Employment, health, safety, and environmental issues continue to top the list of concerns for Latin Americans, but a new worry is emerging: the potential impact of current US political and economic policies, according to Worldpanel’s latest Pressure Groups Latam study.

Top Concerns Across Latin America

The study identifies three main areas of concern among Latin Americans: financial issues (such as employment and income), social issues (such as health and quality of life) and environmental concerns.

Insecurity is a particularly strong concern in Ecuador, where 43% of the population identifies it as their top worry, as the country has been facing a prolonged social and economic crisis since 2021.

Within the environmental category, Peru tops the list, with 14% of its population citing environmental disasters as a source of distress. This is followed by Brazil (12%) and Argentina (11%).

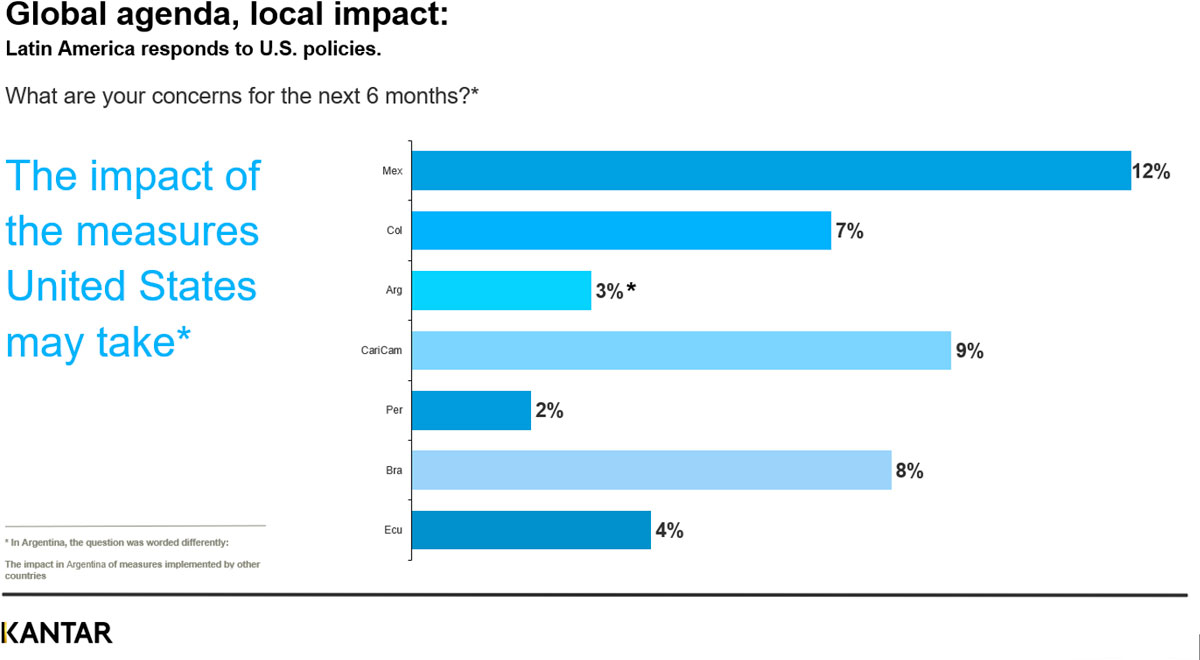

Regarding geopolitical tensions, Mexico tops the list, with 12% of the population expressing concern about US politics. The main reason is economic: Mexico is the world’s second-largest recipient of remittances. In 2023, Mexicans living in the United States sent $63.3 billion back home, equivalent to around 4.5% of the national GDP. Consequently, there are fears that a shift in immigration policies could reduce remittances and negatively impact the economy.

Central America follows, with 9% of the population expressing concern. Looking more closely at individual countries in the region, Panama stands out with the highest level of concern at 14%, even higher than Mexico. This is largely due to the United States’ influence over the Panama Canal, a strategically important waterway that links the Atlantic and Pacific Oceans.

Latin America’s financial divide: more are comfortable, but struggles persist

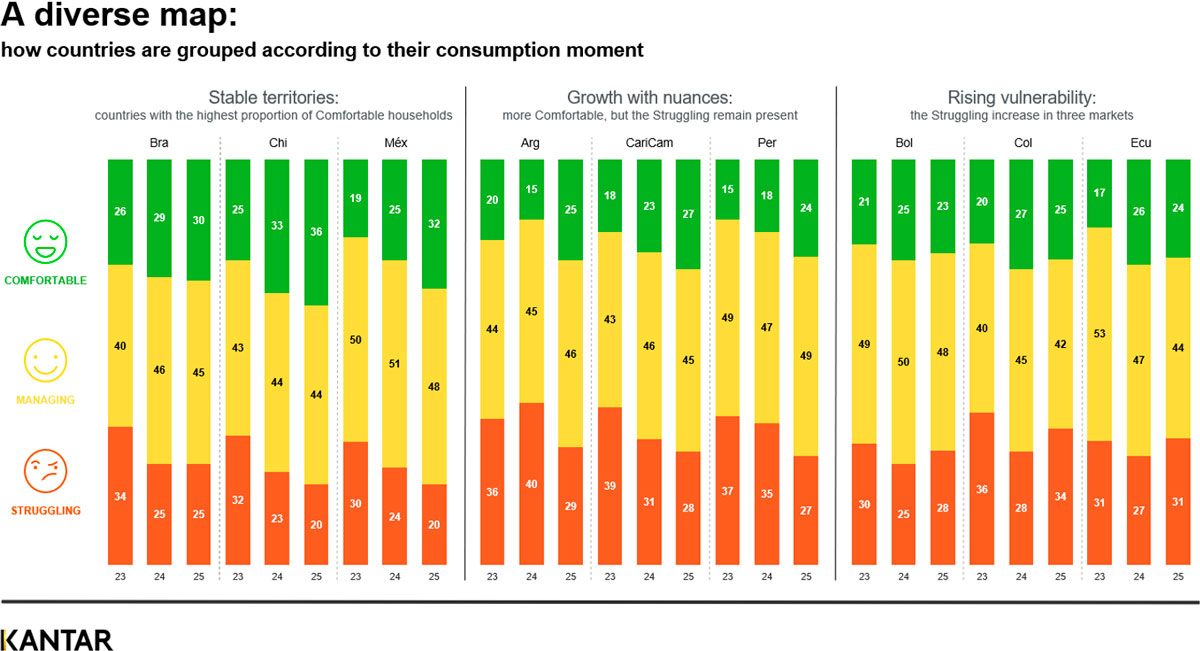

To better understand how Latin Americans navigate economic realities and make daily decisions, the Pressure Groups Latam study categorizes consumers into three financial profiles:

- Comfortable: Financially stable, able to afford most or all of what they want.

- Managing: Need to keep spending under control but are not under major financial pressure.

- Struggling: Living pay check to pay check, with income barely covering essentials, many don't make it to the end of the month with money left.

In 2025, there was a slight increase in the Comfortable segment, which now represents 27% of the Latin American population (up from 25% the previous year). Meanwhile, the Struggling group fell from 29% to 27%. The Managing group remains the largest, holding steady at 46%.

Looking at Latin America overall, the Comfortable and Struggling groups appear fairly balanced, but this varies by country. In Mexico, Chile, and Brazil, the Comfortable segment outnumbers the Struggling. Mexico showed the greatest improvement, rising from 25% in 2024 to 32% in 2025, followed by Chile (from 33% to 36%). Brazil remained stable, inching up from 29% to 30%.

In contrast, although the Comfortable segment grew in Argentina, Central America, and Peru, the Struggling group still makes up the majority. In Bolivia, Colombia, and Ecuador, the most financially vulnerable group increased. For example, in Colombia, the percentage of Struggling consumers rose from 28% to 34%.

Want to learn more about what’s driving consumer behaviour in Latin America? Check out the full report and contact us.