Back to school is normally one of the biggest advertising events of the year. However, with so much uncertainty around how schools will reopen due to the ongoing COVID-19 pandemic, BTS is shaping up to be very a different retail advertising season this year with important implications for brands, according to Kantar findings.

Advertising spend drops

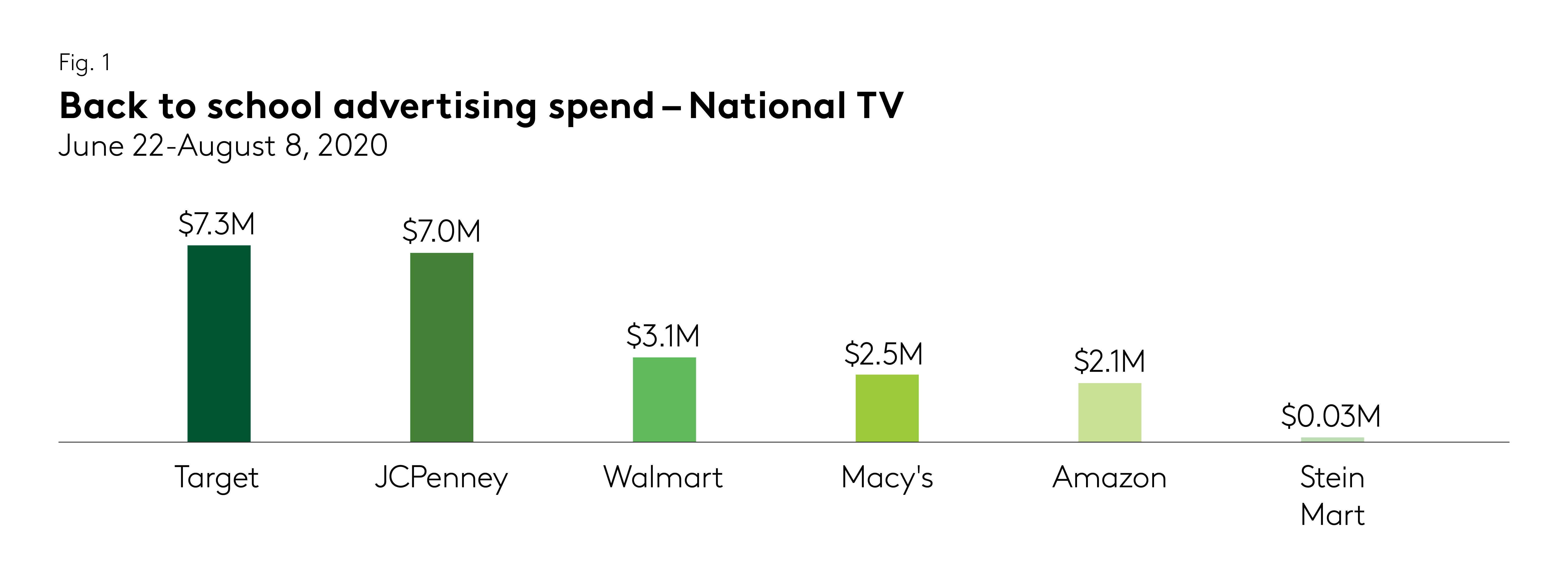

U.S. back to school advertising on national TV is down 70% so far this season compared to last year. From June 22-August 8, 2020, Kantar found retailers spent $23 million on BTS ads on national TV from retail advertisers vs. $76 million spent during a similar time period in 2019. What’s more, national TV advertising this year is coming from just six retailers, compared to 100 in 2019.

While spending may make some incremental gains in the coming weeks, given these significant declines we anticipate that total BTS advertising spend on national TV through September will not be anywhere close to the $133 million advertisers spent last year. However, given the possibility that schools may reopen later in the school year depending on conditions, BTS advertising may be ongoing/start up again later in 2020 or even 2021.

Fewer advertisers means greater opportunity

BTS is typically a very cluttered ad environment. With so many advertisers opting out this season, there is a significant opportunity for brands to engage consumers and build customer relationships, as less activity and a scaled down competitive field give those who do participate a greater chance of winning share of consumer wallets. After all, students will need supplies whether they are learning remotely from home or attending in-person class, so cutting out advertising altogether could be a costly mistake.

Creative shifts from pre-COVID era

Typical BTS ads feature happy families shopping for school supplies and new clothing, as well as students at school with friends, dancing in hallways and excelling in the classroom. In 2020, those visuals have been replaced with school supplies being ordered online for at-home delivery and curbside pickup, virtual learning on computers, and exploring the great outdoors. Few ads show students in school, and those that do feature children wearing masks.

In today’s new normal, successful ads must show that brands are adapting to consumer needs. As such, the primary focus this year has been “here for you whatever the 2020 school year may bring.” Many parents are feeling anxious about the current uncertainty and conveying their needs will be met, no matter the circumstance, is key. Placing an emphasis on savings and value is also especially important this year due to the economic strain many families are facing.

Lesson in Amazon’s success: create a connection

During a time when many consumers are feeling isolated, creating a feeling of connection is imperative for brands. Of the retailers that kept BTS advertising in their budgets, Kantar data shows that Amazon’s commercial resonated best with consumers. The spot portrays children learning in creative ways at home, with the recognizable Amazon search bar appearing on the screen multiple times throughout the ad.

Kantar found Amazon’s approach gave consumers an immediate sense of emotional connection to the brand. In fact, consumer reaction to the commercial indicated Amazon should expect to see six times the gain in ad awareness compared to Target, JCPenney, Walmart and Macy’s.

Further, Kantar finds Amazon’s ad may also drive increases in sales over competitive ads. For instance, consumer feedback indicates the Amazon commercial is 25% more likely to generate sales lift than Target’s. The main difference between the two is that Target used only illustrations (showing no people from start to finish), which created less of a human connection and ranked lower with consumers.