To be sure, we’ve never seen a post-Memorial Day election season like this, with a pandemic raging, the incumbent president boiling and Biden, until recently, in a bunker. All true, but the election is still going to happen in November and campaigns still have to answer fundamental questions of who they need to talk to, what they need to say to them and how they are going to touch them. And, when it comes to touch, paid advertising will again be the major vehicle—and one perhaps even more important in a time when campaigns can’t touch people in person with rallies, door knocking and meetings.

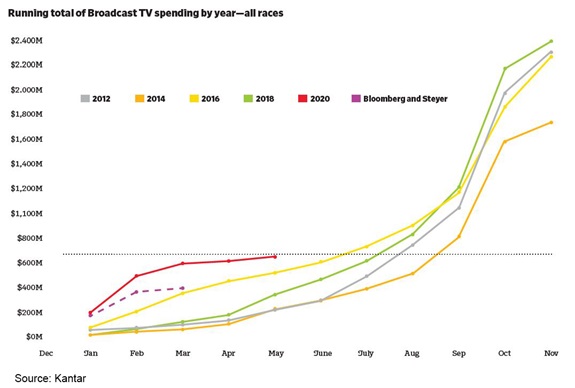

The accompanying chart compares ad spending to date in 2020 to spending over time in the last four general elections. It shows that the second quarter is typically a down time and that Memorial Day is the starting line for six months of constantly increasing political advertising spending. It also shows that the billionaire-fueled Democratic presidential primary has already put broadcast advertising spending way ahead of previous years’ to date totals.

In what is likely to be an even-more-important world of paid advertising, these fundamentals are unlikely to change. Dollars spent will be a function of dollars available. Dollars available will be a function of voter (more specifically, donor) enthusiasm or more likely, anger, and competitive races, neither of which are in short supply.

And, dollars available for advertising will be even greater when campaigns are cutting back or completely limiting travel and other in-person events. In other words, all the dollars not going to fuel charter planes, pay for hotel stays, stand up field offices and rent arenas will go to the ad buyers. Where those dollars will be spent is a function of where those competitive races are, and the avenues avail- able to campaigns seeking to reach their target voters.

For now, audiences are in front of their screens, though more might venture out of doors more often, then back in again, as the virus ebbs and flows. How captive an audience advertisers might find might depend more on demographics than ever, with older, more vulnerable populations continuing to shelter in.

So far there has been great variance in the shares that different campaigns directed towards different sorts of screens. The largest spender on the Democratic side during the primaries, Mike Bloomberg, spent 64 percent of his budget on broadcast TV. The Trump campaign directed 64 percent of its spending on digital platforms.

Still, down the line, the largest share of political ad dollars will surely flow to local TV advertising and geographically targeted spot cable will continue to get an increasing share of the political advertising pie. Digital platforms, in general, and Facebook, in particular, will show massive growth over their 2016 and 2018 numbers. Overall, to date, in general election focused ad spending tracked by Kantar CMAG, local broadcast has attracted 43 percent of ad dollars, local cable 21 percent, national broadcast 6 percent, national cable 2 percent and digital platforms 30 percent.

Those initial national figures might portend a back-to-the-future moment with campaigns taking a more serious look at national broadcast and cable advertising. We have no Olympics, no pre-election World Series, football is in a state of suspended coin toss and fewer new shows are in development. On the other hand, with large advertisers already taking advantage of any available contract outs to pull out the upfront commitment they made for the third quarter, there is cheap network inventory to be had on the spot market. And political advertisers, both candidates and in- dependent groups, who had dismissed national advertising as wasteful may be taking another look.

While network advertising might not be coveted in the summer, there’s an excellent chance that spot TV will bounce back strongly in the fall from pent-up demand making local markets expensive. Some network advertisers might also find them- selves dipping into spot particularly if not all their stores are open. That has the potential to leave network advertising with more avails than usual and could prove tempting to presidential advertisers. That could be an economical way to cover the second-tier states that are perhaps a bit too close for comfort.

All of this, of course, is speculation. Although there isn’t a lot of evidence that fundraising is going down—nor of that magic fundraising combo of competitive races and angry voters disappearing anytime soon— anything can happen in this dreadful new economy. The best tell as the campaign season unfolds will be the ads themselves. Campaigns will continue to do extensive internal polling to try to get some sense of which way to hold the map as the world continues to spin around them, and the results of that polling will be reflected in both their creative and their buys.