Australia’s video streaming landscape continues to evolve as competition intensifies and consumer expectations shift. The latest Entertainment on Demand (EoD) data for Q3 2025 reveals a market that is maturing but still dynamic, shaped by rising adoption of ad-supported tiers, ongoing price pressures, and an uneven commitment to local content. While overall video on demand (VOD) penetration has stabilised, new entrants and evolving partnerships are reshaping the competitive balance, and consumers are becoming more discerning about value, experience, and content variety.

Key behaviours within the VoD market in Q3 2025

- 5.6 million Australian households now have at least one paid ad-supported (AVoD) subscription, growing +77% year-on-year. 30% of new subscribers chose an ad-supported plan in Q3, with uptake highest among new Netflix subscribers (73%).

- Paramount+ had the largest share of new subscribers in Q3 at 13%, followed by HBO Max in its second quarter of operating in Australia with a share of 11%.

- Stan Sport’s new subscriber share more than trebled quarter-on-quarter following its acquisition of the English Premier League rights from Optus Sport.

- Sport and live events accounted for 27% of new VoD subscriptions in Q3, growing from 23% a year ago.

- Free ad-supported streaming TV (FAST) services continued to gain traction, growing +39% year-on-year to reach 1.9 million households.

- Weekly usage of BVoD (Broadcaster Video on Demand) services grew 6% year-on- year to 5.1 million households, with 7Plus the most popular service and growing 9 %.

- New data revealed that 68% of households watched content via YouTube in an average month during Q3.

- 76% of households (8.1 million) had at least one VoD service in Q3, remaining flat compared with Q2.

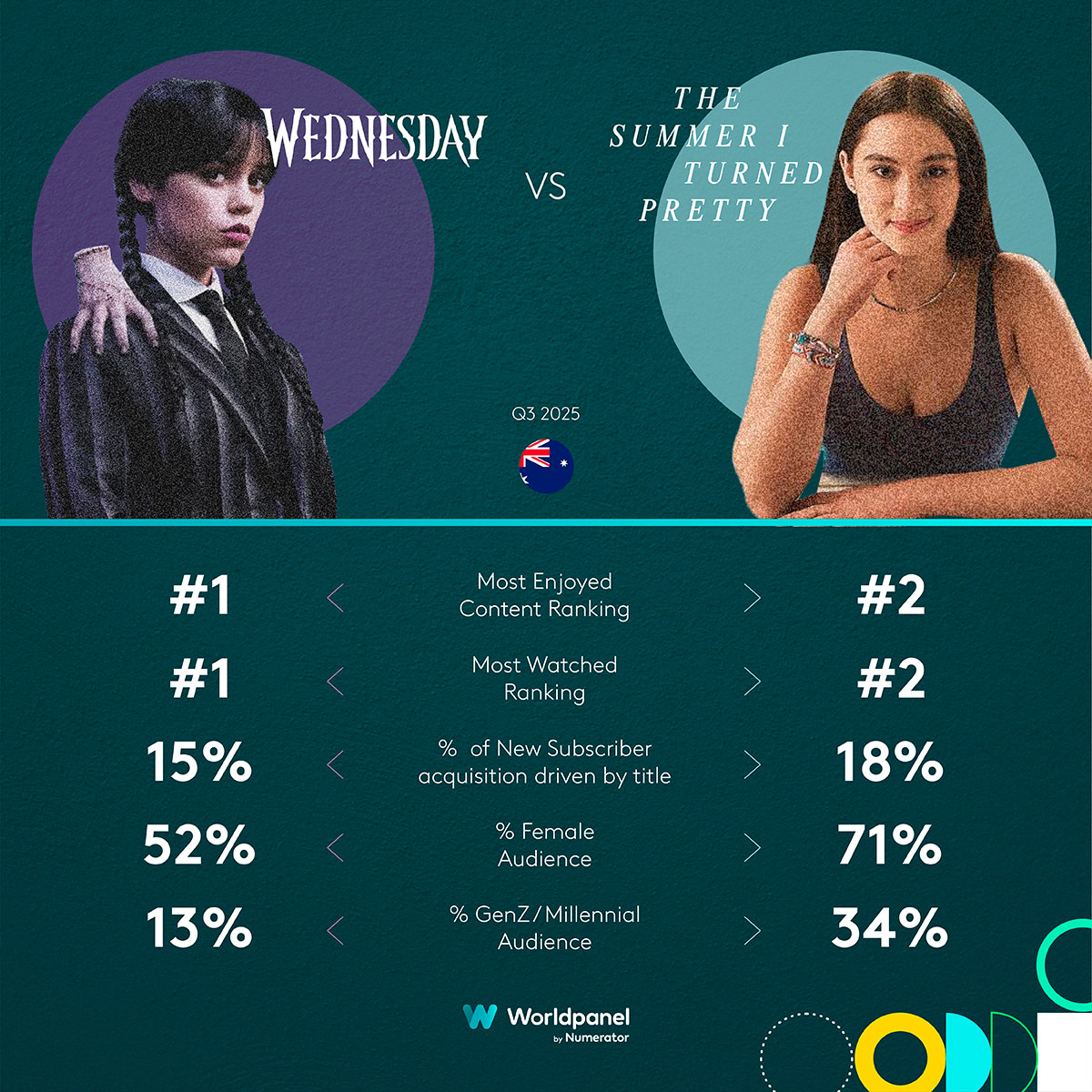

- Netflix’s Wednesday took the top spot for most viewed and most enjoyed content, boosted by the release of its second season, followed by The Summer I Turned Pretty on Amazon Prime Video.

HBO Max’s base builds – but users are not ready to recommend

Having entered the Australian streaming market with its DTC (direct to consumer) offering on 31 March 2025 under the ‘Max’ brand, Warner Bros . Discovery reverted to the HBO Max name in early July, signalling a strategic shift back toward its premium HBO content.

This move helped drive a 73% quarter-on-quarter increase in subscribers, yet brand advocacy remained notably weak at just +1ppt in Q3, making HBO Max the least recommended of the major streaming services. The platform underperformed on key satisfaction drivers such as local Australian content, children’s programming, the availability of new-release films, and the number of ads on its ad-supported tier.

Data indicates that user experience on HBO Max tends to be poor during the first six months of use but improves as subscribers become more familiar with the interface and as the recommendation algorithm refines its accuracy. However, the service has not yet reached this stage of maturity in Australia.

Although HBO content is no longer available via Binge, there remains a strong but evolved partnership with Foxtel, with the HBO Max ad-supported plan included in every residential plan. While this strategy has given HBO Max a major boost in user numbers, those Foxtel customers who have activated the offer are not having a good experience, with NPS (net promoter score) negative at -7ppts. Their number one driver of dissatisfaction is adverts, in particular the number of ads shown, and how varied the ads are.

In a further effort to expand reach and visibility, HBO Max joined Prime Video Channels in September. Despite launching late in the quarter, 7% of new HBO Max subscribers in Q3 2025 signed up via Prime Video, reflecting a strong early impact. Other services also benefited from this distribution model, with 13% of Paramount+’s new subscribers in Q3 coming through Prime Video Channels.

Are consumers reaching breaking point? Netflix price rises challenge Aussie loyalty

As a mature market leader, Netflix has shifted its strategy toward revenue optimisation. This approach has resulted in a series of steady price increases that are now testing the limits of consumer price tolerance and goodwill.

The price adjustment in August marked the sixth increase in Australia since Netflix’s 2015 launch. While the Standard with Ads plan rose by $2 to $9.99 per month, the greatest impact was seen in the ad-free tiers. The entry-level ad-free Standard plan now costs $20.99 per month after a $2 increase, while the top Premium plan climbed by $3 to $28.99. These changes firmly establish Netflix as the most expensive entertainment VoD service in the Australian market.

The price rises have negatively affected user sentiment on value for money, with net satisfaction dropping by 3 percentage points quarter-on-quarter to 21 points. The decline has been driven largely by ad-free SVoD subscribers, where satisfaction fell to just 15 points, below the category average of 20 points. This suggests Netflix may be nearing a critical tipping point, as more subscribers begin to question whether the premium cost remains justified. Churn rose from 6 percent in Q2 2025 to 7.7 percent in Q3, and a further 8.5 percent of customers plan to cancel their subscriptions within the next three months.

Despite these challenges, Netflix’s strong content lineup is likely to remain its key retention factor. The platform continues to lead the market in satisfaction with its Netflix Originals content, which sit well above other major services at +38 percent. Titles such as Wednesday, which topped both the most enjoyed and most viewed rankings this quarter, continue to underpin its appeal.

Local but limited: Australia’s streaming shortfall

Spending on local Australian content by the five major streaming providers is nominally growing, according to voluntary reporting to the Australian Communications and Media Authority (ACMA). However, investment is increasingly concentrated in a narrow range of commercially driven genres, such as high-budget drama (often ‘Originals’) and live sports, while documentaries and children’s content have declined.

Net satisfaction with local Australian content has remained poor over the last year, hovering at around +4ppts. Of the major players, only local giant Stan boasts a double-digit score of 13ppts. Acclaimed Stan Originals such as Bump, Ten Pound Poms and Black Snow all feature in the top eight titles driving new sign-ups in the last year, having helped to build a brand synonymous with premium Australian storytelling. Foxtel’s Binge has the second highest user satisfaction for local content at 8ppts, with the Original drama series The Twelve making it into the top five most enjoyed titles across all services for Q3 2025.

The extent to which local Australian content is a magnet for new subscribers to SVoD services is also minimal, with just 12% stating it as a driver. This trails European markets such as Spain and France, where local content holds greater importance. This is particularly evident among those signing up for global giants Netflix and Disney+, where legal requirements mandate that streaming services must invest a percentage of their revenue in European works.

The Australian streaming market is entering a new phase defined by consolidation, experimentation, and cautious growth. Ad-supported models and sports rights are fuelling short-term gains, but long-term success will rely on improving user experience and strengthening investment in local storytelling. As services such as HBO Max seek to build momentum and Netflix tests subscriber loyalty through pricing, the key challenge for all providers is to align business strategy with genuine consumer value. To learn more about our EoD insights or to discuss how these findings can inform your business strategy, contact our team for a deeper discussion.