In France, not only is the sharp rise in food prices artificially boosting turnover – it’s also masking another reality. Daily product sales have been decreasing in volume since the start of the year, with sales of FMCG products dropping 4% from January to March.

Food price inflation climbed once more in March 2023 to reach a new record of 16.2% (source: Circana) – the sixth consecutive month of double-digit increases. This would theoretically lead to a €42 increase in households’ monthly spending, if they bought the same products as the year before. However, spend only increased by 10%, due to consumers employing a range of tactics to buffer the price increases, taking remedial action and adapting their behaviour.

1. Budget control

French consumers are splitting up their shopping sessions to manage their budgets on a daily basis, adjusting their purchases as they go. They are visiting shops more often, but buying less each time: only 11.6 items on average in March 2023 compared to 12.3 in 2022. Meanwhile, outlay for each trip has increased by €1.95 (6.5%). Shopping frequency increased in all channels in March, with the number of visits going up by 3.2% to 8.5 transactions over four weeks.

Shoppers are also ‘store-hopping’, buying each product category in the lowest priced store. The average number of retailers used dropped from 8.6 to 8.5 at the end of 2022, but is now stabilising. Three quarters of consumers (76%) say they systematically write out a shopping list, and setting a budget ceiling for each session is also a popular tactic.

2. Hunting for the best prices

The very sharp hike in FMCG prices heavily affects the way the French consume. Fewer than half of households (45%, -1.4 points year-on-year) now say they place "a lot of importance on the brand", and downscaling to a cheaper option is at its highest level ever.

Consumers are opting more and more for private labels, which have gained 2.5% in market share, at the expense of brands. The latter are finding it difficult to defend their positions, as retailers unleash their weapon of promotional operations to support their own private brands.

Promotions are more popular than ever: 60% of households (+2%) say "I’ll buy a brand that I don’t usually buy, if I see it is discounted", with 37% claiming "I visit several stores to take advantage of the best discounts". Promotions account for 25% of spending on health and beauty care.

3. Change of eating habits

French households have drastically reduced the volumes they purchase. Overall FMCG deconsumption stands at -4%, and -5.8% across traditional fresh produce. At the fish counter the drop in volume sales is a dizzying -12%.

Households are cooking dishes based on pasta, rice and eggs, which contain less animal protein. They are cutting back by occasionally dropping a starter, or sometimes the cheese or dessert course.

Double jeopardy for the poorest households

Spending increased the most for households with the most modest incomes in the first quarter of 2023. Having greatly reduced their purchase volumes last year, these rebounded as they restocked their cupboards. A lot of these products were bought on promotion.

The increase in spending is more marked for lower income households than for the average household, as their baskets contain more low-price and essential, everyday goods. These products, as well as the retailers’ own brands, are the most highly inflated, owing to their heavy dependence on raw materials and energy, which have all increased in price.

The channels: corner shops gain momentum

This is an extremely competitive sector, and if customers don’t like the prices in one store, they go elsewhere: each household shops in nearly 9 different supermarkets on average.

Since the beginning of the year, the channels that have performed most highly are:

- Hard discounters – increasing their market share by 0.4% to 11%

- Supermarkets, with a rise of 0.2% to 29.6%

- Corner shops, which boosted their market share by 0.2% to 6.8%). Traffic increased by 7% due to an increase in shopping frequency. French consumers use corner shops as a stopgap solution, but the channel accounts for 50% of the FMCG supply for the 2.2 million customers living in the largest French cities, who visit 89 times per year!

- The online channel dropped 0.2% of its market share to 9.0%, while the hypermarket format – which had recovered thanks to its low prices – has again lost 0.1%.

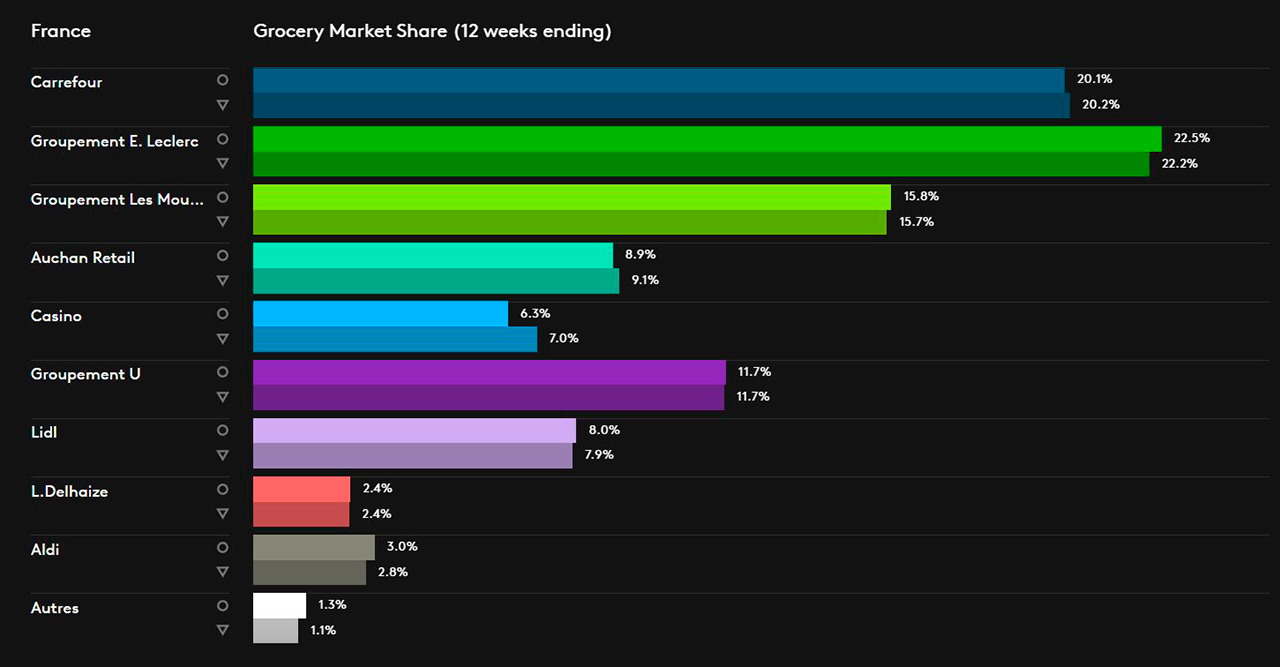

Retail brands: discounters are attractive to all

The retailers that are perceived to offer the best prices win the jackpot, with the highest gains in market share.

Lidl, Aldi and E.Leclerc are in the lead – with the latter now holding a 22.5% share. Discounters and destockers are always appealing to consumers at every income level. The Les Mousquetaires group rose 0.1pt, to reach 15.8% of market share, driven by the Intermarché stores.