In today’s video streaming landscape, winning back past customers is just as important, if not more so, than acquiring new ones. Our latest Entertainment on Demand report tracks the customer lifecycle of video streaming and defines “boomerang” subscribers as those who cancel and return to the same video service within a 12-month period. These “boomerangers” have become a key metric for understanding loyalty and customer lifetime value.

To see why boomerang behavior is becoming so common, consider the paid U.S. video streaming market. The average number of paid video subscriptions (ad-free or ad-supported) per household has stagnated - declining slightly to 4.1 services in Q2 2025 from 4.2 in Q1 2025 - and has remained unchanged since Q3 2024. This suggests that consumers have reached a stacking ceiling: a limit on how many services they are willing to pay for.

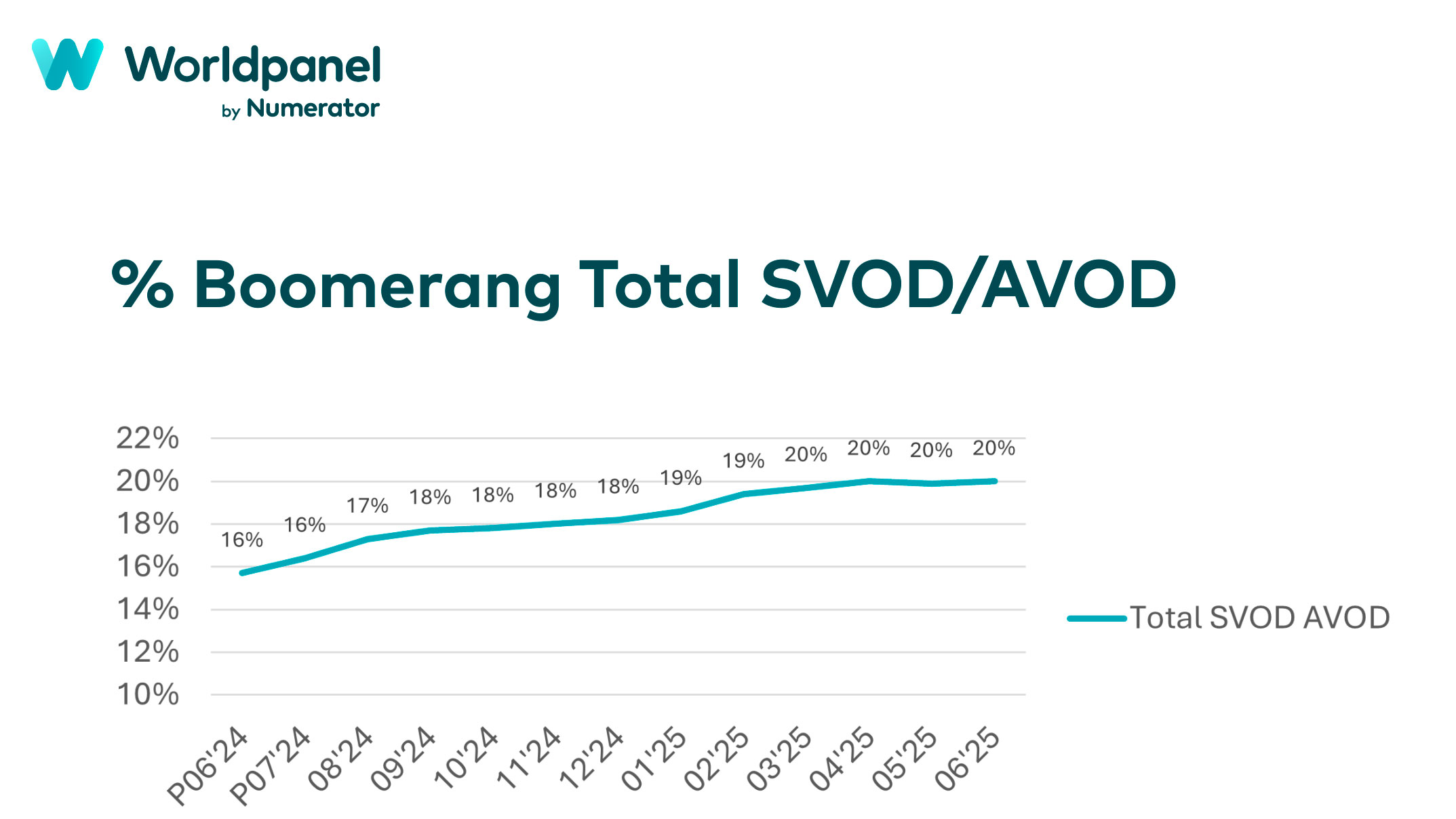

At the same time, quarterly churn in the U.S. has held steady at around 14% of all paid subscriptions since Q2 2024. With both churn and stacking plateauing, the market has seen a noticeable rise in boomerang activity. In Q2 2024, 16% of all paid subscriptions were boomerang subscriptions; by Q2 2025, that share had climbed to 20% - a 27% year-over-year increase.

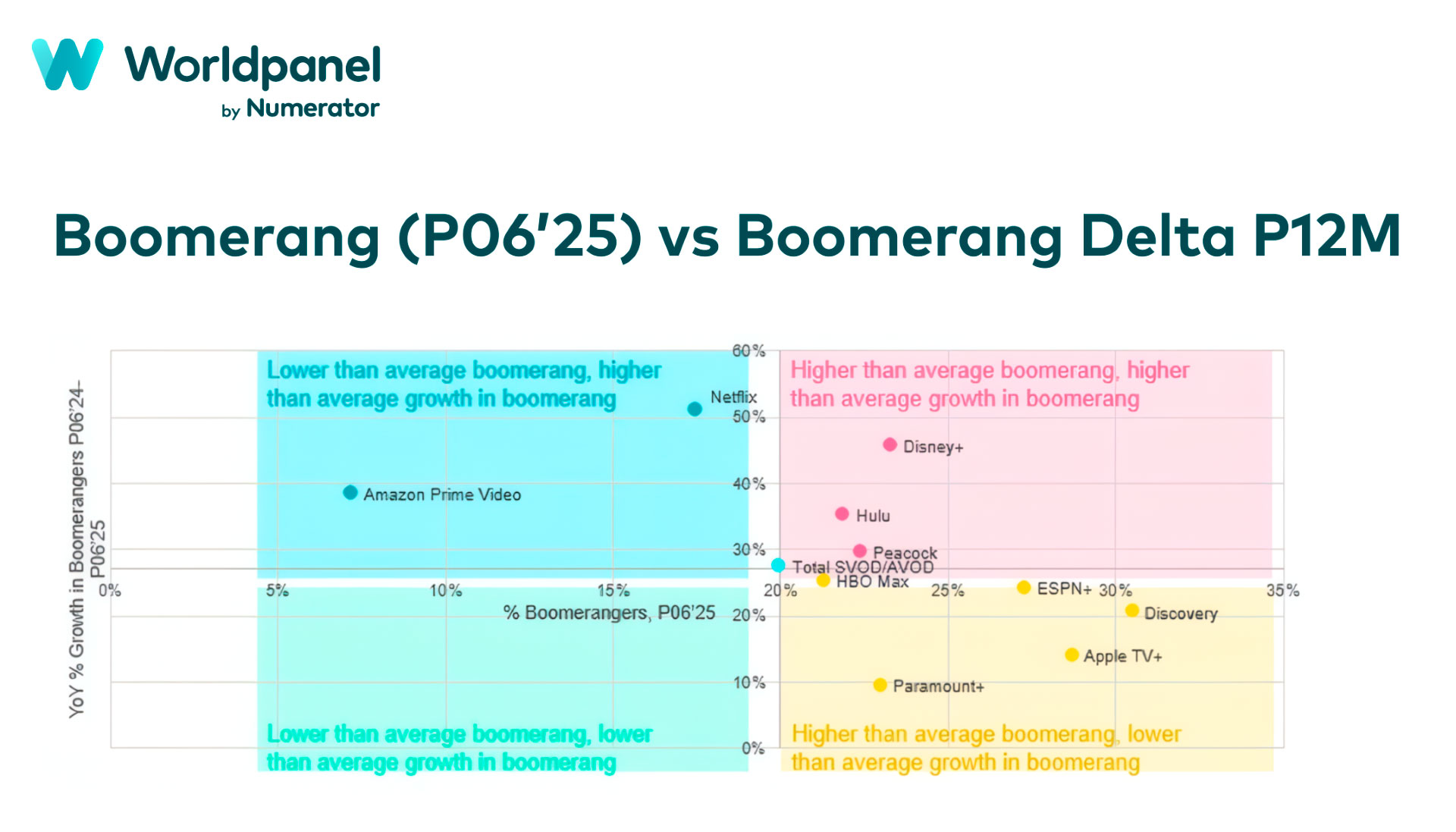

Some streaming services are more affected by boomerang behaviour than others. For Prime Video, which has a higher share of annual subscribers, only 9% of current subscriptions boomeranged in the past year. However, Prime Video’s boomerang rate grew 38% year over year,well above the industry average of 27%.

At the other end of the spectrum is Apple TV (formerly Apple TV+). The platform, which relies heavily on free trials, has one of the highest rates of boomerang subscriptions at 29% as of Q2 2025. Yet, its growth in boomerang activity was relatively modest, rising just 14% over the past year.

By looking at both the incidence of boomerang subscriptions and their year-over-year growth, paid streaming services can be grouped into three categories: low boomerang with high growth, high boomerang with high growth, and high boomerang with low growth. Viewed this way, it’s clear that no service experienced both below-average boomerang incidence and slower-than-average growth. Boomerang behaviour is now a universal trend across streaming platforms, one that underscores the need to understand and manage this evolving dynamic.

Common Behaviours of Boomerangers

The drivers behind boomerang behaviour vary by service. While it’s easy to assume this pattern is tied to specific titles launching or ending, end-of-demand (EOD) data suggests the motivations are more nuanced. Although the reasons differ across platforms, several consistent characteristics emerge among boomerangers.

Boomerangers tend to be high-value streamers: they want access to more content and are willing to pay for it. On average, they subscribe to one more paid streaming service than typical streamers (5.2 subscriptions vs. 4.1 per household). They’re also more likely to have paid for a TV or film stream/download (11%), rented content online (12%), or paid to stream a live sporting event (4%) within the past three months compared with the average paid streamer.

Their cancellation reasons also highlight a common theme: a desire for fresh content. “Not enough new TV content” or “not enough new film content” consistently over-index as cancellation drivers among those who later return. For instance, 20% of boomeranged HBO Max users initially cancelled due to a lack of new TV shows (versus 13% of all HBO Max churners in the past 12 months). Similarly, 18% of Apple TV+ boomerangers churned due to limited new film content, compared to 12% of all Apple TV+ churners in the same period.

Another shared trait among boomerangers is their appreciation for ease and convenience when rejoining a service. One in three re-subscribers return via an add-on option (e.g., through Prime Video Channels), compared to one in five among non-boomerangers. This correlates with higher post-return satisfaction around interface usability and search quality, underscoring how a frictionless experience can play a key role in winning them back.

The Rise of Boomerang Behavior with Netflix

Netflix has below average boomerang subscribers who in the last year have churned from the service but later returned. Just 18% of its subscriber base as of Q2 2025 are boomerangers, versus the 21% SVOD and AVOD average. Netflix also had the highest year over year rate of growth of boomerangers compared to any other paid streaming service. Share of Netflix’s subscriber base that boomeranged grew 51% from Q2 2024 to Q2 2025.

Netflix is a good representation of the paid streaming category in what drives cancellation among those who return: compared to its total churned base, Netflix cancellation among boomerangers was more likely driven by not enough new TV and technical difficulties. But it is unique versus competitor boomerangers in that cancellation is also more likely driven by having “too many subscriptions. I can’t use them all.”

Netflix has been able to win back churners through live events and sports, driving acquisition of 12% and 13% of boomeranged Netflix subscribers, respectively, versus just 6% and 8% of all new Netflix subscribers in the same time period. Between the Christmas-day football games in 2024 and the Mike Tyson-Jake Paul fight, Netflix has slowly and strategically invested in singular sporting events. Netflix’s approach to sports differs from competitors who pay millions to billions of dollars for multiple, if not all, games in a specific sport. For Netflix, these singular events have helped win back a portion of its churned customer base.

The platform has successfully re-engaged former subscribers through live events and sports. These have been acquisition drivers for 12% and 13% of Netflix’s boomerangers, respectively - double the rates among all new Netflix subscribers (6% and 8%). From the Christmas Day football games in 2024 to the Mike Tyson–Jake Paul fight, Netflix has taken a strategic, selective approach to sports - opting for high-impact, one-off events rather than investing billions in full-season rights. This targeted strategy has proven effective in winning back portions of its churned audience.

How Paramount+ Resists Boomerangers

Paramount+ has one of the highest shares of boomerang subscribers among major streamers, with 23% of its subscriber base having churned and returned within the past year. However, despite this high proportion, Paramount+ experienced the slowest growth in boomerang subscriptions of any paid competitor. Across the SVOD and AVOD category, boomerang subscriptions grew 27% year over year from Q2 2024 to Q2 2025, while Paramount+ saw a more modest 10% increase.

Examining loyal Paramount+ subscribers who have not boomeranged in the past year reveals key factors behind the platform’s ability to retain users. Compared to Paramount+ boomerangers, these loyal viewers express significantly higher satisfaction with the amount of original content available (index 137), the variety of TV series (index 142), and the overall quality of shows (index 120).

End-of-demand (EOD) data shows that perceptions of content volume strongly correlate with subscriber loyalty. Paramount+, which has slowed its boomerang growth relative to competitors, has simultaneously seen rising satisfaction among loyal subscribers regarding its original content. In Q2 2024, 34% of loyal users reported being satisfied with the amount of original content, and this figure climbed to 39% by Q2 2025.

This growing perception of abundant, high-quality originals appears to create a halo effect across the platform’s content library. When subscribers feel they can move from one original title to another with confidence in both variety and quality, they are less likely to churn and more likely to stay loyal over time.

Boomerang behavior has become a defining feature of today’s video streaming landscape. Even platforms such as Paramount+, which has experienced relatively slow growth in this trend, still see roughly a quarter of their subscriber base returning after cancellation within the past year. While boomerang subscribers share common traits, such as a strong appetite for content and a willingness to pay for more, the specific reasons behind cancellation and re-subscription differ by service. Each platform has unique strengths and weaknesses that influence why subscribers leave and what ultimately brings them back.

Understanding these drivers at the service level is essential for both slowing the pace of churn and developing strategies to effectively re-engage former subscribers. To learn more about how your service can identify and act on these insights, contact us.