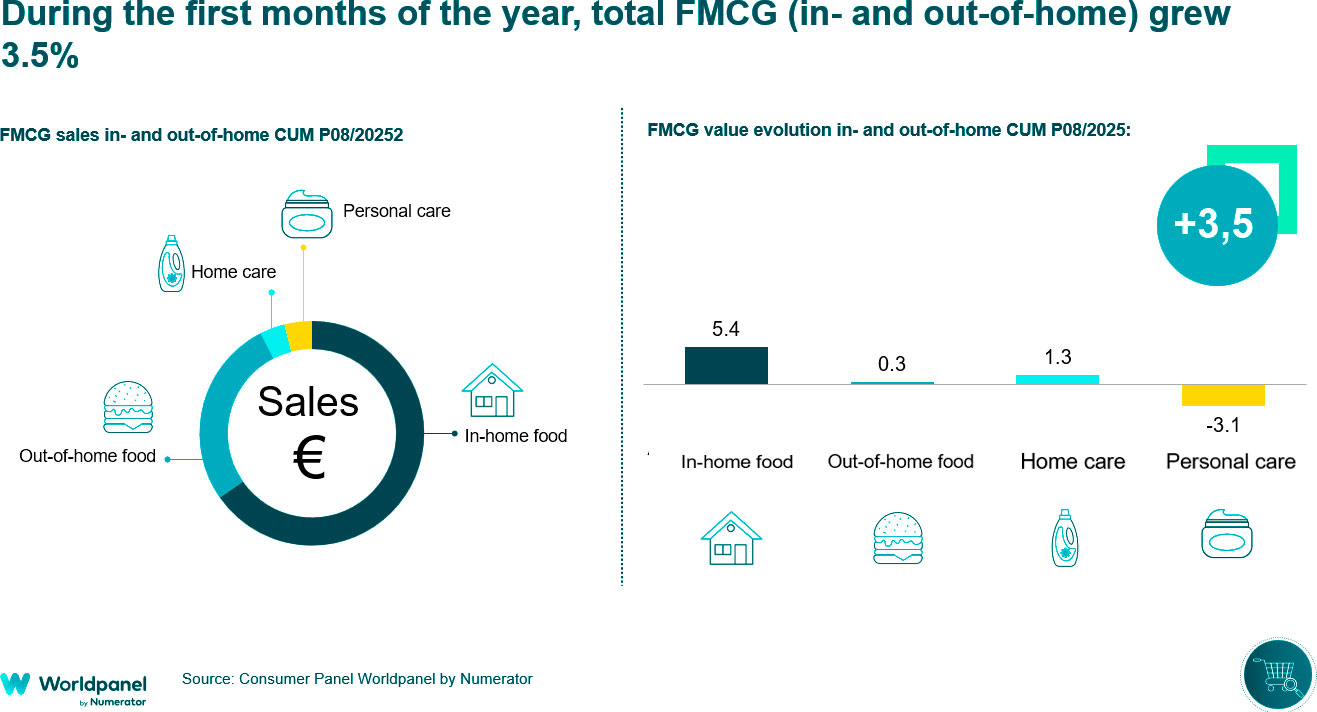

2025 confirms that the mass-consumption market has entered a phase of stability. However, consumers continue to keep strict control over their spending, which means they are still cautious when filling their shopping baskets, while private-label brands continue to gain ground. In this context, total spending on in- and out-of-home consumption has increased 3.5% through August, with in-home consumption performing better, up 4.4%.

During the period analysed, consumers are managing their shopping baskets more carefully, making more trips to stores but with smaller purchases. At the same time, they use different chains to cover their needs: in 13.6% of cases, they visit more than one retailer in the same day (excluding traditional trade), a behaviour encouraged by the sector’s growing concentration.

Private-label brands have grown by 1.7 percentage points so far this year, maintaining a pace similar to the previous year. Although they have shown some slowdown in recent periods, their market share already reaches 45.9% through August, driven mainly by limited-assortment chains.

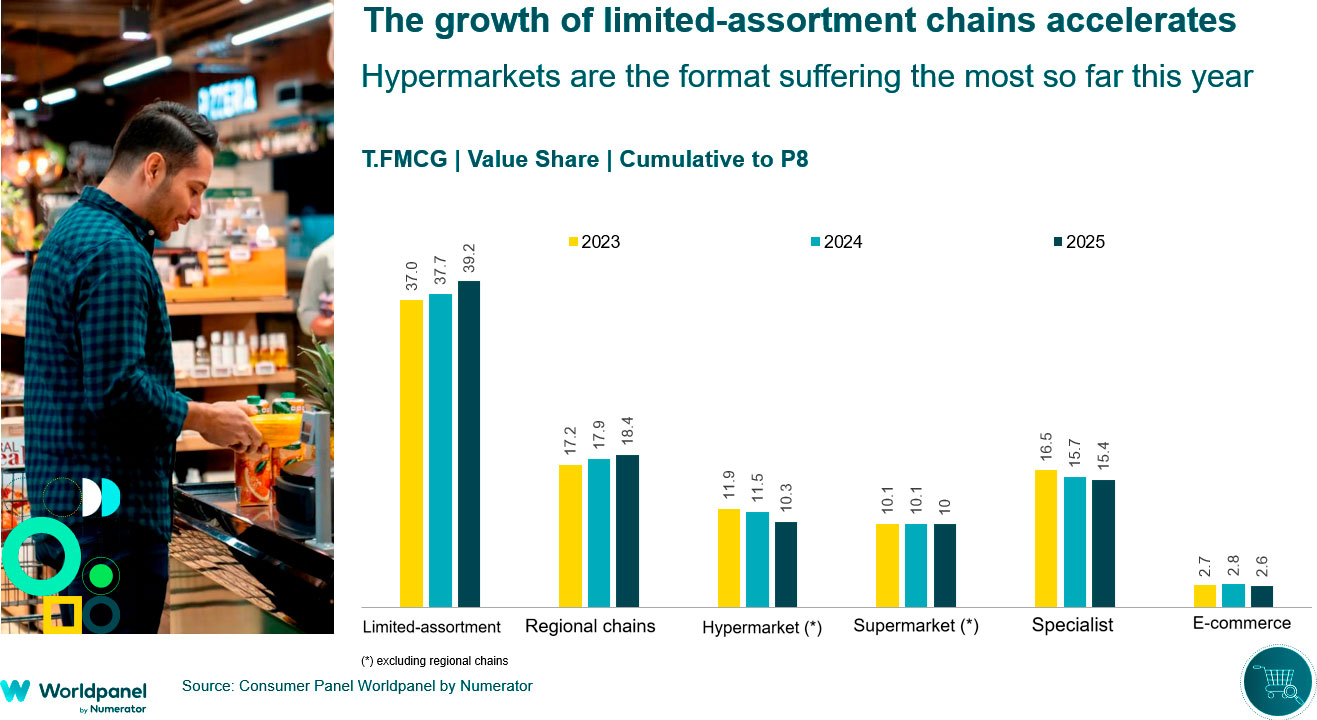

Limited-assortment and regional chains lead the growth

In line with what happened in 2024, limited-assortment and regional chains are the ones growing the most in 2025. The former are now close to a 40% share (+1.5 p.p. compared with the same period last year), while the latter stand at 18.4% (+0.5 p.p.).

By contrast, the hypermarket format has been the most affected, closing the first eight months of the year with a share just above 10% (-1.2 p.p.), while traditional trade remains around 15%, which means a continued decline, though at a slower pace than in previous years (-0.3 p.p.).

In general terms, limited-assortment chains have been the ones gaining the most share so far this year, especially in areas where they have a strong presence, while other banners have managed to grow thanks to attracting more shoppers or strengthening customer loyalty. However, hypermarket-related formats continue to struggle and have not managed to offset losses with other proximity formats.

In this context, organized retail faces an increasingly stable market with less growth coming from traditional trade, while consumers diversify their shopping choices more and more. One of the main avenues for growth lies in senior households without children, which represent more than half of the market still beyond the reach of modern retail. Another opportunity is to drive alternatives to out-of-home consumption, thereby expanding the scope of the market beyond traditional models.