Over the last decade, innovation in FMCG in Spain has changed dramatically. The flow of new products entering the market has been shrinking year after year. In 2010, the market saw 156 pure innovations launched. Today, that figure has fallen to 75 — a reduction of 48%.

Before looking at why this matters, it is important to clarify what we mean by innovation. In this analysis, innovation refers to any product launch that brings a new and relevant attribute to the category — beyond changes in size or format. To be considered successful, an innovation must prove two things: it must gain penetration within its category, and it must achieve repeat purchase. In other words, it must convince shoppers to try it — and to come back.

A market where private label advances as innovation slows

During the same period, private label has grown significantly. Since 2002, it has gained 26 percentage points of share and today explains 59% of the downtrading happening in the market. The data shows a clear correlation: as the number of innovations decreases, private label advances.

If the current pace is maintained, our projection indicates that private label could reach 52% share by 2035, while innovation would represent only 13% of the market’s value.

In a context where demand is stable and volume does not grow, innovation becomes a lever to activate value in the entire ecosystem — for manufacturers, retailers and shoppers.

What makes the Top 25 innovations different

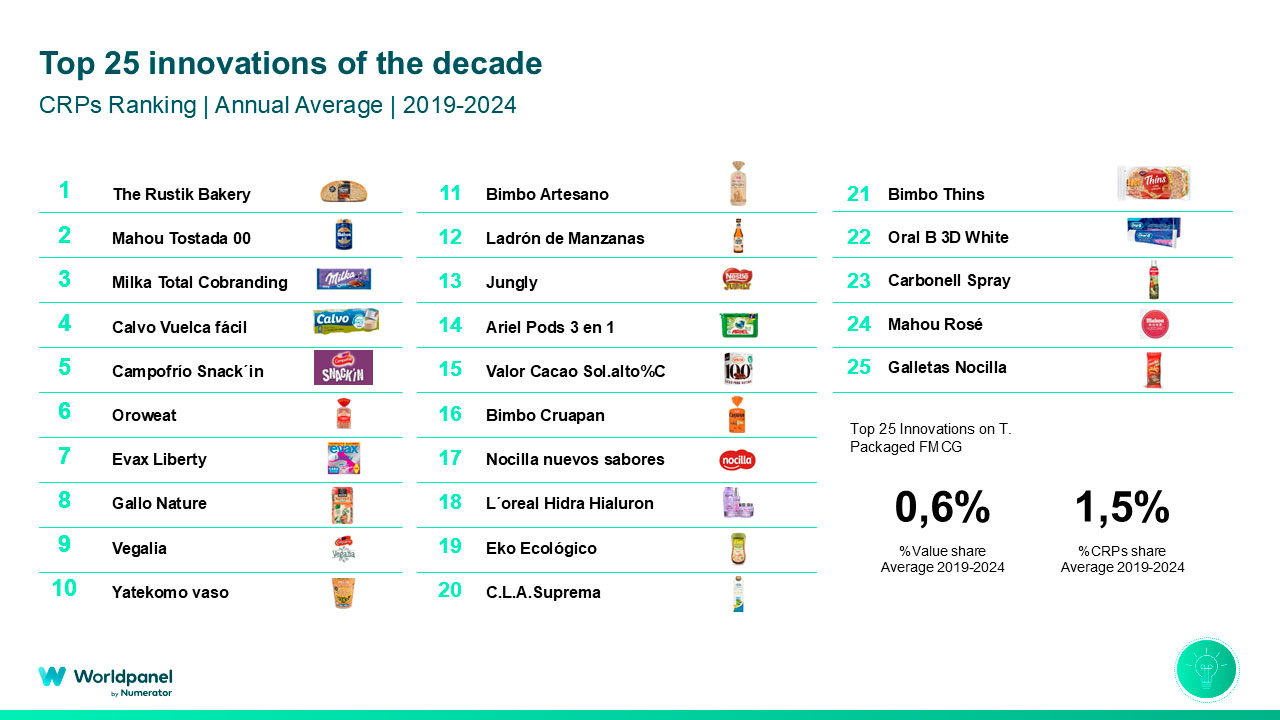

At Worldpanel by Numerator, we analysed the Top 25 most successful innovations launched in Spain over the last decade. Their collective impact is remarkable: in terms of purchase acts, these launches are comparable to established categories such as broth or fresh pasta, each representing around 1.5% of total FMCG transactions in a year. This means that a small number of well-designed launches can influence consumer behaviour at scale.

What links these successful launches is not their category, but the needs they address. They speak to three core motivations that currently drive shoppers: health, convenience and pleasure. Importantly, many of them combine more than one benefit. Within the Top 25, 44% of innovations deliver on two or more of these drivers, while within the broader Top 100, only 28% achieve this.

These products are not just “new”; consumers perceive them as relevant. They introduce elements that did not previously exist in the category, opening new consumption moments, reaching new targets or responding to unmet motivations.

Consumers reward innovation — and retailers help amplify it

Despite being new to the market, these successful innovations do not compete on price. They enter with a premium: on average, they are priced around 20% higher than the average branded price and almost twice the average price of their category on a €/kg basis. Consumers accept that premium because they perceive added value. Nearly 66% of the incremental business generated by innovation comes from this price difference, which means consumers are willing to pay more when the product brings something genuinely new to the category.

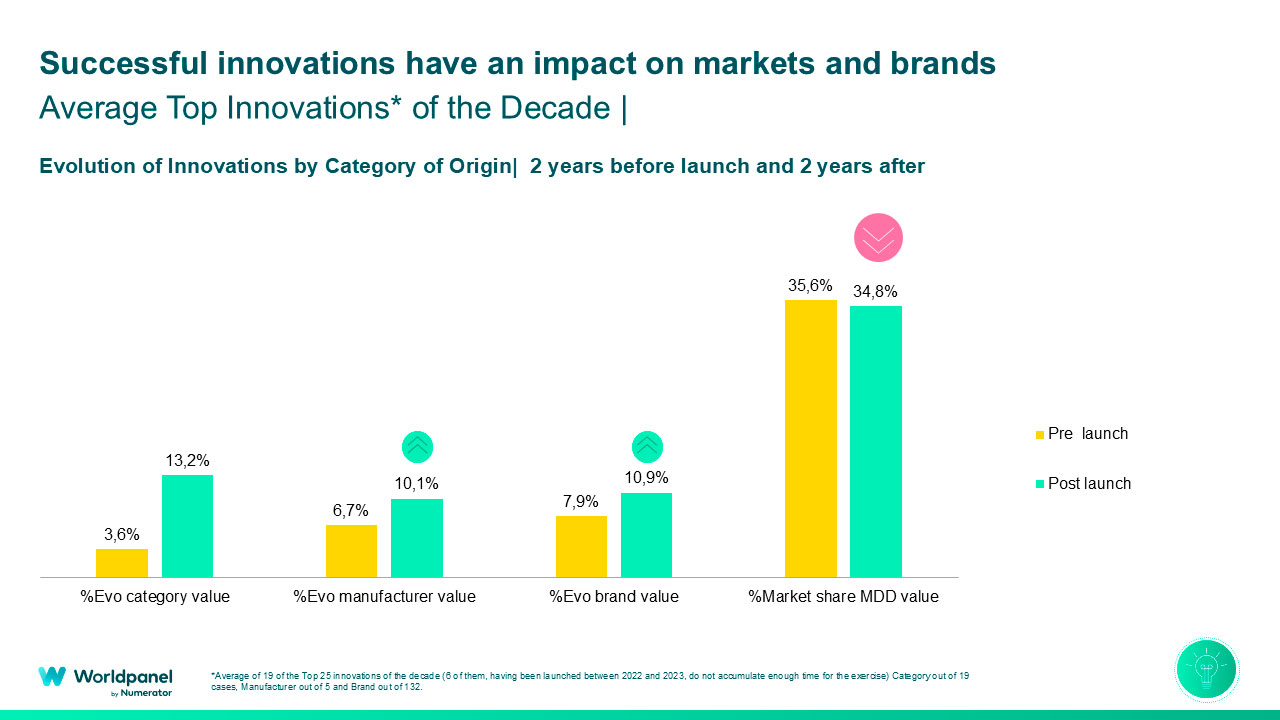

This willingness to pay translates into tangible market growth. When we look at the two years prior to launch and the two years after, these innovations are associated with a substantial lift in category value — almost multiplying growth by four. In parallel, private label loses nearly one point of share within those categories during that same period.

Once consumers show this level of engagement, retailers play a decisive role in increasing the impact of the innovation. Mercadona, one of Spain’s strongest retail players, illustrates this amplification effect. Among the Top 25 innovations of the last decade, 32% achieved presence in Mercadona for at least one year between 2020 and 2024, defined as 50 or more annual purchase acts generated in the retailer.

Presence in a leading retailer accelerates scale — but it is consumer relevance that opens the door.

Looking Ahead

The last decade shows that meaningful innovation must be more selective and more connected to consumer needs. The most successful launches demonstrate that when innovation offers something truly new — not just a different format — consumers embrace it, repeat it, and are willing to pay a premium.

To explore the detailed analysis and understand the levers behind successful innovation in Spain, access the full report Radar de la Innovación.