that are pursuing this approach – including QSR, bakeries, sandwich shops, and impulse outlets – many are unlocking growth by adding ice cream to their menus.

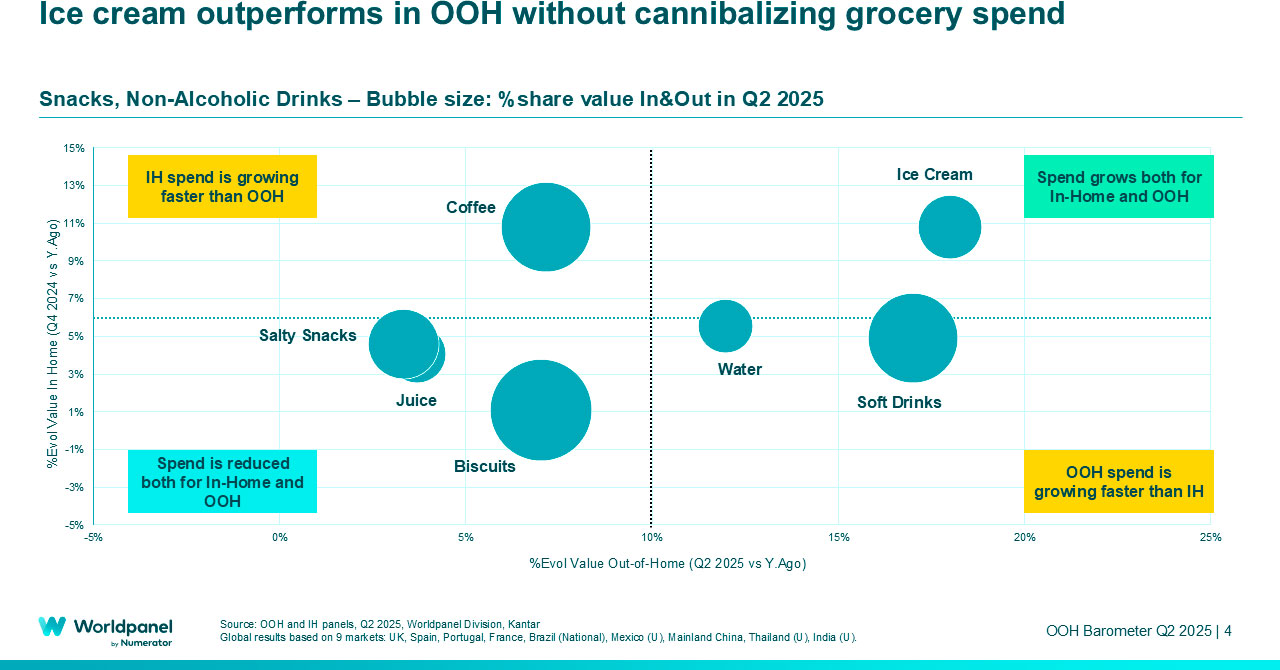

Ice cream is the hottest category

Ice cream was the highest performing category in Q2, growing its share of OOH value from 58% to 59% year on year. And this growth was achieved without cannibalising grocery spend: value is increasing across both OOH and in-home consumption.

This premium category is showing remarkable growth across Europe, but especially in the UK. Here, OOH value share has risen from 19% to 33% year-on-year due to the opening of a high number of ice cream and dessert shops, such as Creams and Kaspas. The proportion is highest in India, where 93% of spend comes from OOH sales.

Across other channels, share of spend in QSR has increased from 15.2% to 16.6%, and in bakeries, sandwich shops and other Horeca (including ice cream shops) from 15.2% to 16.6%.

Looking more widely at key OOH categories, spend on coffee is growing fastest in-home, while spend on water and soft drinks is accelerating fastest OOH. Spend on salty snacks, juice and biscuits has reduced both in-home and OOH.

Conclusion

OOH sales of snacks and non-alcoholic drinks for immediate consumption are essential for the health of the overall market, contributing 40% of its total value. Due to the higher price point, the more a product depends on OOH the more total spend will drop if sales decline.

The chief driver for increased OOH spend is no longer greater frequency, but price increases. This creates a potentially precarious situation: how sustainable is the current rate of growth?

The biggest penetration gains are being achieved by bakeries and sandwich shops, owing to the launch of more diverse menus, and QSR, with their new propositions. Their success appears to be negatively impacting hyper and supermarkets.

The exceptional growth of the ice cream category is evidence that growth is still possible, fuelled by the right proposition and distribution strategy. OOH brands and channels must identify new ways to capture new occasions, address consumers’ priorities, and understand different market structures.