It’s half-time in 2025, the latest Asia Pulse report from Worldpanel by Numerator reveals a tale of three regions united under an umbrella of steady to strong growth.

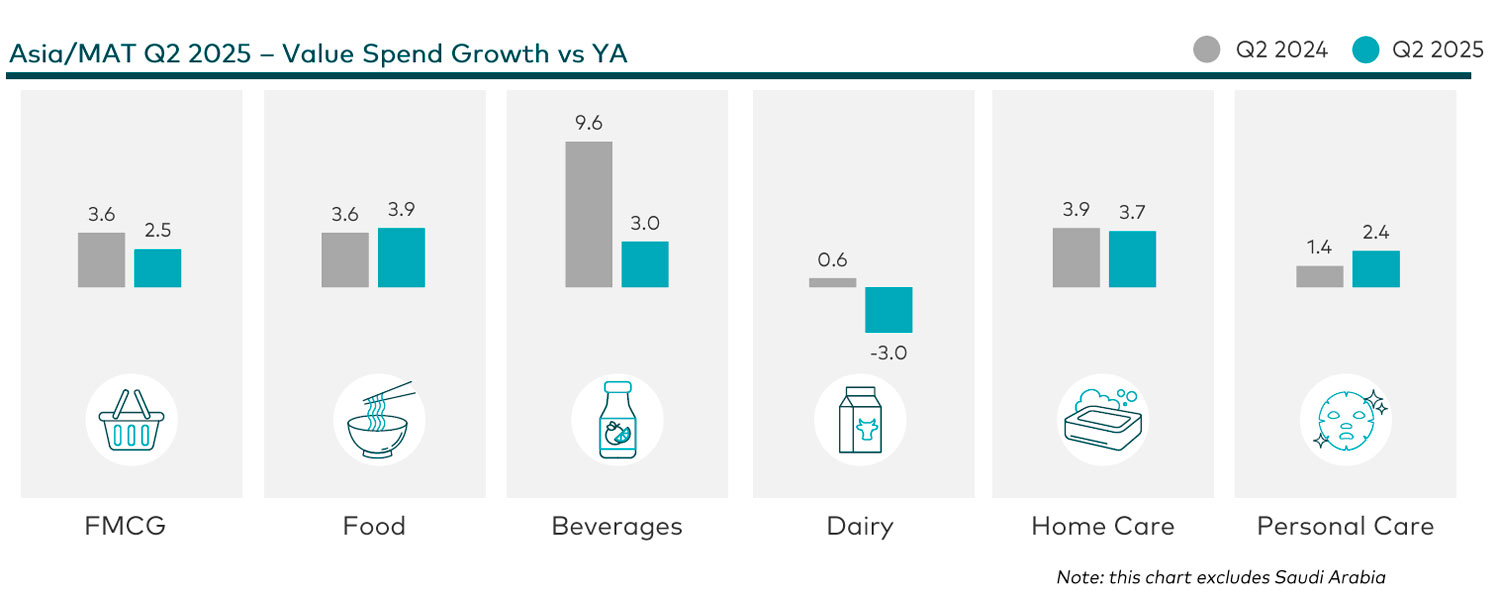

Despite everything that’s going on in the world economy, Asia’s FMCG sector showed resilience in early 2025, posting 2.5% value growth in the second quarter.

The big winners were in South and West Asia, where growth hit 8.3% thanks to a strong performance in India. Southeast Asia also performed well at 3.2% and North Asia was in credit, although 1.6% growth is slow by recent standards.

At a sector level, food and beverages showed stronger growth with the former up 3.9% and the latter improving by 3.0%, while home care (3.7%) outpaced personal care (2.4%).

North Asia: Even the hotspots are slowing

The biggest market in North Asia, Mainland China, saw soft growth in the first half of 2025, with the lower-tier cities, especially town and county-level markets, functioning as key growth engines.

A similar story played out in South Korea, where growth of 3.8% represents a dramatic slowdown from the double-digit expansion seen a year ago. Inflation takes the blame as the economic downturn forces consumers to tighten their spending and reduce frequency.

Even Taiwan saw momentum easing. FMCG value may have expanded by 7.8% in Q2, but this is down from 8.8% in Q1, and full-year growth is likely to normalise between +0% and 5%.

Southeast Asia: Performance softens

Across this sub-region, one fact is true: FMCG is growing at a slower pace than last year, with volumes down as shoppers find ways to cope with price increases.

In Indonesia, for example, beverages and dairy led the volume decline, while home care volumes shrank as shoppers reprioritised, downtrading toward cheaper options in categories such as baby care, for example.

The same trend was seen in Malaysia, where despite inflation falling and ongoing festive promotions, FMCG spending remained limited. This suggests a more fundamental shift in shopper behaviour, with value-consciousness starting to outweigh the draw of promotional offers.

In Thailand, local factors such as the lack of strong government subsidy were also at play and resulted in a decline for in-home FMCG. Personal care has slowed down the most, after a strong two-year recovery driven by urban shoppers taking part in more OOH activities.

The long-term picture in the Philippines remains positive but again FMCG value sales are softening despite volume remaining steady across essential categories.

Defying the sub-regional picture, however, was Vietnam’s urban FMCG performance, which Recorded its strongest first-half growth in 15 years. Price increases – mainly in food, foodstuffs and electricity – contributed but volumes were in decline, particularly in beverages. The picture was more typical of the sub-region in rural areas, where value saw a sharp decline as consumers cut back.

South and West Asia: Growth powered by India

India’s strong headline performance hides a more cautious attitude among shoppers. Urban FMCG volume grew 4.6% in Q2, although this is a drop from the 5.5% growth recorded the previous year.

The biggest drop was seen in beverages. Having recorded 14% volume growth last year, the sector could only hit 2% this year. Performance was even weaker among bottled soft drinks, which went negative year on year.

Macro-economic factors may be prompting consumers to spend more cautiously, a shift in behaviour that can be seen particularly in discretionary categories such as milk drinks and coffee, where consumers are opting for smaller pack sizes.

Further West, the United Arab Emirates and Saudi Arabia both saw volume improvements due to population growth. Volume per buyer and basket size may be flat but there’s a huge opportunity in recruitment – making entry easy with accessible packs and price points.

Asia Pulse Q2 2025, curated by Worldpanel by Numerator household panel in 11 Asian markets, provides an in-depth look into evolving market trends across the region. For further insights and tailored analysis, feel free to reach out to us.