In practice, Latin Americans mix channels, combine premium brands with affordable alternatives and better plan each visit to the point of sale. In a study carried out in Brazil, it was found that, between 2023 and 2025, the share of the budget allocated to mass consumption goods fell from 55% to 49%, while other sectors like Bets gained space, going from 7% to 12%.

This new profile of intentional consumer is the protagonist of four central trends that are redesigning the market in the region: the consolidation of omnichannel, the rise of channels focused on cheaper prices, more strategic brand management and the acceleration of digital purchases. Learn how each of these transformations is taking place.

Omnichannel is consolidated

In 2025, for the first time, the majority of Latin American households (52%) use seven or more shopping channels throughout the year, with Ecuador, Bolivia and Chile leading this expansion.

At the same time, consumers are visiting stores less often and leaving with fuller, more stocked carts. The average units per visit rose by 5.7% from 2023 to 2025. So-called supply missions — large, planned purchases — already account for 38% of total spending, up 1.5 percentage points.

Expanding channels consolidate as part of the buying journey

Instead of focusing solely on low prices, the Latin American intentional shopper seeks the best balance between brands and channels to maximize value. As a result, wholesalers and discount stores are experiencing the greatest growth in both share and volume.

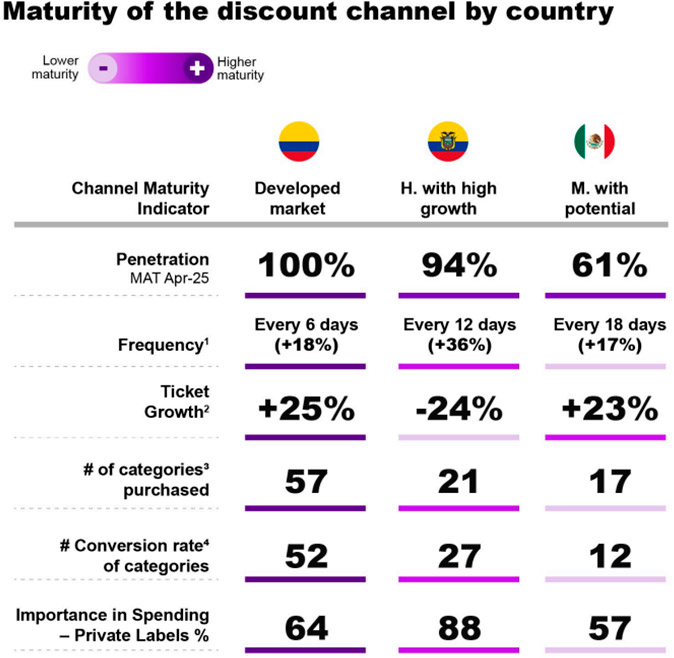

In Colombia, for example, discount stores reached 100% of the population, with more than 60 annual visits per household and 57 categories purchased. In Brazil, meanwhile, 88% of households visit wholesalers, which account for 21% of spending on mass consumption goods. This channel, which is growing rapidly in Ecuador and expanding rapidly in Mexico, is also consolidated among the upper classes, with an average of 35 categories purchased per family.

Private and premium brands grow together

The regional consumer does not limit himself to choosing the cheapest product. It seeks to maximize resources by balancing brands. Between 2024 and 2025, economic and private label options grew 0.4 percentage points each in value share, while premium options advanced 1.4 percentage points, reaching a 21% weight in the shopping baskets.

The average number of brands purchased also increased: from 87 in 2023 to 89 in 2025. In this context, consumers are carrying more units of premium (+3), economy (+2) and private brands (+7), while reducing the consumption of mainstream options (-7).

Smaller sizes are predominant among premium (46%) and private (34%) brands, while larger packages weight moret among budget options (42%).

Countries such as Argentina, Peru and Brazil lead the growth of premium brands. On the other hand, Ecuador, Mexico and Colombia stand out for the advance of private labels, with Colombia being the most developed market in this segment, with a 27% local share.

Digital accelerates

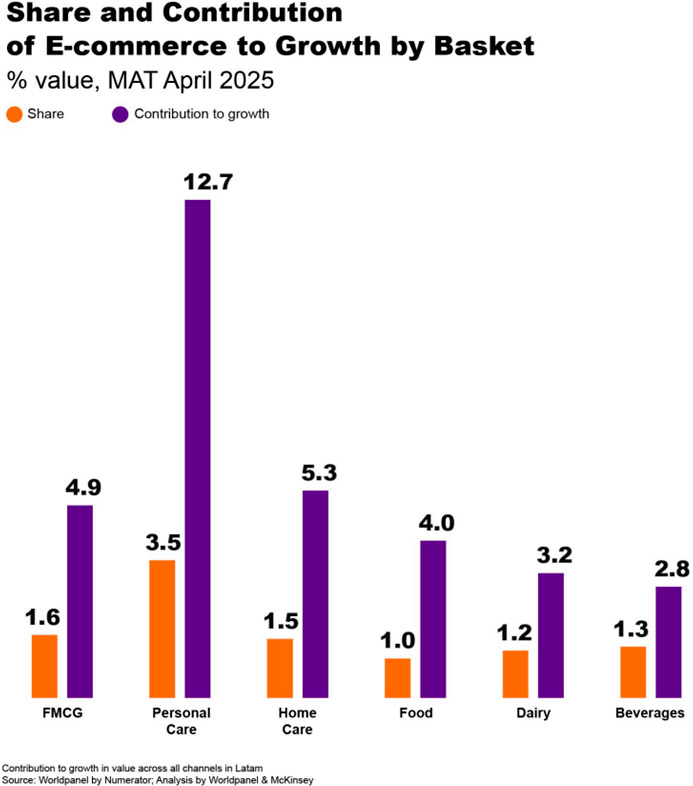

E-commerce of consumer goods in Latin America is growing at a rate five times faster than physical retail. Between 2024 and 2025, digital purchases increased by 60%, compared to 13% growth in physical stores. In almost every country in the region, more than a third of the population already makes online purchases at least once a year.

The so-called non-pure e-commerce – purchases made on applications or retailer sites that also operate brick and mortar stores – leads the digital channel, with a 52.7% share. WhatsApp appears in second place, with 19.8%.

The most purchased categories online are beauty and home care, which shows that the digital channel still has room to grow in more traditional segments.

Latin American consumers are becoming more intentional in their shopping, carefully balancing premium and affordable brands across multiple channels to get the best value for their money. This shift emphasizes the importance of a strategic approach to channel mix and product offerings for brands and retailers to meet the demands of the evolving consumer. Stay ahead of the curve by adapting to the evolving shopper, read Beyond Omnichannel Grocery: Growth in the Age of Intentional Shoppers for key insights and strategies.